Shares in Parsons (PSN) rose by almost 2% during Wednesday’s pre-market trading after the defense and intelligence contractor clinched a new $88 million award from the U.S. Air Force.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Under the new contract, the Virginia-based company will support the U.S. Europe/Africa Command’s Air Base Air Defense (ABAD) mission at the Ramstein Air Base in Germany. Specifically, over the next three years, the critical infrastructure provider will procure and configure advanced equipment for the command.

What Are the Other Deliverables?

Parsons will also be responsible for systems integration and training specialized operators. This will be in addition to providing technical support to the command and continuing its maintenance function.

Parsons secured the award under its existing ten-year single-award contract with the ABAD mission. The long-term contract was awarded in 2021 and has a maximum possible value of up to $953 million.

Parsons Snubbed for $12.5B Overhaul Project

The umbrella contract was awarded under the Indefinite Delivery Indefinite Quantity design. This means that it is a flexible, as-needed contract with no guaranteed number of orders or total dollar value. So far this year, Parsons has been awarded about $192 million in contracts under the ABAD umbrella contract.

The latest contract comes days after Parsons lost the $12.5 billion project to renovate the U.S. air traffic control system to Peraton, a private national security firm. The U.S. Federal Aviation Administration picked Peraton over a joint bid from Parsons and IBM (IBM).

The upgrade project is part of President Donald Trump’s One Big Beautiful Bill Act.

Is PSN Stock a Good Buy?

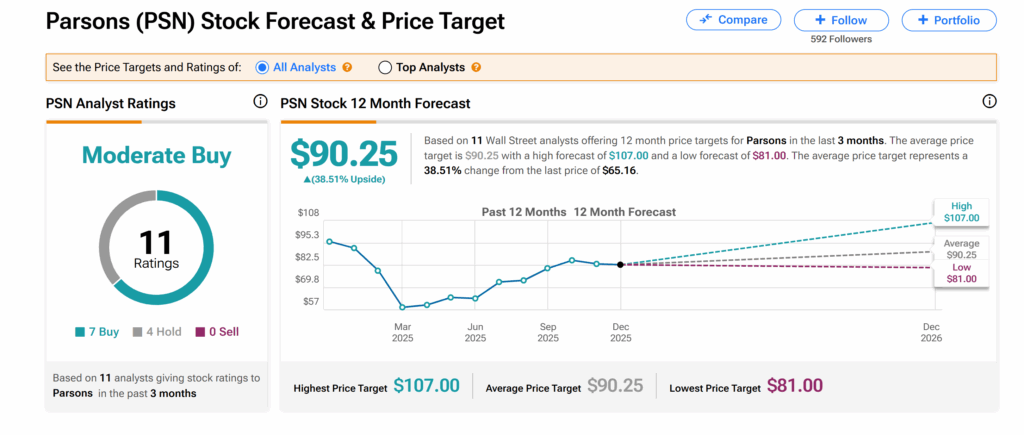

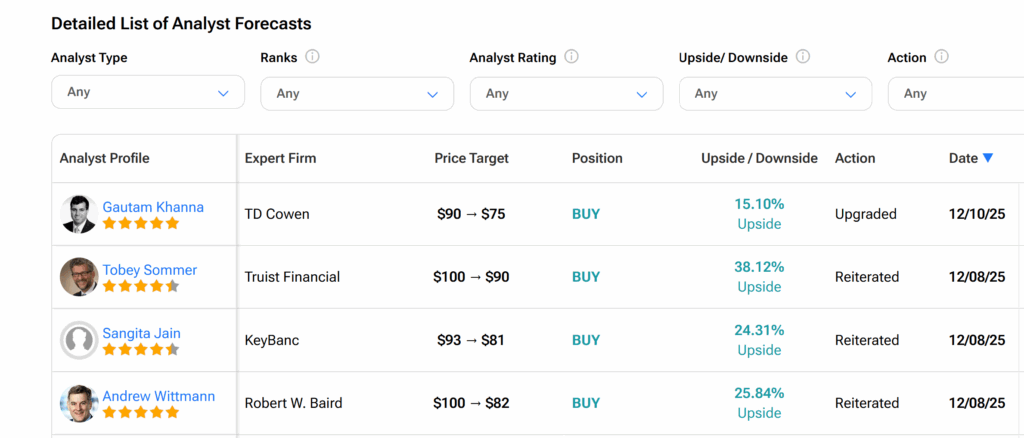

Turning to Wall Street, Parsons’ shares have a Moderate Buy consensus rating from analysts. This is based on seven Buys and four Holds issued by 11 analysts over the past three months.

At $90.25, the average PSN price target implies approximately 39% growth potential from current trading levels.