Palantir Technologies (PLTR) is trending higher in pre-market trading Tuesday, extending Monday’s 2.5% gain after unveiling a new defense partnership with the Polish government. The stock climbed to an intraday high of $192.83 on Monday and is now up more than 150% this year. Investors are keeping a close watch as Palantir prepares to report its third-quarter results on November 3.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The stock also gained from a broad rally in AI and tech shares, helped by progress in U.S.–China trade talks. Investors are showing renewed confidence in companies tied to AI software and defense technology, with Palantir often seen as a key player in both areas.

Palantir Signs Defense Agreement in Europe

According to Bloomberg, Palantir signed a letter of intent with Poland’s Ministry of Defense to provide software for data analytics, AI, and cybersecurity. The deal was signed in Warsaw by Defense Minister Wladyslaw Kosiniak-Kamysz and Palantir CEO Alex Karp.

Although financial terms were not shared, officials said Poland is looking at several Palantir systems for battlefield management, logistics, and data links between military units. The country plans to spend about 200 billion zloty ($55 billion) on defense next year.

The deal shows Palantir’s growing role in European defense, as more countries look for AI-based systems to improve security and operations.

Earnings in Focus

Palantir will release its Q3 earnings on November 3, and investors are watching for signs of continued revenue growth. Analysts expect solid results from both government and commercial contracts, driven by rising demand for the company’s AI Platform (AIP).

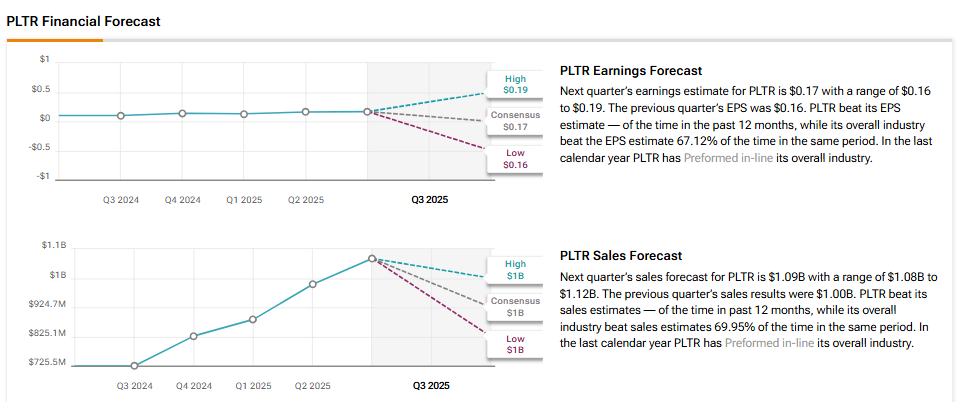

Wall Street expects earnings of $0.17 per share, up 70% from last year, and revenue of about $1.09 billion, reflecting nearly 50% growth year over year.

With new global deals and steady AI momentum, Palantir’s recent rally reflects a growing belief in its long-term potential. The company’s next earnings update will show whether it can keep building on its strong 2025 performance.

Is PLTR a Good Stock to Buy Now?

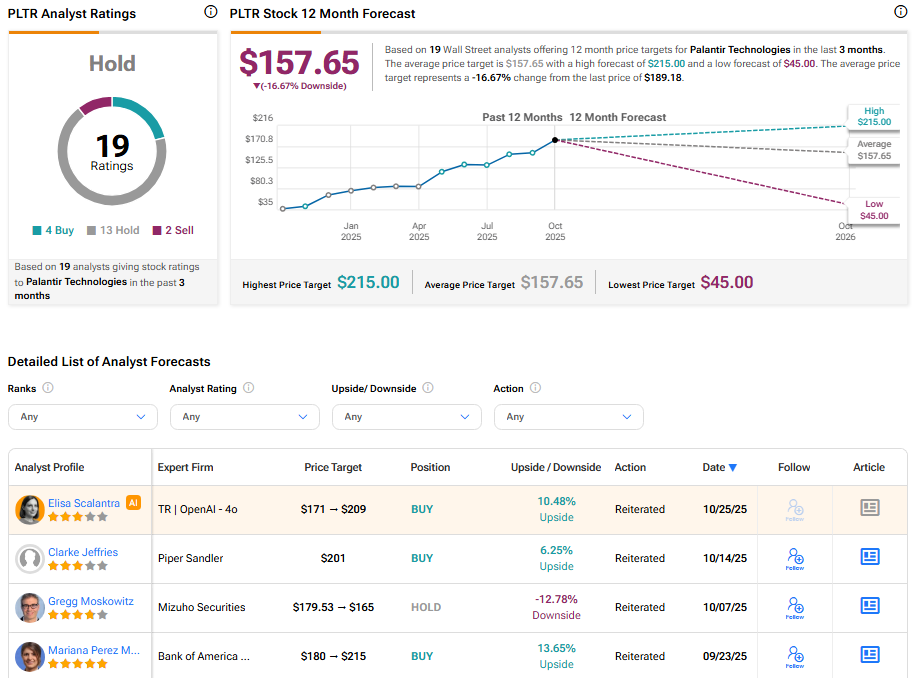

Overall, Wall Street is sidelined on PLTR stock, with a Hold consensus rating based on four Buys, 13 Holds, and two Sell recommendations. The average PLTR stock price target of $157.65 implies 16.67% downside risk from current levels.