Technology company Oracle Corporation (ORCL) is scheduled to announce its results for the fourth quarter of FY25 tomorrow, June 11. Oracle stock has rallied over 42% in the past year, fueled by strength in cloud infrastructure and its AI-driven services. Wall Street analysts expect the company to report earnings of $1.64 per share, reflecting about 1% year-over-year growth.

TipRanks Cyber Monday Sale

- Claim 60% off TipRanks Premium for data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

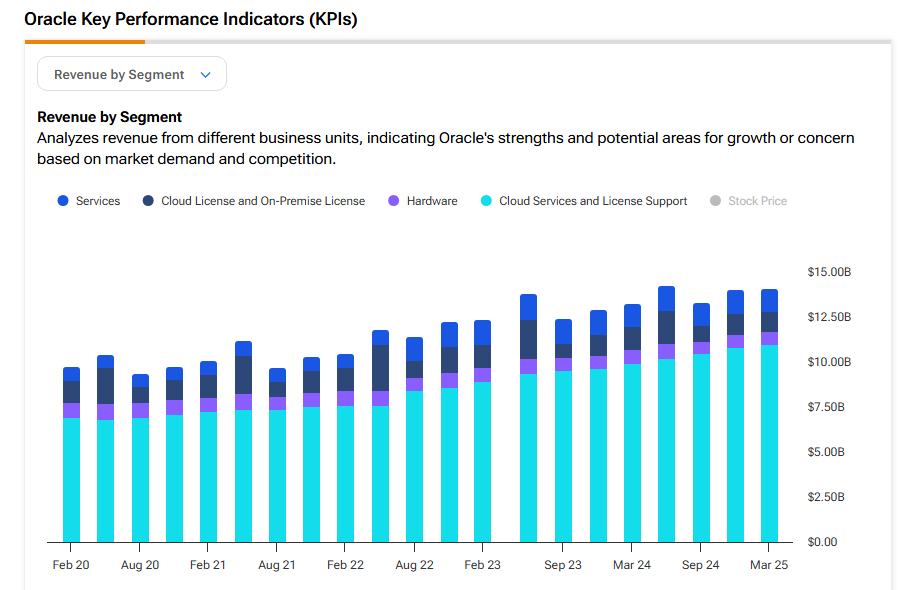

Meanwhile, revenues are expected to grow by 9% from the year-ago quarter to $15.58 billion, according to data from the TipRanks Forecast page. The expected growth is mainly due to strong demand for Oracle’s cloud services, especially as more users turn to it for generative AI work. It’s important to note that Oracle has outperformed EPS estimates in six out of the past nine quarters.

Analysts’ Views Ahead of ORCL’s Q4 Print

Ahead of the Q4 report, Jefferies analyst Brent Thill sees more upside for Oracle stock, driven by strong momentum in the company’s RPO (remaining performance obligations). This metric shows how much future revenue Oracle has locked in through signed deals. The 5-star analyst noted that RPO growth has been a key bright spot over the past four quarters. For Q4, Thill expects strong seasonal bookings, with Street estimates pointing to 40% growth, or about $137 billion.

Meanwhile, Cantor Fitzgerald analyst Thomas Blakey maintained a Buy rating on Oracle with a $175 price target. He said recent checks were strong, with Oracle doing well in moving workloads to its cloud unit, OCI. He pointed to Oracle’s edge in AI tools due to its innovative chips, strong safety tools, and easy access to GPUs. Blakey added that Oracle has been gaining ground in the cloud space, with business picking up in the fourth quarter after a slow Q3.

According to Main Street Data, Oracle’s Cloud and License unit grew 12% year-over-year. The jump was led by strong demand for Oracle Cloud Infrastructure (OCI) and key business apps.

Options Traders Anticipate a Large Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 7.64% move in either direction.

Is Oracle a Good Stock to Buy Now?

Overall, Wall Street has a Moderate Buy consensus rating on ORCL stock, based on 16 Buys and 14 Holds assigned in the last three months. The average Oracle stock price target of $180.08 implies about 2% upside potential from current levels.