Shares of the leading software company Palantir Technologies (PLTR) have marked a stellar recovery so far this year. For instance, Palantir stock has gained over 285% year-to-date. This impressive gain can be attributed to several factors, including strong Q3 earnings results and its growing demand for its AI solutions across government and commercial sectors.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Interestingly, Jim Cramer, the well-known host of CNBC’s ‘Mad Money’ program, is crediting Musk for driving the recent momentum in Palantir shares. Cramer wrote, “Palantir is up a lot because I believe Musk is going to turn to them and say, ‘The Defense Department, it’s yours … get rid of all those people.” With this perspective, it’s a good time to to explore who owns PLTR.

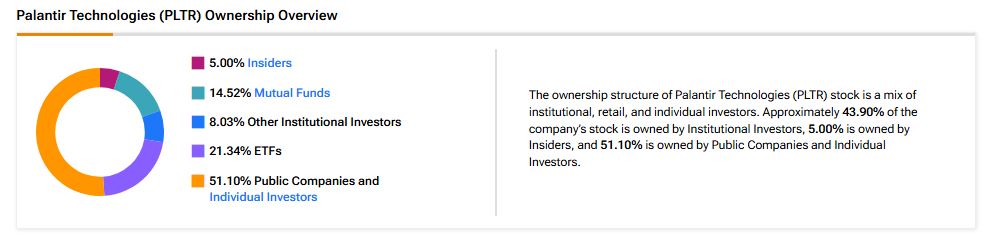

Now, according to TipRanks’ ownership page, public companies and individual investors own 51.10% of Palantir. They are followed by other institutional investors and insiders at 43.9% and 5%, respectively.

Digging Deeper into Palantir’s Ownership Structure

Looking closely at top shareholders, Vanguard owns the highest stake in PLTR at 10.31%. Next up is Vanguard Index Funds, which holds a 9.08% stake in the company.

Among the top ETF holders, Vanguard Total Stock Market ETF (VTI) owns a 2.95% stake in Palantir stock, followed by Vanguard S&P 500 ETF (VOO) with a 2.45% stake.

Moving to Mutual Funds, Vanguard Index Funds holds about 9.08% of PLTR, whereas Fidelity Concord Street Trust owns 0.89% of the stock.

Is PLTR a Good Stock to Buy Now?

Palantir has a Hold consensus rating based on three Buys, seven Holds, and six Sell ratings assigned over the last three months. The average PLTR stock price target of $38.73 implies about 41.36% downside potential from current levels.

Conclusion

TipRanks’ Ownership tool provides PLTR ownership structure by category, enabling investors to make well-informed investing decisions.

For a thorough assessment of Palantir stock, go to TipRanks’ Stock Analysis page.