Shares of cloud computing company PagerDuty (NYSE:PD) gained 8.4% in Thursday’s after-hours trading after it reported better-than-expected Q1 EPS. Further, PD’s management remains upbeat and stated that the company is well-positioned for growth in the upcoming quarters and will continue to generate solid free cash flow. Moreover, its top-line growth rate will likely accelerate in the second half of Fiscal 2025.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

It’s worth noting that PagerDuty’s annual recurring revenue growth showed signs of stabilization. Further, Q1 marked the seventh consecutive quarter wherein it delivered positive adjusted earnings. Thanks to the momentum in its business and improving cash flow, PagerDuty announced a share repurchase program for up to $100 million.

Against this backdrop, let’s delve into PD’s Q1 financials.

PD Delivered Mixed Q1 Financials

PagerDuty delivered revenue of $111.2 million, up 7.7% year-over-year. However, it fell marginally short of the Street’s forecast of $111.7 million. Nonetheless, PD’s customers with annual recurring revenue over $100,000 increased by 6% year-over-year to 811. Moreover, the total paid customers were 15,120 as of April 30, 2024, compared to 15,089 in the prior year.

The company’s remaining performance obligations were $388 million. However, the dollar-based net retention rate was 106%, compared to 116% a year ago.

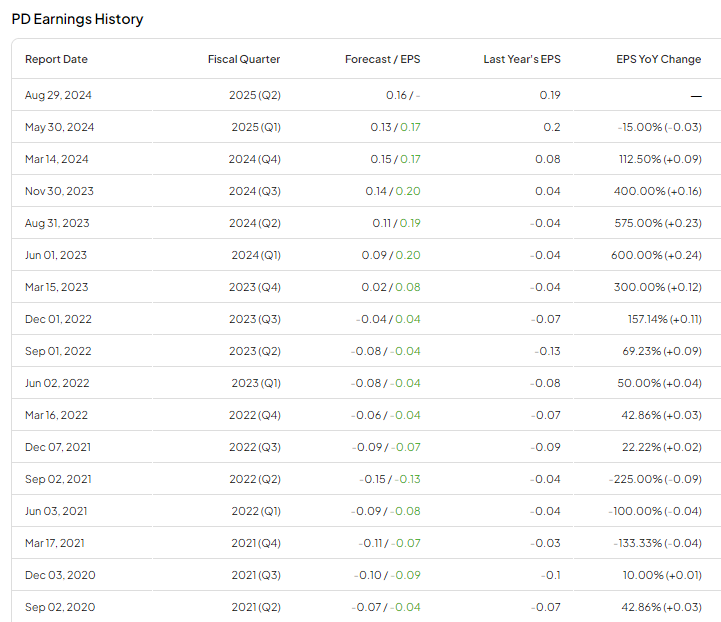

The company delivered adjusted EPS of $0.17 per share, down about 15% year-over-year. However, its adjusted EPS exceeded analysts’ expectations of $0.13. According to TipRanks’ earnings page, PD has consistently surpassed the analysts’ EPS estimates for several years.

Outlook Indicates Acceleration in Growth Rate

The company expects its top line to increase by 7-9% in the second quarter of Fiscal 2025. As for Fiscal 2025, it projects total revenue to be in the range of $471 million to $477 million, representing a year-over-year growth rate of 9% to 11%. This guidance suggests that the company’s top-line growth rate will likely show moderate acceleration in the second half of the current fiscal year.

PD forecasts Q2 EPS to be $0.16 – $0.17. Moreover, it projects Fiscal 2025 earnings in the range of $0.66 to $0.71 per share.

Is PD a Good Stock to Buy?

PD stock is down about 22.5% year-to-date. Wall Street analysts maintain a cautiously optimistic outlook on the stock. It has four Buys and five Hold recommendations for a Moderate Buy consensus rating.

The analysts’ average price target for PD stock is $25.50, implying a 42.06% upside potential from current levels.