Investors appear not to be totally convinced by enterprise software giant Oracle’s (ORCL) ambitious 2030 forecasts made at its high-stakes AI World event in Las Vegas on Thursday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

On Friday, the company’s shares plunged more than 7% to about $291 per share, as of 12:12 p.m. EDT. This is despite Wall Street largely showering ORCL stock with Buy ratings and price target boosts following the event. The stock extended its 2.4% drop during pre-market trading on Friday.

Oracle Has ‘All the Tools’

TD Cowen’s five-star analyst, Derrick Wood, even said Oracle is “delivering the goods” across key metrics, including revenue, earnings per share, and gross margin. Wood also argued that Oracle has “all the tools” — apps, data, infrastructure, and AI — to succeed in an era defined by artificial intelligence.

However, investors appeared to have heeded the voice of caution of the few who issued a Hold rating — as TipRanks’ data shows — following the event. While about 14 Wall Street analysts assigned Buy ratings between Thursday and Friday, only four went with a Hold.

Oracle Raises the Bar

During the event, Oracle dismissed a recent report by The Information pointing to weaker-than-expected margins in its AI cloud infrastructure business. The software giant argued that the numbers only factor in the upfront cost of setting up data centers before they go live. It said the actual gross margin of the contracts across their entire life stands at 35%.

After the dismissal, Oracle raised the bar with ambitious 2030 forecasts — it expects revenue from its cloud business, the Oracle Cloud Infrastructure (OCI), to grow massively from $10 billion expected in Fiscal 2025 to $166 billion by 2030. It raised the figure from an earlier projection of $144 billion.

Across the board, Oracle predicts its overall revenue will rise to $225 billion by 2030, up from the previously targeted $104 billion for 2029. This is even as its total backlog of contracted work has topped $500 billion. However, $300 billion of that amount comes from a single client — OpenAI.

So, What’s Happening?

According to Stifel’s Brad Reback, Oracle’s projected earnings per share for fiscal years 2026 and 2027—$8.00 and $10.65, respectively—fell slightly short of what Wall Street analysts had anticipated. This is primarily because the company is incurring initial expenses to grow and scale its business.

On his part, Morgan Stanley analyst Keith Weiss sees short-term risk, even as Oracle failed to clarify how much in investments will be required to achieve the ambitious goals. Similarly, Stephens analyst Brett Huff argued that Oracle’s OCI capacity is already priced into its current share price.

Is Oracle a Buy, Sell, or Hold?

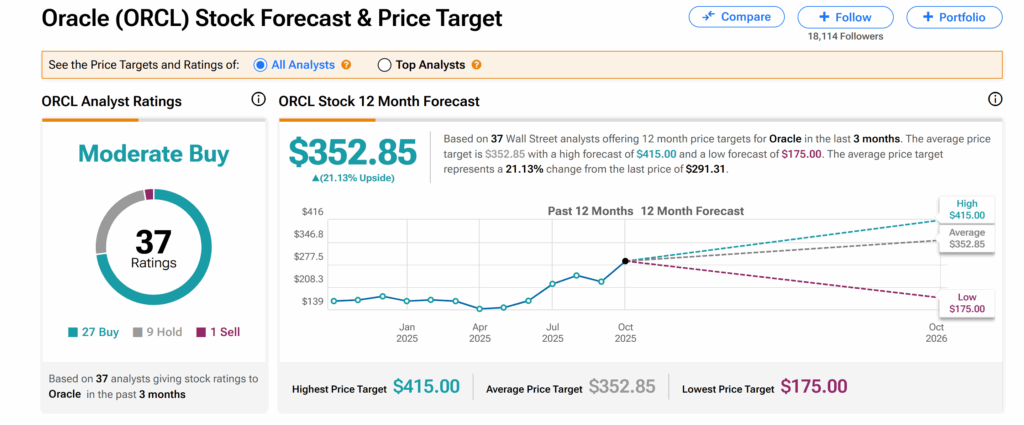

Across the broader Wall Street, Oracle’s shares currently have a Moderate Buy consensus rating. This is based on 27 Buys, nine Holds, and one Sell assigned by 37 Wall Street analysts over the past three months.

However, the average ORCL price target of $352.85 suggests a 21% growth potential from the current level.