Fintech company PayPal (PYPL) is scheduled to announce its results for the second quarter of 2025 on July 29. PYPL stock has declined about 9% year-to-date due to slowing user growth, margin pressures, and rising competition from major players like Apple Pay (AAPL) and Shopify (SHOP) in the digital payments space. However, the stock is still up about 32% over the past year, supported by improving profitability and cost-cutting efforts. Wall Street expects PayPal to report Q2 2025 EPS (earnings per share) of $1.30, indicating 9% year-over-year growth.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Also, revenue is expected to rise about 2.7% to $8.08 billion. Investors will look for updates from PayPal’s management on progress with cost-cutting measures, the impact of tariffs on international business, and the rollout of new products. Meanwhile, TipRanks’ AI stock analysis has assigned an Outperform rating to PayPal stock with a price target of $84.00, indicating a 7.72% upside potential.

Analysts’ Views Ahead of PayPal’s Q2 Earnings

PayPal is drawing mixed views from investors ahead of its Q2 earnings report on July 29. In a new note dated July 24, Bernstein analyst Harshita Rawat raised her price target from $80 to $85 and maintained a Market Perform rating on the stock.

Rawat pointed to growing competition from Apple Pay and Shop Pay, but also highlighted positives like cost-cutting efforts, share buybacks, and new initiatives under CEO Alex Chriss. She noted that PayPal’s current valuation and a 10% free cash flow yield leave enough room for upside if execution improves.

Meanwhile, Truist analyst Matthew Coad maintained a Sell rating on PayPal with a $68 price target. He cited concerns that ongoing promotions could hurt profit margins, even though U.S. payment volumes remained stable and Venmo trends showed improvement.

Options Traders Anticipate Large Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry; the Options tool does this for you.

Indeed, it currently says that options traders are expecting about a 7.13% move in either direction in PYPL stock in reaction to Q2 results.

Is PYPL Stock a Buy, Sell, or Hold?

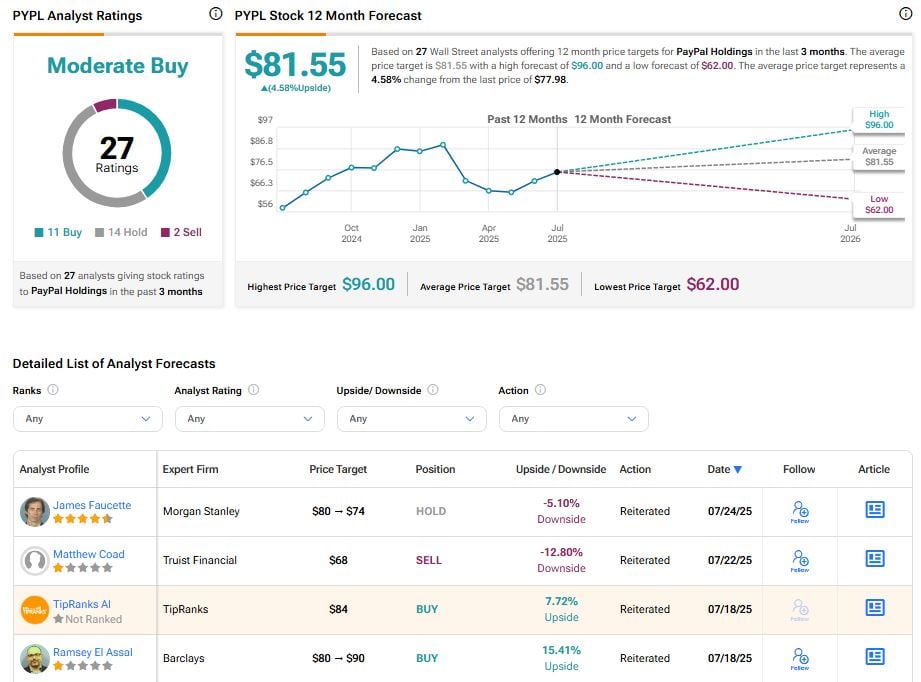

Overall, Wall Street has a Moderate Buy consensus rating on PayPal Holdings stock based on 11 Buys, 14 Holds, and two Sell ratings. The average PYPL stock price target of $81.55 implies about 5% upside potential from current levels.