In this piece, I evaluated two media stocks, Paramount (NASDAQ:PARA) and Warner Bros. Discovery (NASDAQ:WBD), using TipRanks’ Comparison Tool to see which is better. A closer look suggests neutral views of both.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Paramount Global is a mass media and entertainment conglomerate currently controlled by National Amusements, although it has a pending merger with the privately held Skydance Media underway.

Warner Bros. Discovery is the result of the combination of two large media firms, Discovery and AT&T’s WarnerMedia. It owns global media networks like CNN, Discovery, HBO, and some well-known media franchises like Game of Thrones.

Shares of Paramount Global have tumbled 21% year-to-date and are down 30% over the last year, while Warner Bros. Discovery stock has plunged 36% year-to-date and is down 45% over the last year.

With both stocks off so much year-to-date and over the last year, a closer look is needed to determine why and whether those selloffs are warranted. Paramount’s stock price is linked to the pending merger deal, but for Warner Bros. Discovery, a price-to-sales (P/S) comparison can be useful because the company is not profitable.

The media industry is trading at a P/S of 1.1 versus its three-year average of 1.4.

Paramount Global (NASDAQ:PARA)

After months of negotiations, Paramount agreed to merge with Skydance in a deal worth $15 a share for class B shareholders. At the current price below $12 a share, a merger-arbitrage play could be possible here. However, regulators could threaten the transaction, suggesting a neutral view might be appropriate.

PARA, the ticker evaluated in this article, represents the company’s class B shares, which places a ceiling of $15 a share on the stock. The class A shares (NASDAQ:PARAA) are trading at around $21 a share, nearly in line with the pending deal’s offer of $23 a share for class A.

The total deal is worth $4.5 billion for public shareholders, and Skydance will inject another $1.5 billion into Paramount’s balance sheet to deal with some of the large debt pile of nearly $15 billion.

Regulators must still approve the merger, which is expected to close in the third quarter of 2025. Thus, a key concern for anyone who would buy Paramount Global stock based on the discount to the $15-per-share price should consider whether the merger will pass muster with the Department of Justice.

The DOJ could file a lawsuit to block the transaction due to over-consolidation within Hollywood. In fact, an antitrust professor at Vanderbilt University Law School sees “significant risk” that the DOJ moves to block it. She noted the high level of aggression by regulators recently against “high-profile mergers that people read about in papers.”

According to The Hollywood Reporter, thousands of jobs fell to over $400 billion in telecom megamergers between 2009 and 2020, with just five transactions accounting for most of that total. Of course, it remains to be seen whether the DOJ will block this megamerger.

However, buying Paramount stock, even at the current price, seems a bit like playing with fire. Even if the deal goes through, Paramount may have to sell off some assets in exchange for regulatory approval, so I’d prefer to wait for more information before considering the shares.

What Is the Price Target for PARA Stock?

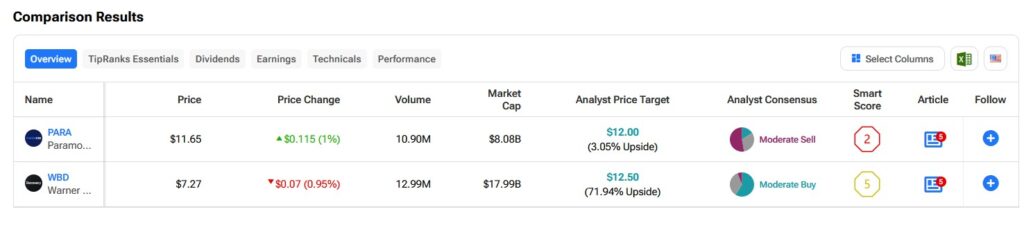

Paramount Global has a Moderate Sell consensus rating based on three Buys, six Holds, and 10 Sells assigned over the last three months. At $12, the average Paramount Global stock price target implies an upside potential of 3.05%.

Warner Bros. Discovery (NASDAQ:WBD)

At a P/S of 0.44, Warner Bros. Discovery looks very cheap compared to its industry, although its market capitalization is still near $18 billion. The company also faces several potential issues, suggesting a neutral view might be appropriate, at least for now, because those issues may take time to resolve.

On the one hand, we’re going into a presidential election this year, which means more political advertising revenue for Warner Bros. Discovery. However, the key problem is that the company was saddled with $50 billion in debt from the merger.

Nonetheless, it’s been steadily paying that down, which is a very good sign that recovery is underway. After repaying $1.1 billion in debt during the first quarter, the company’s gross debt stood at $43.2 billion.

Unfortunately, management is already talking about more mergers and acquisitions, which will likely increase the company’s debt levels further. Thus, this bear is watching because any additional M&A activities that significantly add to Warner Bros. Discovery’s debt load could negatively impact its stock.

Other issues, like the possibility that the company will lose its NBA broadcasting rights, are key overhangs for the stock right now. Thus, I’d probably wait a bit to see what happens and then decide whether a buy-the-dip opportunity exists.

What Is the Price Target for WBD Stock?

Warner Bros. Discovery has a Moderate Buy consensus rating based on 10 Buys, six Holds, and one Sell rating assigned over the last three months. At $12.50, the average Warner Bros. Discovery stock price target implies an upside potential of 71.47%.

Conclusion: Neutral on PARA and WBD

While Paramount Global and Warner Bros. Discovery both receive neutral views, the issues they’re facing are very different. Warner Bros. is the winner of this pairing because its problems may be closer to resolution — unless its debt fortunes reverse again after another megamerger. With Paramount, a key issue is that its megamerger may not go through or may require such significant divestitures that it no longer becomes attractive for Skydance.