Palantir Technologies (PLTR) just unleashed a slew of positive data on the market, with strong commercial sales capping off an excellent second quarter. Plus, Palantir is preparing for a full year of stellar sales, so the short sellers had better be on notice. All in all, I am bullish on PLTR stock and look forward to further developments from Palantir.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Palantir Technologies offers security, data analytics, and artificial intelligence (AI) services. It seems like every technology company is infusing AI into its products and services nowadays. Palantir is no exception to this rule, but investors might wonder whether the AI-tech adoption is all hype with no real results.

As it turns out, Palantir Technologies delivered measurable results that even the staunchest skeptics can’t complain about. As long as there is demand for AI-capable security services from governments and private businesses, Palantir is well-positioned to meet these needs with its product offerings.

Palantir: This One Statistic Will Stun You

In light of Palantir Technologies’ second-quarter 2024 results, D.A. Davidson managing director Gil Luria commented, “Enterprise customers are increasingly selecting Palantir to help them find a path to leveraging artificial intelligence within their business.” That’s an insightful remark, and it highlights a stunning statistic about Palantir’s sales to private businesses.

Believe it or not, Palantir Technologies’ Q2-2024 U.S. Commercial sales grew 55% year-over-year to $159 million. So, don’t pigeonhole Palantir as a company that relies too much on government contracts. Clearly, Palantir is quite capable of generating revenue from private businesses as well.

Plus, here’s another jaw-dropper. Palantir Technologies’ U.S. commercial market customer count grew 83% year-over-year to 295 in 2024’s second quarter. I don’t expect Palantir to be able to maintain that growth pace, but for now, who could really argue with these stellar numbers?

Don’t get the wrong idea, though. Palantir Technologies also takes pride in its Government business, including its arrangement with the U.S. Armed Forces. “The strength and dominance of the US military must be preserved and defended,” Palantir Technologies CEO Alex Karp emphasized.

Palantir Technologies’ Government sales increased by 23% year-over-year to $371 million, surpassing Wall Street’s consensus forecast of $346.6 million. Overall, Palantir generated quarterly revenue of $678 million, up 27.15% year-over-year and a decent beat when compared to the consensus estimate of $653 million.

Palantir’s AI Bet Pays Off Big-Time

Moreover, Karp clearly wanted investors to know that Palantir Technologies isn’t just spending money and effort on AI technology development because it’s a hot trend. He insisted, “Our growth across the commercial and government markets has been driven by an unrelenting wave of demand from customers for artificial intelligence systems that go beyond the merely performative and academic.”

Karp also declared that Palantir Technologies’ AI platform has “already transformed” the company’s business. This leads to an important question, though. Palantir’s AI-tech development may lead to stronger revenue, but it also certainly costs money. In other words, it would be problematic if Palantir is spending more money than it’s making.

There’s no need to worry about that, though. For 2024’s second quarter, Palantir Technologies reported net income of $134 million, easily beating Wall Street’s consensus call for $82.8 million. In terms of adjusted profit, Palantir reported earnings of $0.09 per share, coming in ahead of the consensus prediction of $0.08 per share.

The takeaway here is that Palantir Technologies’ bet on AI technology appears to be paying off, so far. Still, it’s not a bad idea for investors to keep tabs on Palantir’s spending habits to make sure that the company’s financial outlays don’t exceed the revenue.

So, what does the future hold for Palantir Technologies? No one knows for certain, but the outlook is bright, as Palantir guided for full-year adjusted income from operations of $966 million and $974 million. This represents a sizable increase from Palantir’s previous guidance range of $868 million to $880 million.

Is PLTR Stock a Buy, According to Analysts?

On TipRanks, PLTR comes in as a Hold based on three Buys, five Holds, and six Sell ratings assigned by analysts in the past three months. The average Palantir Technologies stock price target is $22.42, implying 17.4% downside potential.

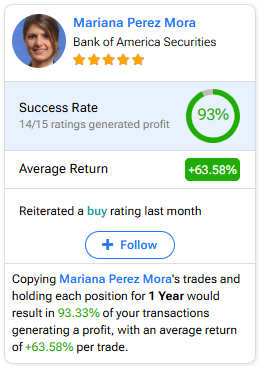

If you’re wondering which analyst you should follow if you want to buy and sell PLTR stock, the most profitable analyst covering the stock (on a one-year timeframe) is Mariana Perez Mora of Bank of America (BAC) Securities, with an average return of 63.58% per rating and a 93% success rate. Click on the image below to learn more.

Conclusion: Should You Consider PLTR Stock?

Palantir Technologies took a chance and went all-in on AI-embedded cybersecurity and data analytics products. Currently, it appears that Palantir’s government and private clients are on board with this AI-product push, and the company’s results demonstrate impressive growth.

In other words, Palantir Technologies is winning and there’s hardly any evidence that the company’s sales growth will come to a halt. Consequently, Palantir’s shareholders have the wind in their sails, and I would definitely consider taking a position in PLTR stock.