PayPal stock (PYPL) has soared 56% over the past year, marking a sharp turnaround after a few years of lackluster performance. The company, which operates one of the largest and most trusted platforms for secure digital financial transactions, has recently seen a strong rebound in earnings growth. Additionally, PayPal’s free cash flow is moving upward, a trend expected to continue, enabling hefty stock buybacks. Along with shares trading at an attractive valuation, I remain bullish on PYPL stock despite this past year’s protracted gains.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Achieving Solid Growth in a Saturated Fintech Market

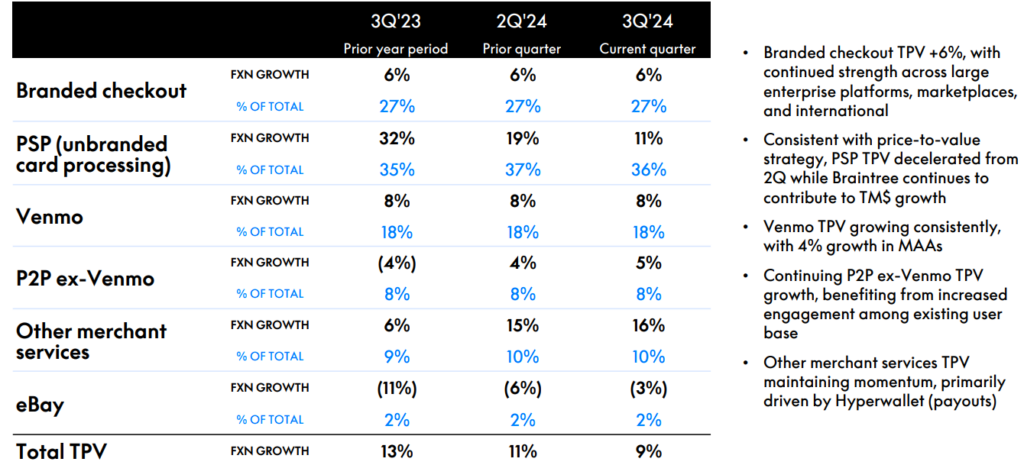

Let me begin by highlighting PayPal’s growth, which continues to land at decent levels despite increasing saturation in the fintech space. This strength was once again evident in PayPal’s recent Q3 report. While at a slightly slower pace than in previous quarters, the company still achieved a 6% top-line growth to $7.8 billion. Notably, PayPal’s total payment volume (TPV) increased by 9% year-over-year, driven by branded checkout, Venmo, and Braintree.

Also, PayPal benefited from expanding its partnerships with companies like Fiserv, Adyen, and Global Payments. These collaborations supported PayPal’s Fastlane initiative, which simplifies checkout processes across merchant platforms and drives TPV growth. In particular, PayPal’s branded checkout continues to be a key factor in increasing the company’s overall transaction volume.

In the earnings call, management emphasized that innovations like new mobile and desktop checkout experiences raised conversion rates by over 100 basis points for vaulted checkouts and up to 400 basis points for one-time checkouts. In my view, these efforts show that PayPal can stay competitive, even in a market crowded with innovative players fighting for share. Venmo, which also continues to gain traction, achieved steady growth in active accounts and transactions, showing increased engagement across its user base as well.

Margin Expansion Boosts Earnings, Free Cash Flow

Besides continued revenue growth, PayPal’s recent initiatives to improve profitability have begun to yield results. The company has seen margin expansion, with its adjusted operating margin reaching 18.8%, up 194 basis points compared to the previous year. According to management’s remarks, this expansion can be primarily attributed to pricing strategy adjustments, tech-led risk management, and disciplined cost control efforts. Revenue from value-added services, like interest on customer balances, also supported profitability, contributing to a more elevated transaction margin overall.

If you combine PayPal’s modest revenue growth and more impressive margin expansion, you can see how it grew its adjusted earnings per share (EPS) by 22% year-over-year in Q3. Simultaneously, the company saw an improvement in free cash flow, with Q3 marking a 31% increase to $1.45 billion. In fact, PayPal is now on track to post a record $6 billion in free cash flow for the year. More importantly, consensus estimates see further growth to $6.71 billion and $7.31 billion in Fiscal years 2025 and 2026, respectively, implying that the favorable tailwinds the company is now enjoying will likely endure in the coming years.

Valuation Remains Attractive Despite Stock’s Rally

Coming back to my initial point, I believe that despite a strong rally over the past year, PayPal’s valuation still seems appealing when considering current and future free cash flow metrics. The stock is now trading at just 14.2 times this year’s expected free cash flow, even though this metric is expected to grow notably over the next few years. PayPal’s aggressive share repurchase program further supports the argument for its attractive valuation. The company is targeting $6 billion in buybacks this year (i.e., its entire free cash flow), which translates to a nearly 7% buyback yield at current price levels.

Building on last year’s $5 billion in repurchases, this year’s target signals the company’s intent to align buybacks with its growing free cash flow. Therefore, with a strong buyback yield already in place and the potential for further increases in the coming years, I believe the positive momentum surrounding the stock will likely remain strong, especially at its current valuation.

Is PYPL Stock a Buy?

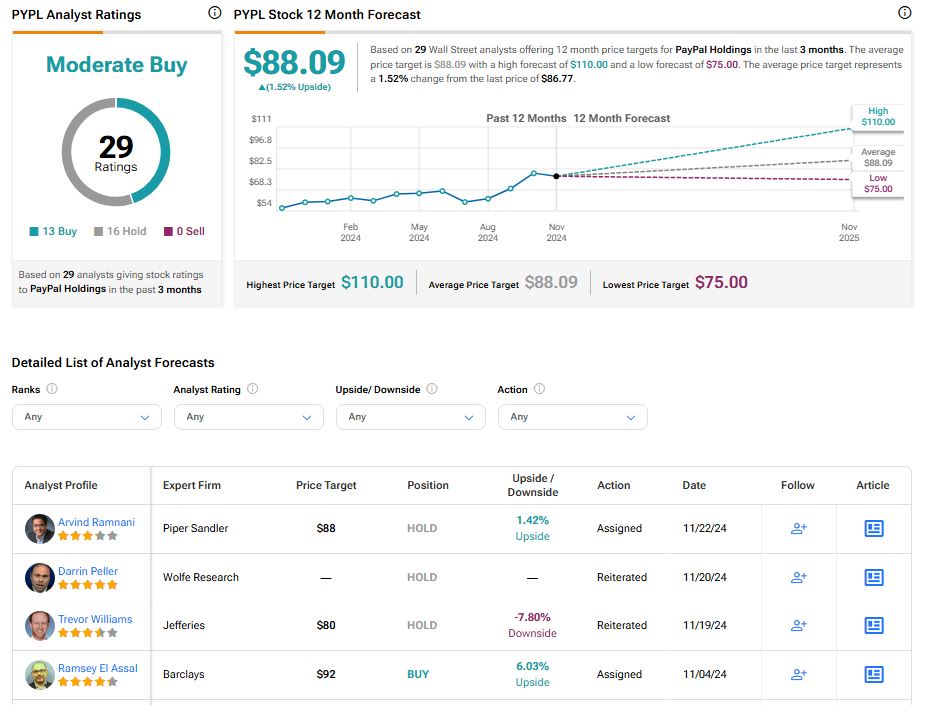

Wall Street analysts seem somewhat more cautious about PayPal’s outlook following the stock’s recent rally. In particular, PYPL stock features a Moderate Buy, with recent analyst ratings consisting of 13 Buys and 16 Hold ratings over the past three months. Still, At $88.09, the average PYPL stock forecast implies an upside potential of 1.52% from its current levels.

For the best guidance on buying and selling PYPL stock, look to Sanjay Sakhrani. He is both the most accurate and profitable analyst covering the stock (on a one-year timeframe), boasting an average return of 28.9% per rating and an outstanding 90% success rate.

Summing Up

Summing up, PayPal’s ongoing share price recovery is driven by solid TPV growth, impressive bottom-line gains, and surging free cash flow. These factors form a compelling investment case despite the fintech industry’s loss of appeal among investors due to increased saturation.

In the meantime, PayPal’s hefty buybacks, which are likely to increase in line with free cash flow growth in the coming years, should drive the stock’s upward momentum and prove accretive to EPS at the stock’s current valuation. Hence, despite this year’s extended rally, PayPal stock may have room for further gains.