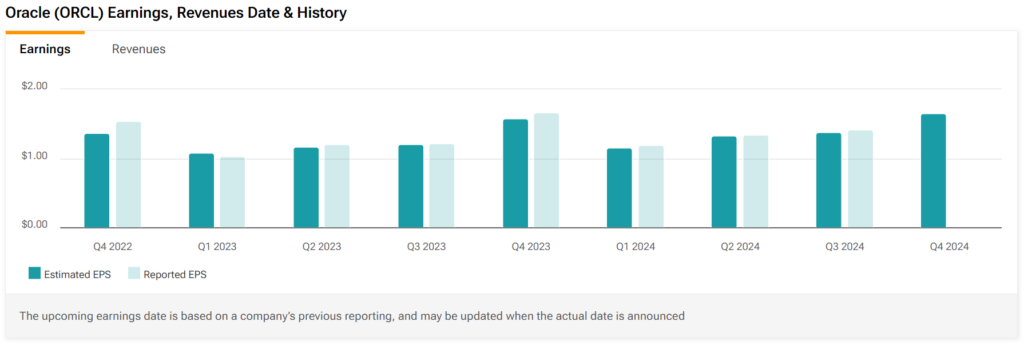

Shares of Oracle (NYSE:ORCL) surged in after-hours trading after the tech firm reported earnings for its fourth quarter of Fiscal Year 2024 and provided solid revenue guidance. Earnings per share came in at $1.63, which fell short of analysts’ consensus estimate of $1.65 per share. This was a rare miss, as Oracle had beaten earnings estimates seven times during the previous eight quarters.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Sales increased by 3.3% year-over-year, with revenue hitting $14.29 billion. This also missed analysts’ expectations of $14.57 billion. Still, this revenue increase was mainly driven by the company’s Cloud Revenue segment, which increased by 20% to $5.3 billion.

However, the company’s FY 2025 guidance seems to be the reason for the share price increase in the after-hours market. In fact, Oracle CEO Safra Catz sees revenue growing by double digits compared to the 8.4% that analysts were expecting. Investors can thank the enormous demand for training AI large language models as well as new deals with Google (NASDAQ:GOOG) (NASDAQ:GOOGL) and OpenAI (NASDAQ:MSFT), which will use Oracle’s cloud infrastructure.

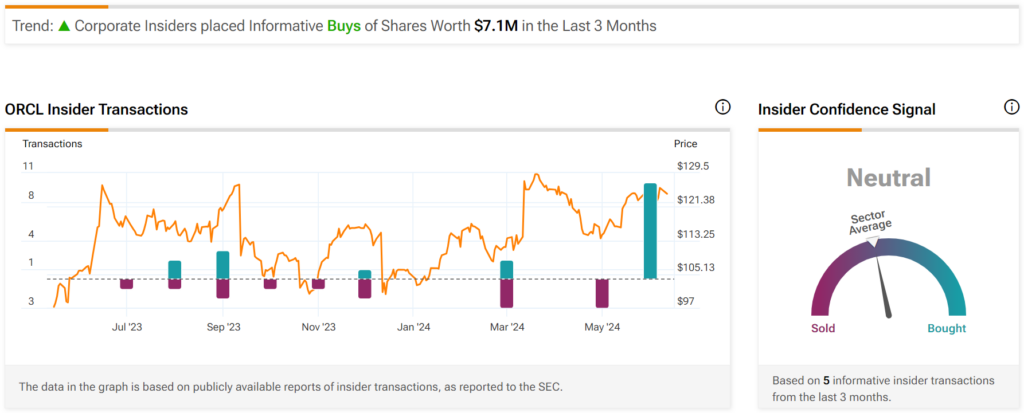

Insider Activity

When looking at insider activity, there seems to be a lot of buying. In fact, insiders have purchased $7.1 million worth of ORCL shares in the past three months. Although the overall Insider Confidence Signal for ORCL is currently neutral, it appears that the sentiment is in the process of improving. In fact, a look at the image below shows a sudden surge in buying activity following a year of mostly selling.

Is Oracle a Buy, Sell, or Hold?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on ORCL stock based on 17 Buys, 13 Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After an 8% rally in its share price over the past year, the average ORCL price target of $140 per share implies 12.9% upside potential.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue