Focusing on growth stocks is a well-known strategy among investors. It involves buying shares of companies expected to grow at a much faster pace than the broader market or their industry peers, potentially delivering outsized returns. These businesses typically reinvest their profits into operations – or may even operate at a loss – to fuel continued expansion and are often active in disruptive or emerging market segments.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Palantir (NASDAQ:PLTR) and Archer Aviation (NYSE:ACHR) are both good examples of growth stocks. Both play in innovative fields – the former in big data and AI, the latter operating in the nascent eVTOL segment – and are seen as respective game-changers in their industries. Both have also delivered huge returns for investors over the past year.

Growth is something billionaire Israel Englander knows all about. In 1989, with $35 million in tow, Englander founded alternative investment firm Millennium Management. Today, the company is one of the world’s largest alternative investment firms, boasting $73 billion in assets under management, with its global employee count crossing 6,200 while Englander’s net worth stands at $14.2 billion. That is some mightily impressive growth that is sure to impress growth-oriented investors.

Both Palantir and Archer have found a spot in Englander’s portfolio but recently this investing giant has shown a preference for one over the other, with the billionaire loading up on one of these names during Q1 while trimming his holdings of the other.

So, which one caught his eye? Let’s dive in – and with a little help from the TipRanks database, we’ll see what the pros on Wall Street have to say about it too.

Palantir

We’ll start off with Palantir, a growth story any way you look at it. This name has been synonymous with the past couple of years’ bull market, displaying huge growth that has made the stock one of the hottest names on Wall Street.

Founded in 2003, the software company specializes in big data analytics and AI. Initially serving U.S. intelligence agencies with its Gotham platform, Palantir then expanded into the commercial sector with its Foundry platform. In 2023, the company added another arrow to the quiver when it introduced its Artificial Intelligence Platform (AIP), integrating large language models into secure, private networks. AIP facilitates real-time, AI-driven decision-making across a wide variety of sectors, from public health to defense.

Its introduction was the cue for both massive real-world growth and outsized share price gains. For the former, a quick look at the company’s most recent quarterly readout offers some evidence.

In Q1 2025, revenue grew 39.3% year-over-year to $883.85 million, topping expectations by nearly $22 million. U.S. commercial growth led the charge with a 71% surge to $255 million, while U.S. government revenue climbed 45% to $373 million. Adjusted EPS came in at $0.13, matching forecasts.

As for the full year, Palantir nudged its revenue guidance slightly higher – now expecting between $3.89 and $3.9 billion, up from its prior range of $3.74 to $3.76 billion. Consensus had that at figure at $3.75 billion.

Meanwhile, the growth in the share price has been off the charts; PLTR stock has trounced the broader markets over the past year, rising by 482%.

As impressive as the growth has been, various Street watchers have warned that the share gains have taken PLTR’s valuation to unsustainable levels. But that is obviously less of a concern for Englander. During Q1, the investing titan increased his stake by 303%, with the purchase of 986,457 shares. These are currently worth more than $124.6 million.

Like Englander, Bank of America’s Mariana Perez Mora, an analyst who ranks amongst the top 1% of Wall Street stock experts, has no problem with PLTR’s valuation. She lays out why the company is not like others.

“Palantir continues to demonstrate not all ‘AI’ offerings are created equal,” the 5-star analyst said. “Companies continue to announce AI initiatives, product developments, and integrations. However, underneath the marketing and fanfare – the AI tools are often ChatGPT-wrappers. While there’s some value for general tools, we continue to remind investors Palantir’s value is creating outcome-focused bespoke AI-enabled products, at scale. We see PLTR as the market definer for organizations leveraging AI to drive accelerated tangible results.”

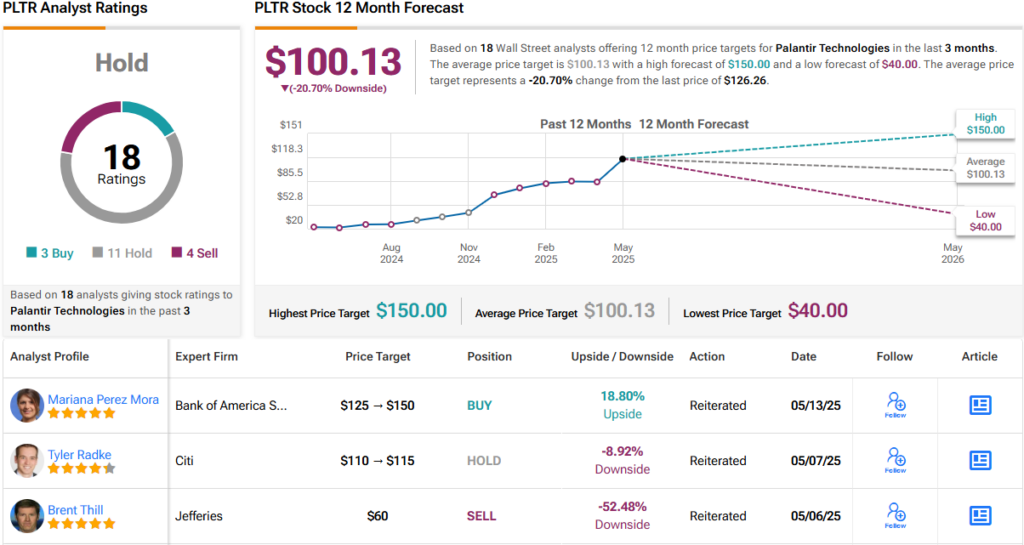

Backing her conviction, Perez Mora gives PLTR a Buy rating and a $150 price target, implying a potential upside of ~19% from current levels. (To watch Perez Mora’s track record, click here)

That said, she’s something of a bull among skeptics. Wall Street at large remains cautious, with 11 Holds, 4 Sells, and just 3 Buys giving PLTR stock a Hold consensus rating. In fact, the average price target of $100.13 points to a ~21% downside potential for the next 12 months. (See PLTR stock forecast)

Archer Aviation

From one growth stock to another, though this next name is playing a very different game. Archer Aviation isn’t just another AI-driven enterprise like Palantir; it’s targeting a sector that still feels like science fiction: flying taxis, or more formally, eVTOL (electric vertical takeoff and landing) aircraft. And the big difference is that, unlike Palantir, Archer is still in the pre-revenue stage.

That status, however, may not last much longer. The company is steadily moving toward commercialization, with a clear roadmap in place.

Archer is focused on its five-seat Midnight air-taxi, designed to fly about 100 miles at up to 150 mph, with the company targeting FAA type certification in late 2025 and per Archer, piloted flight appears likely to start taking place shortly. With partner Stellantis, Archer completed a high-volume plant in Covington, Georgia that will open this year and scale toward 650 aircraft annually by 2030.

Meanwhile, Archer has plenty going on right now: it was recently named the exclusive air-taxi provider for the LA28 Olympic and Paralympic Games, it is developing a Manhattan–airport shuttle network with long-time customer United Airlines, and will deliver its first Midnight to Abu Dhabi this summer ahead of a broader UAE rollout for “Launch Edition” customers Abu Dhabi Aviation and Ethiopian Airlines.

Supported by these anchor routes, a finished production line coming online this year, and regulatory milestones tracking to plan, Archer expects limited passenger service to start in 2026 and to scale rapidly as final FAA approval is secured. Archer has also entered into an exclusive partnership with defense technology firm Anduril Industries to co-develop a hybrid-propulsion vertical takeoff and landing (VTOL) aircraft tailored for U.S. Department of Defense applications.

That all sounds like a recipe for success, and it’s no wonder investors have been getting excited about Archer’s potential, sending shares up by 204% over the past year.

Maybe Englander thinks those gains for a pre-revenue company are enough for now. The billionaire trimmed 68% of his ACHR stake in Q1, selling more than 3.4 million shares.

Meanwhile, J.P. Morgan analyst Bill Peterson is also taking a measured approach. While he acknowledges the smart strategic steps Archer is taking, he’s staying on the sidelines for now.

“Between the acquisitions of a composite facility and IP portfolio from an industry player, we think Archer is getting ramped up on the defense side with a hybrid variant that will also likely be scaled on the passenger side in parallel. We could see Archer leaning even further into the defense opportunity over time given certification delays at the FAA, government support for defense, and uncertain near-term consumer adoption, especially as its high-volume Georgia facility will be able to support volumes for both the defense and passenger sides of the business. With multiple aircraft in assembly now between California and Georgia, we think Archer will be prudent around aligning its production ramp with what is needed from a commercial and testing perspective. We expect volumes to remain low in 2025-2026 before modestly inflecting from 2027 onwards as efficiency gains are made,” Peterson opined.

To this end, the JPM analyst rates ACHR as Neutral, and his $9 price target implies the stock could retreat by ~20% over the coming year. (To watch Peterson’s track record, click here)

Still, Peterson’s caution doesn’t reflect the broader Street view. In fact, most analysts remain upbeat. With 6 Buys on file, Archer earns a Strong Buy consensus rating, and the $12.83 average price target suggests the stock could climb ~15% in the next 12 months. (See ACHR stock forecast)

To find good ideas for growth stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue