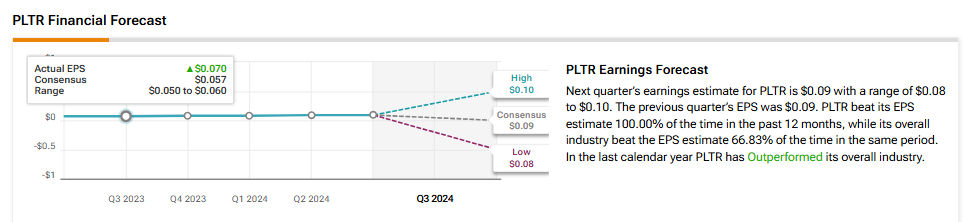

Palantir Technologies (PLTR) will release its fiscal Q3 financials on November 4. Wall Street analysts expect the company to report earnings of $0.09 per share, representing a 29% increase year-over-year. Meanwhile, revenues are expected to grow by 26% from the year-ago quarter to $703.36 million, according to data from the TipRanks Forecast page.

Palantir Technologies is a software company that specializes in big-data analytics and serves institutions, private enterprises, and non-profit organizations. PLTR stock has soared over 142% year-to-date and 205% in the last year, driven by the growing demand for AI applications.

Interestingly, Palantir missed EPS estimates only once out of the last six quarters.

Insights from the TipRanks Bulls & Bears Tool

According to TipRanks’ Bulls Say, Bears Say tool pictured below, bullish analysts are impressed with Palantir’s strong Q2 performance, marked by solid revenue growth and large-deal momentum. Its recent inclusion in the S&P 500 (SPX) has also boosted the stock. Analysts see Palantir’s expertise in data structuring, IT upgrades, and custom AI applications as key strengths, positioning it to capture medium-term enterprise AI opportunities and drive growth.

At the same time, bears point to challenges in Palantir’s reliance on government contracts, where inconsistent revenue raises sustainability concerns. Additionally, Palantir’s sensitivity to tech selloffs suggests that some investors may already be taking profits, while its high valuation compared to peers remains an issue.

Options Traders Anticipate a Large Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 13.86% move in either direction.

Is Palantir Technologies a Good Stock to Buy?

Turning to Wall Street, Palantir stock has a Hold consensus rating. Out of the 11 analysts covering the stock, two have a Buy recommendation, five have a Hold, and four analysts recommend selling the stock. Furthermore, at $28, the average PLTR price target implies 32.63% downside potential.