Tech giant Oracle (ORCL), investment firm Silver Lake, and Abu Dhabi’s MGX will be the main investors in TikTok’s U.S. business, according to CNBC’s David Faber. Together, they will control about 45% of TikTok USA. At the same time, ByteDance, the Chinese company that owns TikTok, will still hold 19.9%, while the other 35% will go to ByteDance’s existing investors and new U.S. backers.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

To keep TikTok running in the U.S., President Donald Trump is expected to sign an executive order that will support this new deal. This is because under a federal law that was passed with bipartisan support, ByteDance was told it had to either sell TikTok’s U.S. operations or face a ban over national security concerns tied to the app’s algorithm. It is also worth noting that last week, Trump signed another order to give ByteDance until December 16 to finalize the divestiture.

Interestingly, the U.S. government won’t take a stake or special control in the new company like it has recently done with other firms. Instead, Oracle will handle TikTok’s security, and the board of directors will be mostly American. Trump also suggested that people like media moguls Rupert and Lachlan Murdoch, Oracle’s Larry Ellison, and Dell Technologies (DELL) CEO Michael Dell may take part in the deal.

Is ORCL Stock a Good Buy?

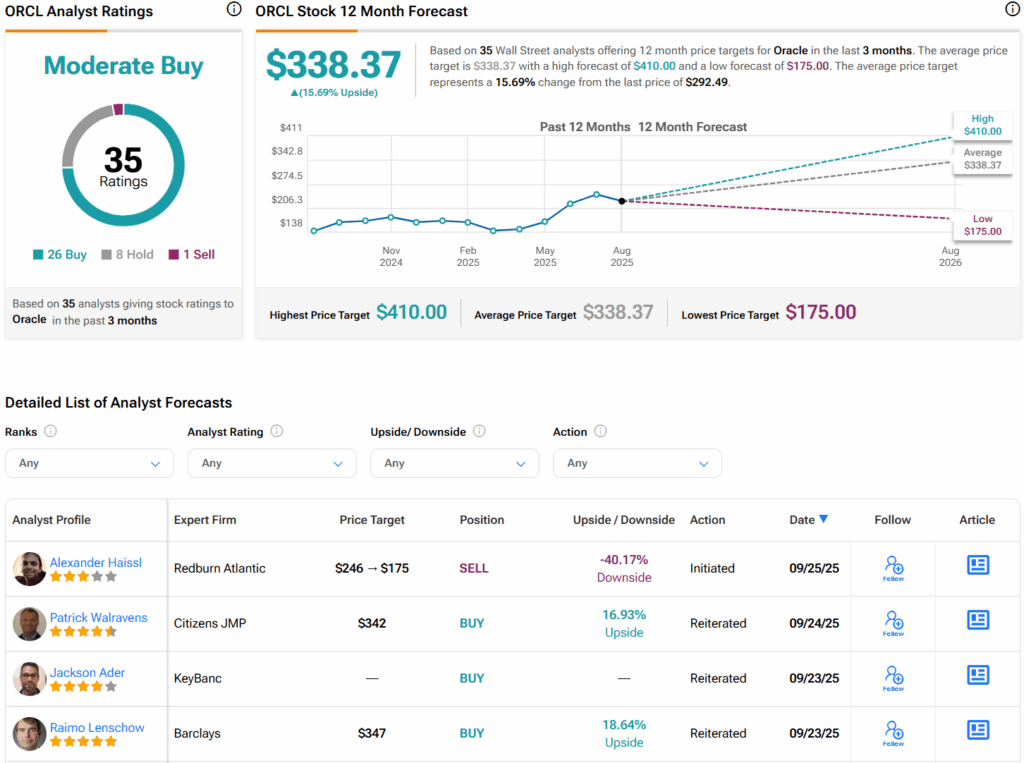

Turning to Wall Street, analysts have a Moderate Buy consensus rating on ORCL stock based on 26 Buys, eight Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average ORCL price target of $338.37 per share implies 15.7% upside potential.