PayPal (PYPL) stock dropped 5.7% on Friday following reports that JPMorgan Chase (JPM) intends to charge fintech companies for accessing its customer data. These new fees could potentially amount to hundreds of millions of dollars.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

According to a Bloomberg report, JPMorgan has circulated pricing sheets to data aggregators or firms that connect banks with fintech firms. The charges will depend on the type of data being accessed.

It must be noted that the new fees are slated to roll out later this year, though they remain open to negotiation.

In recent years, PayPal has relied on free access to customer banking data. This data powers services like Venmo, peer-to-peer payments, and account linking.

Now, JPMorgan argues that it has invested heavily in secure infrastructure and wants to be compensated for maintaining it. Thus, it aims to introduce tiered fees, with payment-focused firms facing the highest charges.

For fintech companies, these fees could erode margins, increase operating costs, and lead to changes in their business models.

Is PayPal a Buy, Sell, or Hold?

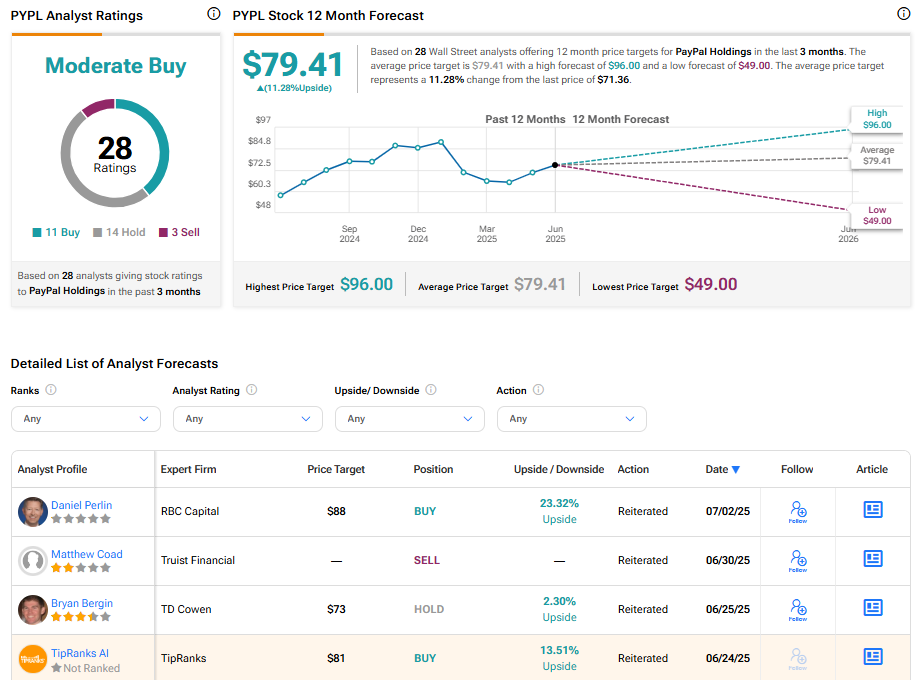

Turning to Wall Street, PYPL stock has a Moderate Buy consensus rating based on 11 Buys, 14 Holds, and three Sells assigned in the last three months. At $79.41, the average PayPal stock price target implies an 11.28% upside potential.