Medical device maker OraSure Technologies (OSUR) may soon find itself in a boardroom showdown as activist investor Altai Capital is building momentum to fight for board inclusion. In early trading on Tuesday morning, OraSure’s stock climbed by 2.46% to trade at $3.33 as of 6 a.m. EDT.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Altai has recently topped its stake in the test kit maker to 5% in preparation to put forward its case, Reuters reported, citing two insiders.

Since the beginning of the year, OraSure’s stock has dipped nearly 10%, with an even steeper decline—over 22%—in the past 12 months. As a result, investors in the at-home HIV testing kit developer are dissatisfied.

Rishi Bajaj, founder of Altai, is also looking to assert pressure on OraSure’s board and management after the Pennsylvania-based company rejected a buyout offer from Ron Zwanziger, founder of diagnostic test manufacturer Alere (ALR). Zwanziger had sought to acquire the company for about $3.50 to $4 a share.

Bajaj believes new additions to the board will help in redirecting the company’s strategy for better stock performance. Hedge fund Cannell Capital, which also has a stake in OraSure, similarly believes that the device maker’s board needs new faces.

Public Budget Cut, USAID Funding Freeze Tests OraSure

Meanwhile, OraSure recently named Anne Messing as its Chief Commercial Officer, entrusting her with the goals of securing market leadership and fostering long-term growth for the company. Last year, the company also acquired diagnostic provider Sherlock Biosciences to expand its business.

However, investors are still not all optimistic. While the company’s diagnostics segment grew by 3% year-over-year in its recent second-quarter results released in early August, sales from its sample management business plummeted by 22%. This was due to a fall in orders from a major consumer genetics customer.

Furthermore, the firm’s revenue from its U.S. business fell by 1% from the same period last year. This trailed uncertainty arising from potential cuts to public health program budgets and a reduction in staff numbers across key U.S. health agencies.

This development piled on disruptions in the international diagnostics industry, triggered by the White House’s funding freezes for the United States Agency for International Development (USAID). The move affected the rate of deployment of OraSure’s HIV test kits.

Is OraSure Stock a Good Investment?

Turning to Wall Street, OraSure’s stock has attracted a mix of sentiments from analysts. While Citi’s (C) Patrick Donnelly recently reiterated his Buy rating on OSUR stock, Evercore’s (EVR) Vijay Kumar stuck to his Hold rating.

Donnelly estimates the average OSUR price target at $6, suggesting a potential 85% upside, while Kumar projects an 8% downside risk with a price target of $3.

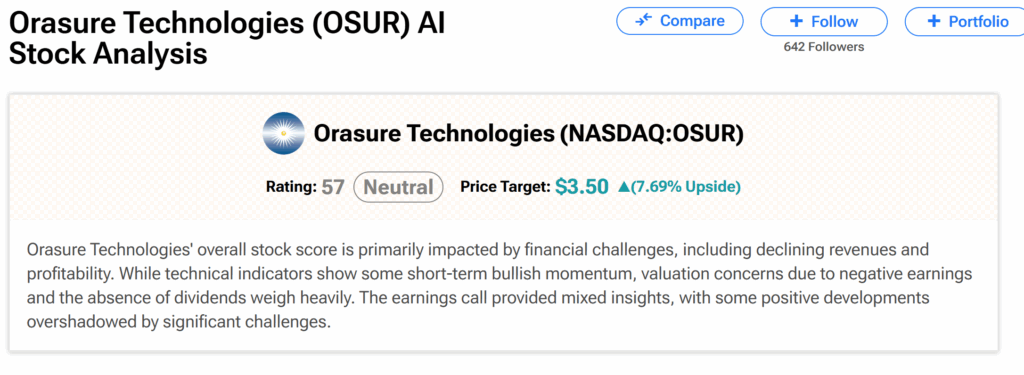

Moreover, TipRanks’ AI Stock Analyst gives the shares a Neutral rating. This comes with a $3.50 price target, suggesting a 7.69% growth potential.