Wall Street investment bank Piper Sandler (PIPR) remains bullish on data analytics company Palantir (PLTR) despite its big move higher and lofty valuation.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Analyst Brent Bracelin initiated coverage of the stock with a Buy-equivalent overweight rating and a $170 price target. Bracelin wrote that Piper Sandler has monitored PLTR stock since before its market debut in 2020, through late 2022, when it plummeted to $6, and into this year, when the share price has risen 110%, giving it a sky-high price-earnings ratio of 694.

“PLTR has been crowned an AI All-Star on accelerating growth,” wrote the analyst in a note to clients. He added that Palantir is a “secular winner in the AI revolution” and sees another 30% growth ahead for the stock.

Defense Ties

Bracelin adds that he expects Palantir to deepen its ties to the U.S. Army and Department of Defense, gaining from shifts in military spending that will benefit artificial intelligence (AI) software providers.

While Palantir is most often linked to the U.S. government, its commercial division continues to grow as well. Bracelin believes U.S. commercial revenue could expand at a 33% compound annual growth rate (CAGR) to $5 billion by the end of 2030 as more companies use Palantir’s technology.

Bracelin noted that visitor traffic to Palantir’s website surged 144% in the second quarter of this year, up from 62% growth in 2024.

Is PLTR Stock a Buy?

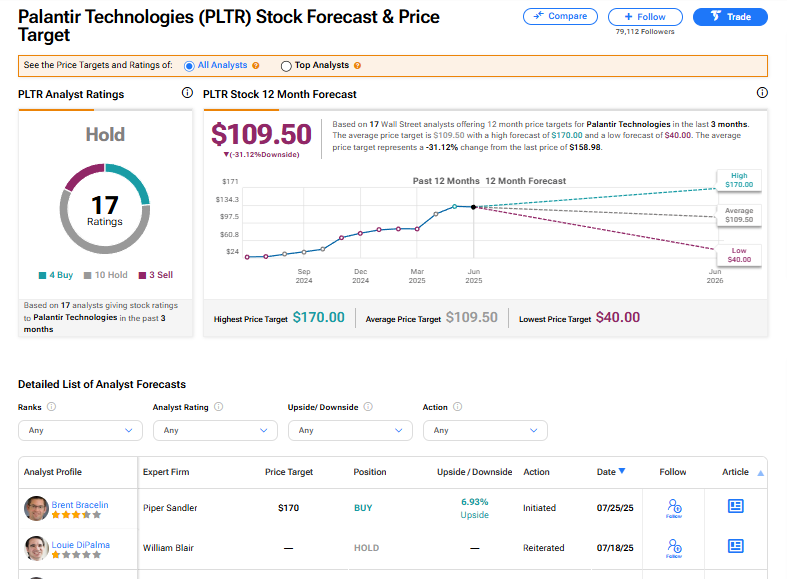

The stock of Palantir has a consensus Hold rating among 17 Wall Street analysts. That rating is based on four Buy, 10 Hold, and three Sell recommendations issued in the last three months. The average PLTR price target of $109.50 implies 31.12% downside risk from current levels.