Palantir Technologies (PLTR) has been one of the most talked-about stocks of 2025 after delivering 150%+ gains year-to-date in the S&P 500 (SPX), placing it among the top performers this year. At the same time, the surge has fueled mixed views on whether the stock can sustain its momentum. Here’s a clear look at what bulls and bears are saying.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge-fund level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The Bull Case for Palantir

1. Accelerating Revenue and AI Adoption: Palantir’s strong performance in 2025 has been driven by accelerating demand across both its government and commercial businesses. In the most recent quarter, revenue rose 63% year over year, supported by a 121% increase in U.S. commercial revenue and a 52% jump in U.S. government sales. The faster growth on the commercial side points to widening enterprise adoption and shows Palantir’s AI platform is gaining traction beyond its traditional public-sector base.

2. Contract Wins Support the AI Story: Bulls point to Palantir’s steady flow of contract wins as proof of its growing role in AI software. The company recently secured a three-year renewal with France’s domestic intelligence agency (DGSI), keeping its platform in daily use. Such renewals are hard to win in Europe and help support results. While commercial growth is rising, government contracts remain a key driver, making deals like this important for the stock.

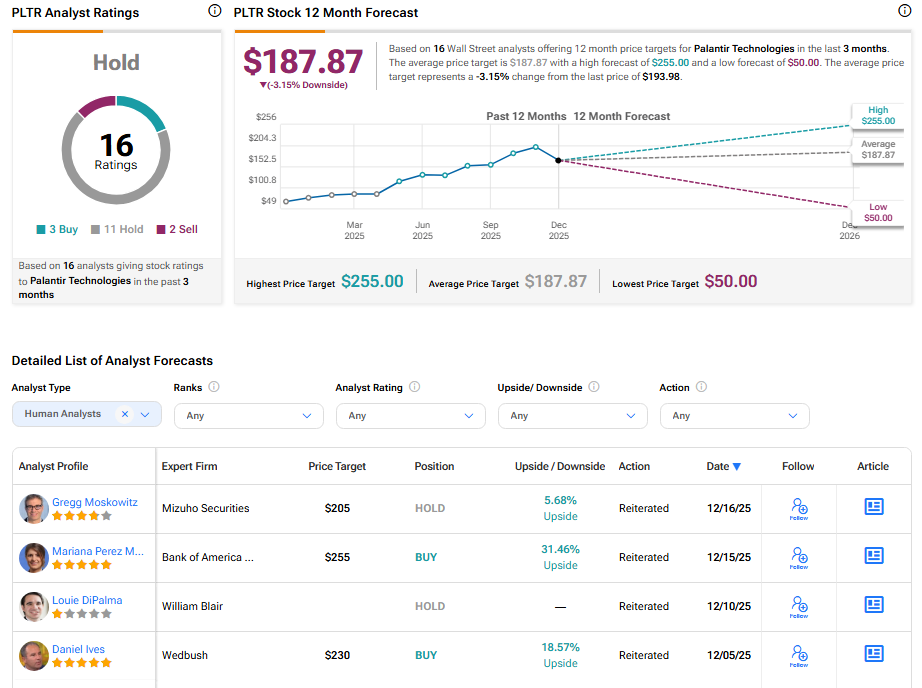

3. Top Analyst Stays Bullish: Some Wall Street analysts remain positive on Palantir, citing its strong position in data and AI software. Mariana Perez Mora of Bank of America recently kept a Buy rating on the stock and set a $255 price target, well above current levels. The analyst said Palantir’s revenue growth shows no signs of slowing, fueled by strong demand from enterprise customers and expanding government contracts.

The Bear Case for PLTR

1. Rich Valuation Raises Risk: Palantir trades at very high valuation levels compared with most software peers. The stock’s price-to-earnings ratio is about 428, far above the sector median of roughly 31, showing investors are paying a steep premium. Bears argue that this leaves little room for error. Even solid growth may not be enough to support the stock if earnings slow or expectations reset.

2. Market Sentiment Remains Cautious: Bears see further downside if valuation concerns and broader market pressure persist. Recently, Raymond James analyst Brian Gesuale reiterated a Hold rating on Palantir after the company posted strong Q3 results, with sharp growth in U.S. commercial and government revenue. Despite the solid results, the analyst remains cautious, saying the stock appears priced for perfection.

Is PLTR a Good Stock to Buy Now?

Overall, Wall Street is sidelined on PLTR stock, with a Hold consensus rating based on three Buys, 11 Holds, and two Sell recommendations. The average PLTR stock price target of $187.87 implies 3.15% downside risk from current levels.

Bottom Line

Palantir’s 2025 performance stands out, but its outlook now depends on valuation and growth trends. Views remain split between long-term AI optimism and near-term valuation concerns.