Earlier today, Parkland Corporation (TSE:PKI), which mainly operates convenience stores and gas stations globally, revised its financial projections. The company raised its 2023 adjusted EBITDA guidance to a range of C$1.8 to C$1.85 billion, a significant increase from the prior C$1.7 to C$1.8 billion estimate. Additionally, the firm expects to reach a milestone of approximately C$2 billion in adjusted EBITDA by 2024, surpassing its initial goal set for 2025.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

CEO Bob Espey attributed this accelerated trajectory to fruitful acquisitions, the realization of synergies, consistent organic growth, and cost efficiencies.

Further, the company reported revised capital expenditures for 2023, now amounting to C$450 to C$500 million, a decrease from the previous C$500 to C$550 million projection. Looking ahead, Parkland foresees a leverage ratio of around three times by the end of 2023, an improvement from 3.4 times at 2022’s close. Also, the anticipated cash flow per share for 2024 is approximately C$9.50, and its return on invested capital is projected to exceed 11% next year, marking a favorable uptick from last year’s 8.3%.

To delve deeper into these developments, Parkland has scheduled an Investor Day on November 14, 2023.

Is PKI Stock a Good Buy?

According to analysts, PKI stock comes in as a Strong Buy based on seven Buys assigned in the past three months. The average PKI stock price target of C$44.07 implies 20% upside potential.

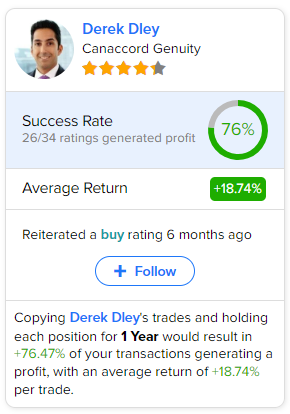

If you’re wondering which analyst you should follow if you want to buy and sell PKI stock, the most accurate analyst covering the stock (on a one-year timeframe) is Derek Dley of Canaccord Genuity (TSE:CF), with an average return of 18.74% per rating and a 76% success rate. Click on the image below to learn more.