Shares of Occidental Petroleum (OXY) are down in after-hours trading after the oil company reported earnings for its fourth quarter of Fiscal Year 2024. Earnings per share came in at $0.80, which beat analysts’ consensus estimate of $0.68 per share. In addition, sales decreased by 5.7% year-over-year, with revenue hitting $6.76 billion. This missed analysts’ expectations of $6.98 billion.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Furthermore, oil and gas pre-tax earnings were $1.2 billion, unchanged quarter-over-quarter and down from $1.6 billion in Q4 2023. This drop was mainly attributable to a decrease in average realized crude oil and natural gas prices.

Moreover, total company production averaged 1,463 thousand barrels of oil equivalent per day, which beat the company’s own expectations by 13 Mboed at the midpoint. The Permian region led the way with a production total of 771 Mboed, while the Gulf of America region lagged at 137 Mboed. The Rockies & Other Domestic regions and International operations also contributed with 325 Mboed and 230 Mboed, respectively.

Investor Sentiment for OXY Stock

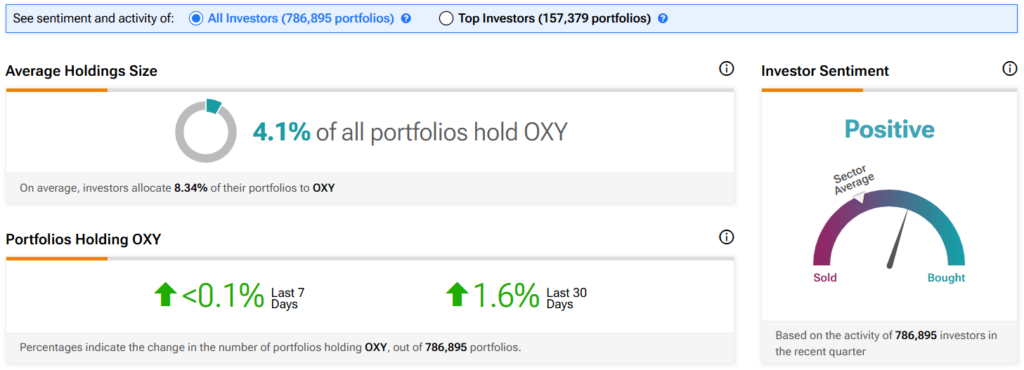

The sentiment among TipRanks investors is currently positive. Out of the 786,895 portfolios tracked by TipRanks, 4.1% hold OXY stock. In addition, the average portfolio weighting allocated towards OXY among those who do have a position is 8.34%. This is a decrease compared to the previous earnings report, when 4.5% of investors had a position, and suggests that investors of the company are less confident than before about its future.

Is OXY a Buy or Sell Now?

Turning to Wall Street, analysts have a Hold consensus rating on OXY stock based on three Buys, 12 Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 16% decline in its share price over the past year, the average OXY price target of $58.69 per share implies 19.73% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.