Shares of software provider UiPath (PATH) jumped in after-hours trading after the company reported earnings for its second quarter of Fiscal Year 2025. Earnings per share came in at $0.04, which beat analysts’ consensus estimate of $0.03 per share. Sales increased by 10% year-over-year, with revenue hitting $316 million. This also beat analysts’ expectations of $303.7 million. However, the thing that enthused investors was the company’s outlook.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Looking forward, management has provided the following guidance for FY 2025:

- Revenue of between $1.420 billion and $1.425 billion versus analysts’ estimates of $1.409 billion

- Non-GAAP operating profit of $170 million

As we can see, the company’s revenue outlook is better than expected, while the non-GAAP operating profit forecast has increased from the previous estimate of $145 million. This likely led to the after-hours gain in the stock price.

Investor Sentiment for PATH Stock Is Very Negative

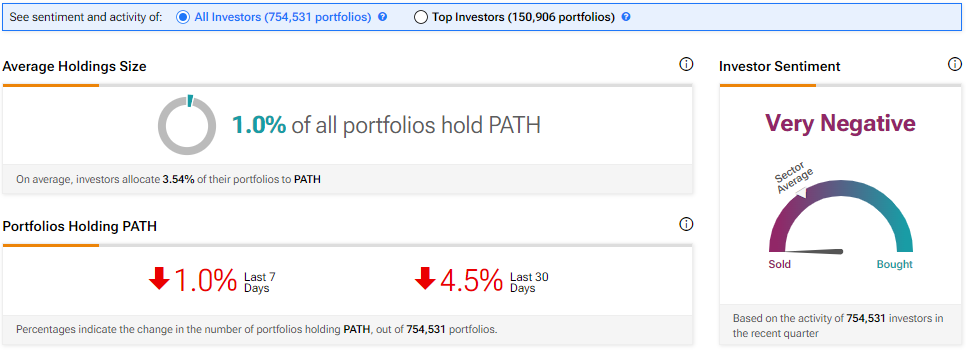

The sentiment among TipRanks investors is currently very negative. Out of the 754,531 portfolios tracked by TipRanks, 1% hold PATH stock. However, this is a slight decrease compared to its previous earnings report, when the percentage was 1.1%. It is not a big decline, but it is part of a larger trend that shows investors are losing confidence. In fact, the stock has been cut almost in half since the start of 2024.

Furthermore, in the last 30 days, 4.5% of those holding the stock decreased their positions. As a result, the stock’s sentiment is below the sector average, as demonstrated in the image below. Nevertheless, it will be interesting to see if this sentiment changes following today’s results or if investors will simply take the opportunity to get out at a better price.

Is PATH Stock a Good Buy?

Turning to Wall Street, analysts have a Hold consensus rating on PATH stock based on eight Holds assigned in the past three months. In addition, the average PATH price target of $14.33 per share implies 12.48% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.