Oracle (ORCL) is heading into its Q2 earnings with growing optimism from Wall Street. Ahead of its earnings on Wednesday, December 10, top-rated analysts at Barclays and Bernstein reaffirmed their Buy ratings on ORCL, citing the recent decline as an attractive entry point for investors. On average, analysts predict an upside of almost 60% in ORCL stock from its current level.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Overall, Wall Street analysts expect Oracle to report adjusted earnings per share (EPS) of $1.64, reflecting 11.6% year-over-year growth. Revenue is projected to rise 15% to $16.19 billion.

Bernstein Keeps Buy Rating on ORCL Stock

Recently, five-star-rated analyst Mark Moerdler at Bernstein reiterated his Buy rating on ai-expansion-ratings">ORCL stock with a price target of $364, implying roughly 65% upside from current levels.

Moerdler noted that Oracle’s stock has declined over the past three months, despite the company announcing more than $300 billion in incremental business during that period. He describes this as an “unusual and ironical turn of events” amid Oracle’s current market position and upcoming earnings report.

He added that while the setup for the quarter appears positive, investors are likely to focus on the fundamentals of Oracle’s AI initiatives and their financial impact. Moerdler expects management to also address investor concerns regarding capital expenditures and free cash flow implications. The analyst believes that once these issues are clarified, investor confidence is likely to rise, making the current stock price an attractive entry point given the potential risk and reward.

Overall, Moerdler believes Oracle’s position as the third-largest hyperscaler strengthens its value proposition.

Barclays Cuts ORCL Price Target but Remains Bullish

Barclays’ top-rated analyst Raimo Lenschow lowered his price target on ORCL to $330 from $400 but maintained a Buy rating ahead of the fiscal Q2 earnings report.

Lenschow noted that concerns over an AI bubble have created an “all or nothing” mindset around Oracle stock. According to the analyst, this environment presents a compelling risk/reward and an attractive entry point at current levels. He expects the company’s Q2 report to highlight strong AI demand and solid execution.

Is ORCL Stock a Buy?

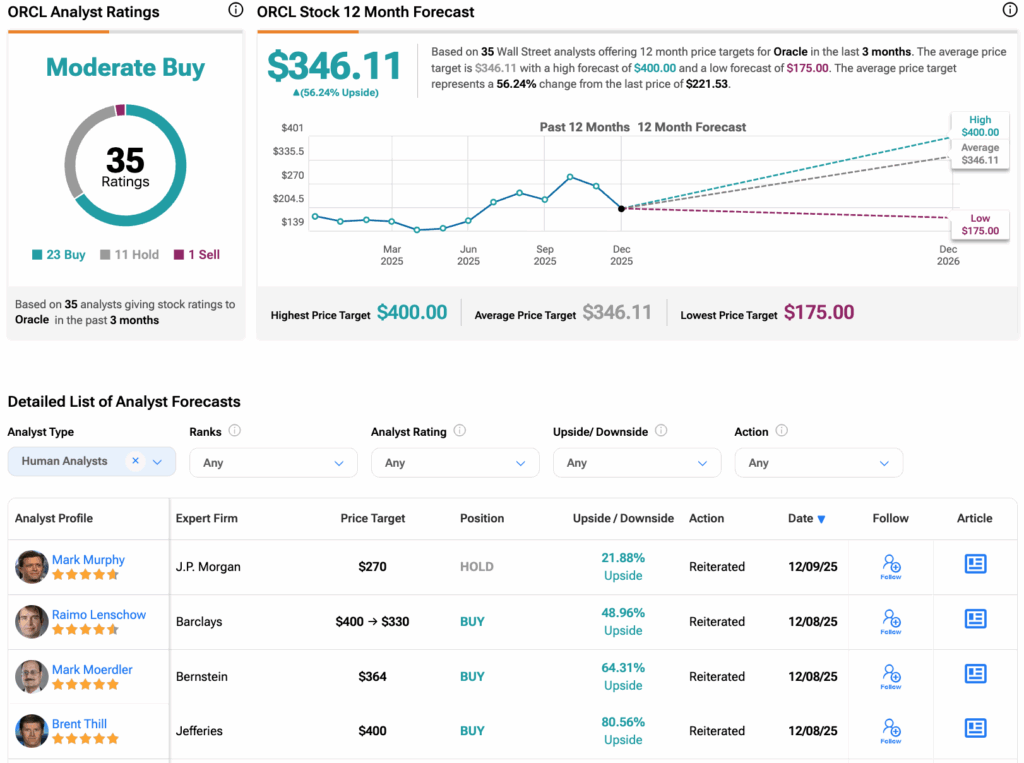

Overall, Wall Street has a Moderate Buy consensus rating on ORCL stock, based on 23 Buys, 11 Holds, and one Sell assigned in the last three months. The average Oracle stock price target of $346.11 implies about an upside of 56.3% from current levels.