Voyager Technologies is holding its initial public offering (IPO) on June 11 in what Wall Street says is a test of market demand for high-flying space stocks.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Voyager’s shares will begin trading on the New York Stock Exchange under the ticker symbol “VOYG.” The defense and space technology company priced its shares at $31, above the original range of $26 to $29. Voyager counts Palantir Technologies (PLTR) and Lockheed Martin (LMT) among its biggest backers, and the Air Force and NASA as customers.

Management at Voyager raised the size of the stock sale from 11 million shares initially to 12.35 million. At the $31 IPO price, Voyager has a starting market capitalization of $1.90 billion. The company raised $382.8 million from its IPO. The listing of VOYG stock comes a week after the blockbuster IPO of stablecoin issuer Circle (CRCL) and ahead of online banking company Chime Financial on June 12.

Strong Finances

Voyager makes its market debut with some strong finances underpinning its stock. The Colorado-based company has a $217.5 million contract with NASA to help design Starlab, a commercial space station that will replace the International Space Station when it is decommissioned in 2030.

NASA is Voyager’s largest customer, accounting for more than a quarter of the company’s $144.2 million in 2024 sales. Voyager’s revenue grew 6% last year and another 14% in this year’s first quarter. However, like many start-up companies, Voyager is not yet profitable, reporting a -$65.6 million net loss in 2024.

Heading into the IPO, analysts said that Voyager is well-positioned to take part in national security contracts such as U.S. President Donald Trump’s plans for a Golden Dome missile-defense shield.

Is VOYG Stock a Buy?

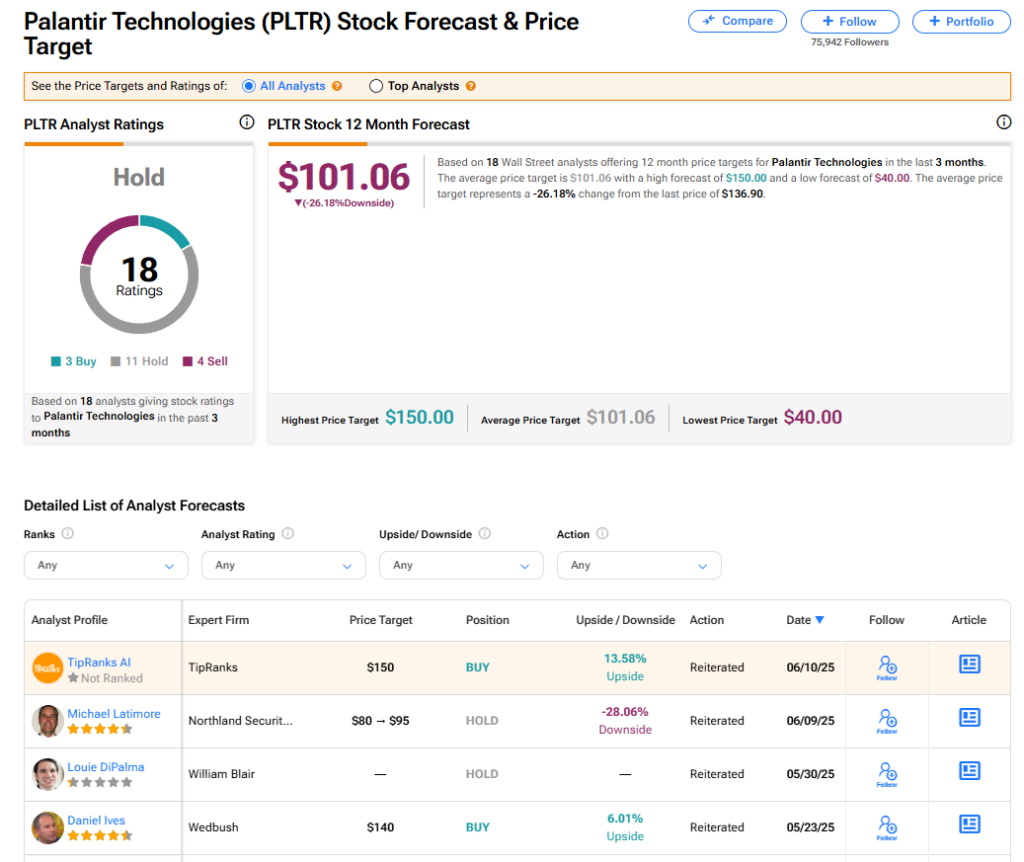

It’s too early for there to be any Wall Street ratings or price targets on Voyager stock. So instead, we’ll look at Palantir’s stock. The stock of Palantir Technologies has a consensus Hold rating among 18 Wall Street analysts. That rating is based on three Buy, 11 Hold, and four Sell recommendations issued in the last three months. The average PLTR price target of $101.06 implies 26.18% downside from current levels.

Read more analyst ratings on PLTR stock

Looking for a trading platform? Check out TipRanks' Best Online Brokers guide, and find the ideal broker for your trades.

Report an Issue