Palantir stock (PLTR) has been on a tear this year as it has rallied over 150% in 2024. It is now trading at levels last seen in 2021, which has brought an end to the years of suffering endured by long-term investors. However, this rally has left Wall Street analysts divided about its future as bearish sentiment rises.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

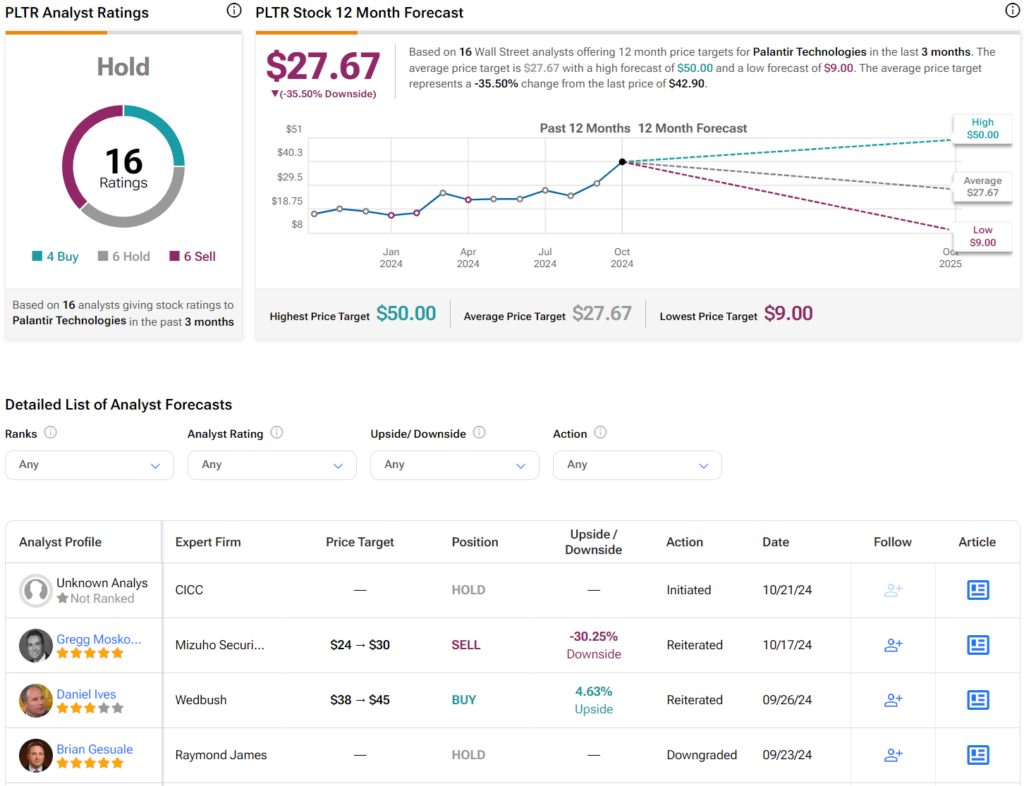

For example, five-star analyst Brian Gesuale recently downgraded the stock to Hold without assigning a price target. Conversely, Dan Ives reiterated his Buy rating while boosting his price target from $38 to $45 per share. So, what are the different arguments made between the bulls and the bears? Let’s explore below.

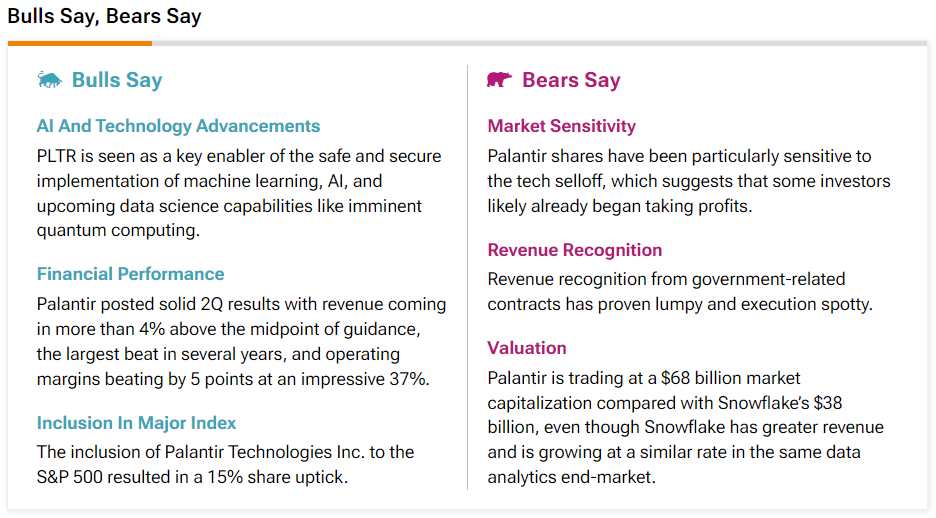

What Do the Bears Say?

The stock’s steep valuation is a major sticking point for bearish analysts, as PLTR trades at over 100 times future earnings. For reference, other AI companies like Nvidia (NVDA) and Oracle (ORCL) trade at 36 and 28 times forward earnings, respectively. Analysts also point out that Palantir has a $68 billion market cap compared with Snowflake’s $38 billion. This is despite Snowflake’s higher revenue and similar growth rate in the same data analytics end-market.

As a result, analysts from Raymond James say that Palantir has “no room for error” in its upcoming earnings. This is because when stocks have a high valuation, any sort of disappointment makes them more sensitive to sharp declines.

What Do the Bulls Say?

When it comes to the Bulls, they see Palantir as a key enabler of safe and secure technology, such as machine learning and AI. This is important because unsafe tech applications can significantly harm operations. As a result, companies are likely to turn to Palantir when implementing advanced technologies. In fact, Palantir’s AI tools have landed new customers like CBS Broadcasting (PARA) and General Mills (GIS) this year.

In addition, CNBC Mad Money host Jim Cramer recently came out in favor of holding PLTR stock. More specifically, he stated that “there is no level that the buyers won’t take this stock higher.” This stance is in stark contrast to the bears’ worry about valuation becoming way too high.

Is PLTR a Good Stock to Buy?

Overall, analysts have a Hold consensus rating on PLTR stock based on four Buys, six Holds, and six Sells assigned in the past three months, as indicated by the graphic below. In addition, the average PLTR price target of $27.67 per share implies 35.5% downside risk.