Shares of Palo Alto Networks (PANW) are down in after-hours trading after the cybersecurity company reported earnings for its third quarter of Fiscal Year 2025. Earnings per share came in at $0.80, which beat analysts’ consensus estimate of $0.77 per share. In addition, sales increased by 15% year-over-year, with revenue hitting $2.3 billion. This also beat analysts’ expectations of $2.28 billion.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

The company’s Q2 results were driven by the success of its platformization strategy, according to CFO Dipak Golechha, which is a strategy that involves creating a central platform that integrates multiple products and services into a seamless customer experience. This led to more than $5 billion in Next-Generation Security Annual Recurring Revenue and Remaining Performance Obligations of $13.5 billion.

PANW’s Guidance for 2025

Looking forward, management now expects revenue and adjusted earnings per share for Q4 2025 to be in the ranges of $2.49 billion to $2.51 billion and $0.87 to $0.89, respectively. For reference, analysts were expecting $2.5 billion in revenue along with an adjusted EPS of $0.87.

For Fiscal Year 2025, revenue is expected to land between $9.17 billion to $9.19 billion, compared to estimates of $9.18 billion. Furthermore, the firm anticipates earnings per share of $3.26 to $3.28 versus expectations of $3.23 per share.

Although Palo Alto’s earnings and guidance exceeded expectations, the reason why shares saw a decline in after-hours trading is likely due to the company’s valuation. Indeed, it is likely that its current price-to-earnings ratio of 109x was already pricing in a beat, especially since shares rallied into the earnings release.

What Is the Price Target for PANW?

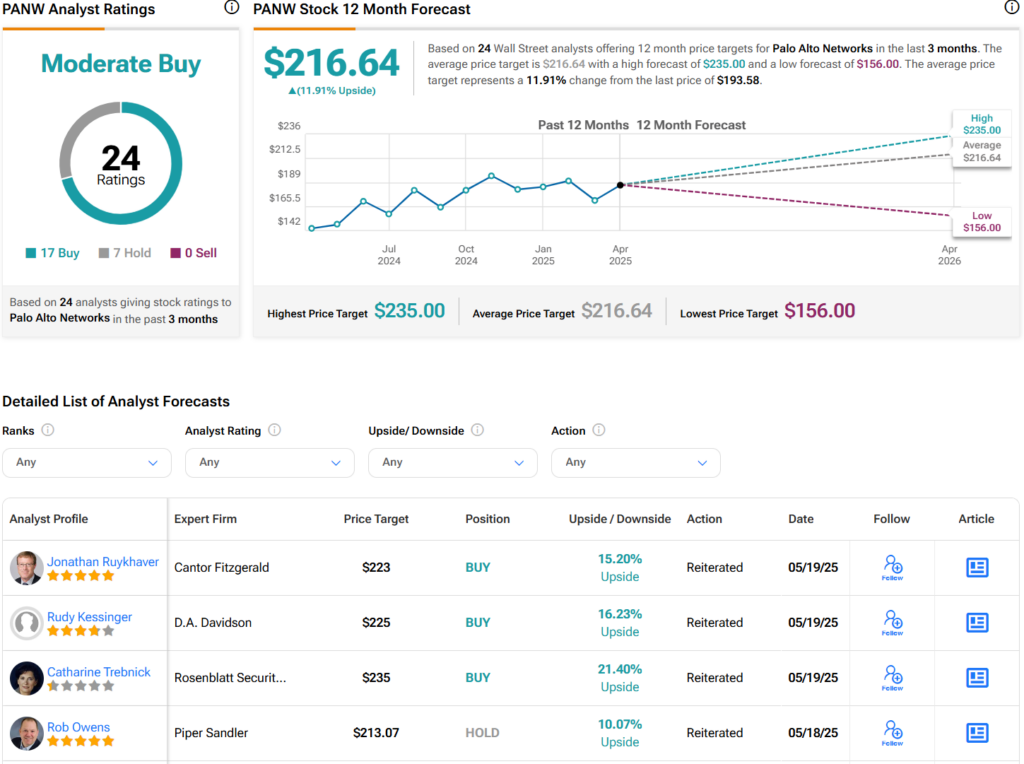

Turning to Wall Street, analysts have a Moderate Buy consensus rating on PANW stock based on 17 Buys, seven Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average PANW price target of $216.64 per share implies 12% upside potential. However, it’s worth noting that estimates will change following today’s earnings report.