Paramount Global (PARA) reported mixed results in the third quarter. The media and entertainment conglomerate’s adjusted earnings increased by 63% to $0.49 per share, exceeding consensus estimates of $0.24 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

PARA’s Revenues Dragged Down by TV Media Business Segment

However, the company’s revenues declined by 6% year-over-year to $6.73 billion in the third quarter. This fell short of Street estimates of $6.9 billion.

In the third quarter, Paramount’s TV media business, which includes channels like CBS and MTV, faced a 6% year-over-year decline in revenues to $4.3 billion. This drop was driven by several challenges, including lower advertising spending, a drop in subscriber numbers, and the absence of high-profile pay-per-view boxing events.

Paramount’s Streaming Business Does Remarkably Well

Meanwhile, Paramount’s streaming unit, which includes the Paramount+ and PlutoTV platforms, showed encouraging results during the quarter. PARA’s streaming services benefitted from price hikes for Paramount+ and strong sports content such as NFL games.

In addition, Paramount+ added 3.5 million subscribers in the third quarter, a substantial recovery after the previous quarter’s loss of 2.8 million subscribers. This reversal suggests that Paramount’s investments in content, particularly sports and hit series, are resonating with audiences.

Is PARA a Buy or Sell?

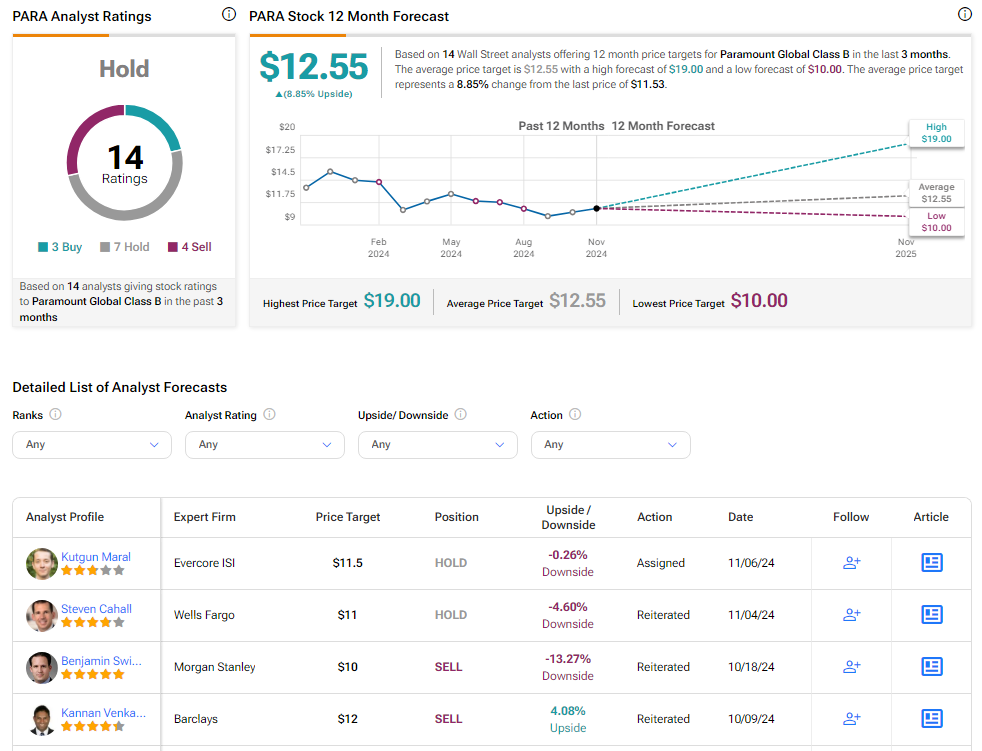

Analysts remain sidelined about PARA stock, with a Hold consensus rating based on three Buys, seven Holds, and four Sells. Year-to-date, PARA has declined by more than 15%, and the average PARA price target of $12.55 implies an upside potential of 8.8% from current levels. These analyst ratings are likely to change following PARA’s results today.