Palantir Technologies (PLTR) and Oracle (ORCL) stand out as leading global AI infrastructure providers. TipRanks’ AI Analyst gives PLTR an “Outperform” rating but assigns ORCL a “Neutral” rating. It highlights Palantir’s strong U.S. growth and AI emphasis, while noting Oracle’s elevated leverage and negative cash flows.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Interestingly, the AI Analyst’s ratings are quite contrasting with Wall Street’s projections. On TipRanks, PLTR has a Hold consensus rating while ORCL has a Moderate Buy consensus rating.

TipRanks’ AI Stock Analysis tool delivers fast, data-driven evaluations to help investors spot opportunities quickly. It draws on leading models like OpenAI’s GPT-4o and Google’s (GOOGL) Gemini, balancing positive and negative factors that impact a company’s stock performance.

Positive on Palantir’s AI Potential

Palantir stock earns a solid score of 74 out of 100 on the AI tool based on the OpenAI 4o model. It also assigns a price target of $203, implying 14.8% upside from current levels.

Key positives for Palantir include robust U.S. revenue growth and accelerating product adoption that expand its market reach and fuel long-term success. Its Northslope partnership enhances AI capabilities and market presence, boosting its competitive edge and innovation across industries. Strong cash generation also provides financial flexibility for growth investments amid economic uncertainty.

On the downside, Palantir’s stagnant European growth hampers global expansion and revenue potential. A potential drop in contract revenue could squeeze profitability, while regulatory scrutiny of government deals poses reputational risks and may disrupt future operations.

Cautious About Oracle’s High Leverage

Oracle stock earns a Neutral score of 66 out of 100 on the AI tool based on the OpenAI 4o model. It also assigns a price target of $215, implying nearly 13.4% upside from current levels.

Key concerns include Oracle’s high leverage, which signals financial strain and limits growth investments during downturns. Negative free cash flow further pressures operations, while its capital-intensive AI infrastructure model burdens resources and hampers long-term profitability.

Meanwhile, the AI Analyst stays bullish on Oracle’s robust cloud revenue growth potential and AI integrations that enhance product capabilities for a competitive edge in the expanding AI market. Its multi-cloud strategy also broadens reach and flexibility, addressing diverse customer needs and compliance to solidify market position.

Wall Street Prefers ORCL Over PLTR

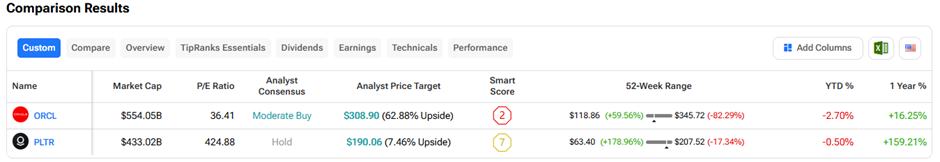

Below, we can see how both ORCL and PLTR perform on TipRanks’ Stock Comparison Tool. ORCL’s Moderate Buy consensus with a massive 62.9% upside potential exceeds the AI Analyst’s target. PLTR’s Hold rating indicates 7.5% upside potential, lower than the AI Analyst’s upside view.

In summary, Palantir’s AI-driven upside rests on its U.S. growth and adoption momentum, while Oracle’s upside hinges on cloud and multi-cloud expansion, despite leverage headwinds.