Enterprise software heavyweight Oracle (ORCL) is in “pole position” to emerge as a leader of the current artificial intelligence boom or “super-cycle” despite its stock having fallen 42% from its highs, according to Wells Fargo (WFC).

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge-fund level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The banking giant rated ORCL as Overweight (Buy) with a price target of $280 per share, representing over 39% upside from the stock’s closing price of $201.10 on Tuesday. Wells Fargo’s comment comes as investors have raised concerns about Oracle’s valuation due to recent debts tied to its AI projects.

Oracle, AI Firms Take on $100B Debt

Oracle is one of several firms, such as SoftBank (SFTBY) and CoreWeave (CRWV), that are positioning to benefit from the AI boom. These firms have collectively taken on about $100 billion in debt to fuel ChatGPT maker OpenAI’s (PC:OPAIQ) growth and AI buildout.

However, Wells Fargo is upbeat about this development, noting that Oracle has secured almost $500 billion from its AI deals with AI firms such as OpenAI, billionaire Elon Musk’s xAI, Meta (META), and ByteDance’s TikTok. In early September, Oracle and OpenAI signed a mouth-watering $300 billion cloud deal, one of the largest cloud contracts in history.

The deal, which will see OpenAI buy compute power from Oracle’s AI-tailored data centers, is expected to kick in 2027. Following the news, ORCL surged as high as 40%, marking one of its biggest single-day rallies since 1999.

Analysts See Potential in Oracle

Recently, other analysts have also backed Oracle. For instance, HSBC analyst Stephen Bersey argued that Oracle can ease its balance sheet pressure by using options, including joint ventures or special purpose vehicles.

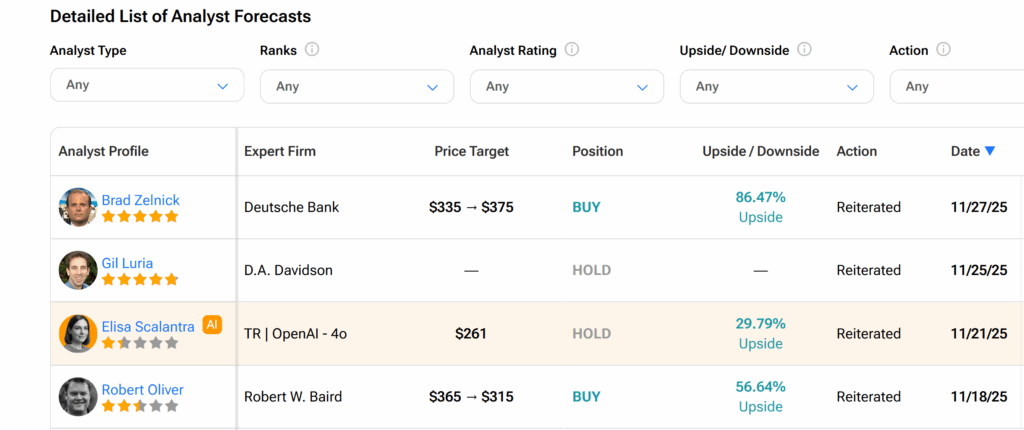

In addition, Deutsche Bank analyst Brad Zelnick contended that while the software giant’s deal with OpenAI comes with financial and operational risks, they present a “very real opportunity.” Zelnick noted that Oracle’s AI exposure is undervalued based on how its stock has been priced recently.

Is Oracle a Buy, Hold, or Sell?

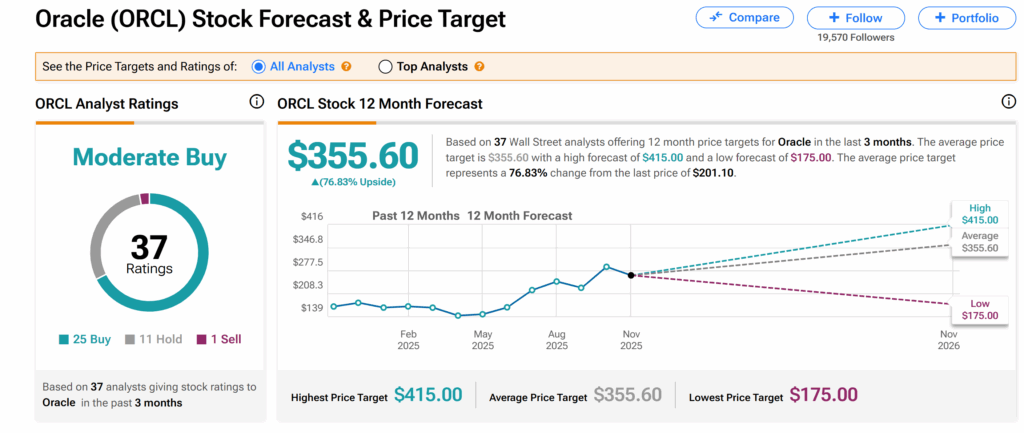

Across Wall Street, analysts remain cautious and have a Moderate Buy consensus rating on Oracle’s shares. This is based on 25 Buys, 11 Holds, and one Sell issued by 37 analysts over the past three months.

Moreover, the average ORCL price target indicates almost 77% upside from the current trading levels.