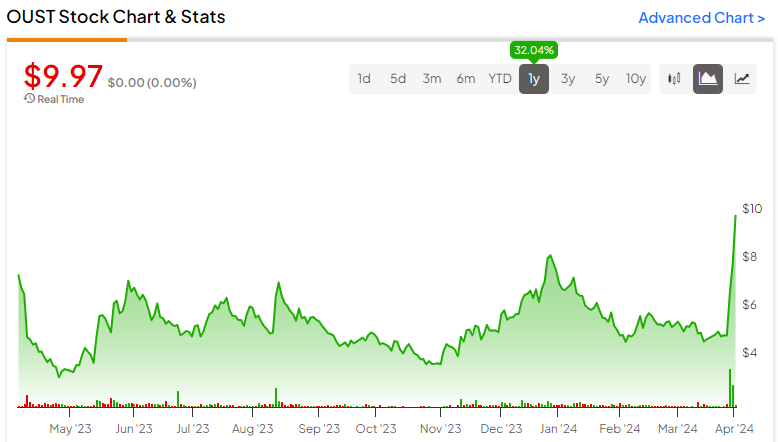

For the past few years, the LiDAR startup scene has resembled the Wild West, with numerous companies, particularly in automotive, offering various solutions, but many struggling to gain traction. However, Ouster (NYSE:OUST) stands out as a frontrunner poised to become a market leader in this space. Following a successful merger and delivering strong financial performance in 2023, its stock has surged nearly 80% in the last month and 32% over the past year. It seems to be an attractive opportunity for investors seeking exposure to this emerging market.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

A Range of LiDAR Applications

Ouster specializes in providing LiDAR sensors for a wide range of needs, from warehousing and industrial robotics to autonomous cars. The company is known for its high-resolution scanning REV7 digital lidar sensors, which are suitable for varied applications.

Recent product launches, such as the cloud-backed Ouster Gemini, a perception platform for smart infrastructure deployments of lidar sensors, and Blue City, a traffic management solution powered by Gemini, have added new revenue streams, lowered the barriers to lidar adoption, and increased customer engagement. This versatility in product offerings positions Ouster to adapt to different market needs, which is a critical factor in its potential for future growth.

As part of the rapidly growing smart infrastructure market, estimated at $32 billion in size, Ouster anticipates that its software-coupled sales will substantially contribute to future growth.

Ouster’s Recent Results & Outlook

2023 was a big year for Ouster. Significant strides were made across operations, most notably with the scaling of production and shipping of their product, REV7, and the successful launch of new revenue streams through Ouster Gemini and Blue City. The scale and financial health of the company were further solidified with its merger with Velodyne last year, which expanded its patent portfolio and streamlined its cost structure.

Q4 financial results showed a new record in bookings at $142 million, helping to drive a marked increase in revenue, totaling $24.44M, beating the projected consensus of $24.06M, and setting a new quarterly record for the company. Additionally, the full year of 2023 ended positively, with overall revenue surpassing $83 million, a significant 103% year-over-year increase.

Ouster ended the year with a robust balance of $192 million in cash, cash equivalents, restricted cash, and short-term investments. This should be enough to see the company through the foreseeable future, or possibly help fund further acquisitions.

The company expects to keep the momentum going with a positive Q1. Expected revenue is between $25M and $26M, slightly above the initial consensus of $25.01M.

What is the Price Target for OUST?

Ouster stock has been highly volatile, though it has significantly trended up recently. It trades at the high end of the 52-week price range of $3.21-$9.97 and continues to show positive price momentum, trading above the 20-day (5.54) and 50-day (5.54) moving averages. Despite the recent jump in price, it still appears to be relatively fairly valued, with a P/S of 4.3x, which is in line with the Technology sector average of 4.6x.

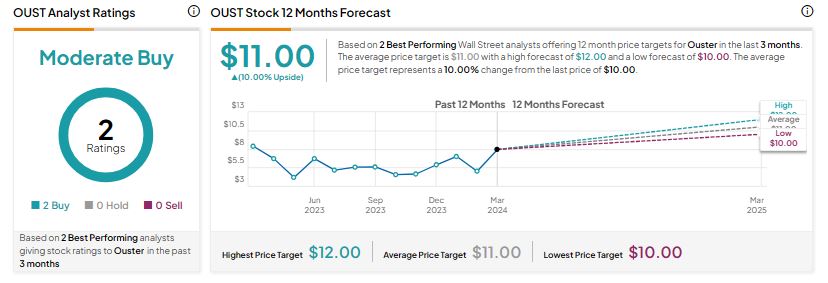

Analysts following the company have been cautiously optimistic about the stock. For example, Craig-Hallum analyst Richard Shannon recently increased Ouster’s price target from $9 to $10 while maintaining a Buy rating on its shares. He expects a rise in sales while keeping operating expenses at or below 2023 levels, thereby expanding margins.

Ouster stock is rated a Moderate Buy based on the two analysts’ ratings and 12-month price targets issued in the past three months. The average price target for OUST stock is $11.00, representing a 10% upside from current levels.

Final Thoughts on OUST

Ouster has emerged as a promising leader among LiDAR technology startups. After successfully navigating a strategic merger and announcing impressive financial results for 2023, the company is well-positioned for exponential growth in a massive market. Despite its impressive recent run-up in price, the stock still looks to be fairly valued, suggesting it is a growth at a reasonable price (GARP) opportunity for investors.