PayPal’s stock (PYPL) has recovered over the past month. Yet, it remains at rather depressed levels. This is mainly due to persistent investor worries over increasing competition in the digital payments space, which has pressured PayPal’s market share and led to a declining take rate. Still, PayPal’s recent earnings report highlights the company’s resilience and potential for significant upside. Its snowballing free cash flow and aggressive stock buybacks strengthen the stock’s investment case. Therefore, I am bullish on PYPL stock.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The Competitive Landscape and PayPal’s Struggles

Let me start by providing some context. Basically, PayPal has dominated the digital payments industry for decades. However, the landscape has become increasingly crowded. Fintech disruptors like Block (SQ), Stripe, and Wise (WISE) have gained robust traction recently, particularly among younger consumers.

These more modern companies have leveraged their platforms to offer seamless payment experiences, often integrating financial services directly into their ecosystems. This is a key reason that PayPal has faced pressure on its market share, leading to a dip in its take rate – the percentage of transaction value that it earns as net revenue. To get some perspective, Paypal’s quarterly take rate in Q4 2019 was 2.27%. It has steadily dropped each quarter since then, reaching only 1.72% in Q2 2024.

The declining take rate is undeniable and explains investors’ unease in recent years as it directly impacts the company’s profitability. In Q2 of 2024, PayPal’s take rate again showed these competitive pressures. However, the Q2 results also suggest that PayPal managed to effectively counter some of the challenges by taking the initiative and continuing to innovate. Let’s take a look!

What’s Driving PayPal’s Growth?

Despite the competitive headwinds, PayPal stock has rebounded from its 52-week lows of $50.22, with the company posting relatively solid growth. Specifically, PayPal’s revenues increased 8% in Q2, reaching $7.9 billion. This growth was primarily driven by a robust 11% year-over-year increase in Total Payment Volume (TPV), which reached $416.8 billion, including gains across nearly all platforms.

To elaborate on that, several factors contributed to TPV growth. First, PayPal’s continued expansion into international markets has been a significant driver. The company has concentrated on key regions outside the U.S., where the adoption of digital payments is rapidly increasing. This international push, combined with the steady performance in the U.S., has helped offset some of the competitive pressures.

In addition, PayPal’s efforts to improve user engagement have paid off, particularly in payment transactions, which grew by 8% to 6.6 billion during the quarter. PYPL’s management stated that introducing and expanding new services like “Buy Now, Pay Later” (BNPL) have been particularly successful, especially in Europe. This has increased transaction volumes and helped PayPal attract and retain a broader customer base.

Regarding PayPal’s bottom line growth, the company’s transaction margin dollars, which increased by 8% to $3.6 billion, further demonstrate its ability to manage costs, even as competition intensifies. Essentially, PayPal has focused on high-margin activities, such as value-added services and cross-border transactions, which has been crucial.

Consequently, PayPal’s GAAP operating income grew by 17% to $1.3 billion, while non-GAAP operating income surged by 24% to $1.5 billion. The operating margin improvements – GAAP margin expanding by 126 basis points to 16.8% and non-GAAP margin expanding by 231 basis points to 18.5% – clearly show PayPal is improving its operational efficiencies. I want to highlight that GAAP and non-GAAP margin expansion was achieved despite the ongoing pressure on its take rate, which is quite impressive!

Free Cash Flow and Buybacks Surge

One of the key factors for my bullish sentiment relies not only on PYPL’s strong top-and-bottom-line growth but on one of the most impressive metrics in PayPal’s Q2 report; its free cash flow and how it utilizes it to buy back stock on the cheap. In particular, in Q2, PayPal posted $1.5 billion in cash flow from operations and $1.4 billion in free cash flow. After adjusting for the timing impact of its European BNPL receivables, the company’s adjusted free cash flow stood at $1.1 billion, marking a 31% year-over-year increase.

Therefore, PayPal returned $1.5 billion to shareholders by repurchasing about 24 million shares. Notably, over the past 12 months, the company has repurchased around 82 million shares, returning $5.0 billion to shareholders. In fact, since the start of 2022, PayPal’s share count has declined by 13% despite the rather hefty stock-based compensation levels.

Is PYPL Stock a Buy, According to Analysts?

Wall Street’s view on PYPL stock features a Moderate Buy consensus rating based on 18 Buys and 16 Holds assigned in the past three months. At $75.96, the average PayPal stock price target suggests a 4.87% upside potential.

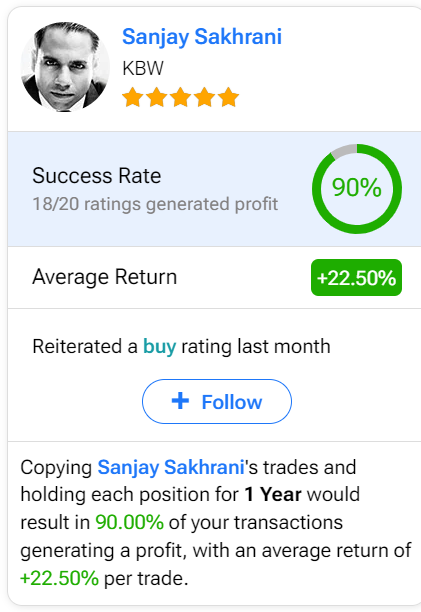

If you’re uncertain which analyst to follow for buying and selling PYPL stock, consider Sanjay Sakhrani from KBW, a five-star analyst according to Tipranks’ ratings. Over the past year, he has been the most accurate analyst covering this stock, delivering an average return of 22.50 per rating with a 90% success rate. Click on the image below to learn more.

Conclusion

In conclusion, despite competitive pressures and a declining take rate, PayPal’s Q2 results demonstrate resilience and potential for continued growth. The company’s focus on international markets and innovative services like BNPL show that management can navigate the current fintech environment and create value. In the meantime, PayPal’s robust free cash flow and aggressive share buybacks reinforce the bullish investment case, suggesting that the stock’s ongoing recovery will likely endure.