Skydance Media has reached a preliminary agreement to acquire National Amusements, the Wall Street Journal reported. The media and entertainment company Paramount Global (NASDAQ:PARA) is a subsidiary of National Amusements. Per the report, the deal, if approved, will lead to a merger between Skydance and Paramount.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Following the release of this news, Paramount stock jumped about 8% in Tuesday’s after-hours trading.

Deal Details

Under the agreement, Skydance plans to buy National Amusements for $1.75 billion, up from its previous offer of $1.7 billion. However, the deal is subject to approval by Paramount’s special committee.

Also, there’s a 45-day window during which other potential buyers can submit offers to secure the best deal.

Background of the Deal

This acquisition is the latest twist in a long and complicated series of negotiations between Skydance and Paramount. Negotiations ended last month when media heiress Shari Redstone ended talks to sell her controlling stake in Paramount Global.

Nevertheless, the talks have resumed with new terms and a higher valuation.

Earlier, Skydance Media restructured its bid to include a provision allowing non-voting Paramount shareholders to sell shares at a premium. Moreover, Skydance planned to inject cash into Paramount’s balance sheet to reduce its high debt. Despite these incentives, the parties have failed to reach a deal until now.

Is Paramount a Buy or Sell?

Paramount stock is down about 27% year-to-date due to concerns about its long-term viability. The decline reflects increased streaming competition and challenges in cable and broadcast networks.

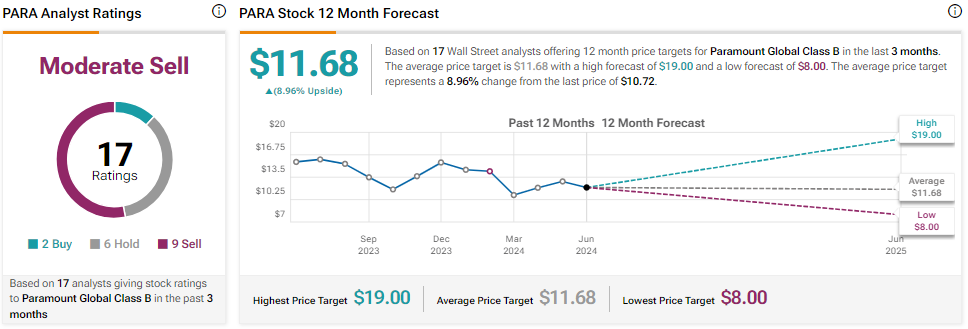

Wall Street is bearish about Paramount stock. It has two Buys, six Holds, and nine Sell recommendations for a Moderate Sell consensus rating. The price target for PARA stock is $11.68, implying 8.96% upside potential from current levels.