Palantir’s stock (PLTR) price “doesn’t make any sense,” according to Jefferies analyst Brent Thill. But that hasn’t stopped it from ripping higher. As the company gears up to report Q1 earnings Monday—with 62% profit growth expected—Wall Street remains deeply divided. Some call it the Tesla (TSLA) of software. Others call it overpriced hype. And in between is a cult-like army of retail investors who don’t care what the spreadsheets say.

Wall Street Splits on Palantir’s True Worth

Analysts expect Palantir’s revenue to rise 36% to $862 million this quarter, with earnings surging 62%. That’s strong. But it hasn’t calmed the valuation debate. Price targets range from $40 to $130. Thill, who has a $60 target and an Underperform rating, told Barron’s, “It’s a great company. I’m not disputing the fundamentals. We’re talking about the stock. The stock and the company are two different things, and Alex Karp doesn’t seem to understand that.”

Palantir currently trades near $118. That’s 69 times its projected 2025 earnings—a multiple higher than any other name in the S&P 500.

Retail Investors Keep Driving the Palantir Rally

While institutional ownership sits at just 59%—well below the S&P average—Palantir’s stock is powered by retail investors. And they’re not going anywhere.

Amit Kukreja, a financial YouTuber with 70,000 subscribers, told Barron’s the retail crowd has long seen what analysts missed. “They said it was expensive at $6, at $10, at $20… and the stock has outrun them.” Kukreja has covered the company for years and says Palantir’s loyal base gelled online during the 2022 bottom.

Since its 2020 debut, shares are up more than 1,100%. For context, the S&P 500 gained just 11% annually over that stretch. Retail holders see Palantir’s long-term vision—and they’re betting on that, not cash flow models.

Palantir’s Software Quietly Powers Hospitals, Burger Chains and Defense

Palantir’s AI-powered platform doesn’t just look flashy—it works. Cleveland Clinic, Swiss Re, and Tampa General all said the firm helped them untangle years of messy data. From hospital staffing to fresh beef inventory for Wendy’s, Palantir’s software turns chaos into clarity.

Founded after 9/11, the company originally helped U.S. intelligence agencies respond to real-time threats. It still serves that world—55% of revenue in 2024 came from governments. But its commercial business is catching up fast.

Is Palantir a Good Stock to Invest In?

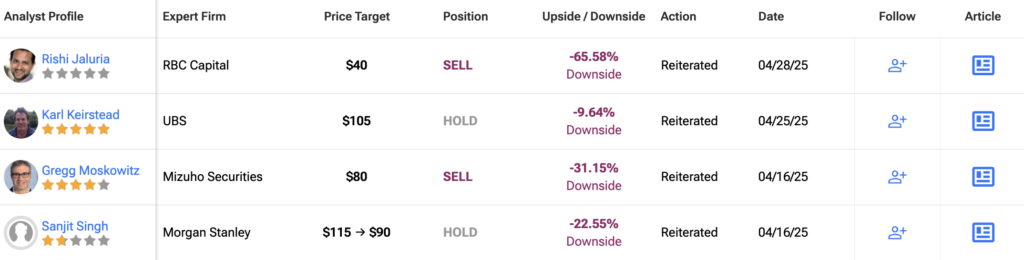

Despite the stock’s momentum, Wall Street still rates Palantir a Hold. According to TipRanks, the average 12-month PLTR price target for Palantir sits at $93.69, nearly 19% below its current price of $116.20. Among 18 analysts covering the stock, the consensus rating is just Hold, with three Buys, 12 Holds, and three Sells on the books.

Price targets range from a bullish $125 to a bearish $40, showing just how split the Street remains on how to value the company. Some analysts see Palantir’s sky-high multiple—currently 69x 2025 earnings—as dangerously inflated. Others argue the company’s commercial upside and loyal investor base justify a premium.

Until earnings hit Monday, this debate isn’t going anywhere. But if you’re holding PLTR above $100, you’re betting on vision, not valuation.