Tech giant Oracle (ORCL) recently revealed its latest AI agents that are designed to support supply-chain workers in various roles, from procurement to sustainability. These AI agents are specialized bots that can automate routine tasks, as well as streamline workflows and provide greater accuracy and efficiency.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The introduction of Oracle’s AI agents is part of a broader industry trend, with companies like Microsoft (MSFT), Google (GOOGL), Amazon (AMZN), and Nvidia (NVDA) also developing AI agents to automate mundane tasks. Oracle is looking to use its new tools to help employees manage tasks like product inspections and delivery instructions in order to free up time for more strategic decision-making.

This comes after the firm announced its participation in the Stargate Project, which is a joint initiative with OpenAI and SoftBank (SFTBY) to build AI data centers across the U.S. as it tries to leverage AI to drive growth. Indeed, Oracle’s cloud infrastructure revenue rose 52% to $2.4 billion in Q2, while cloud application revenue jumped 10% to $3.5 billion.

Is Oracle Stock a Buy, Sell, or Hold?

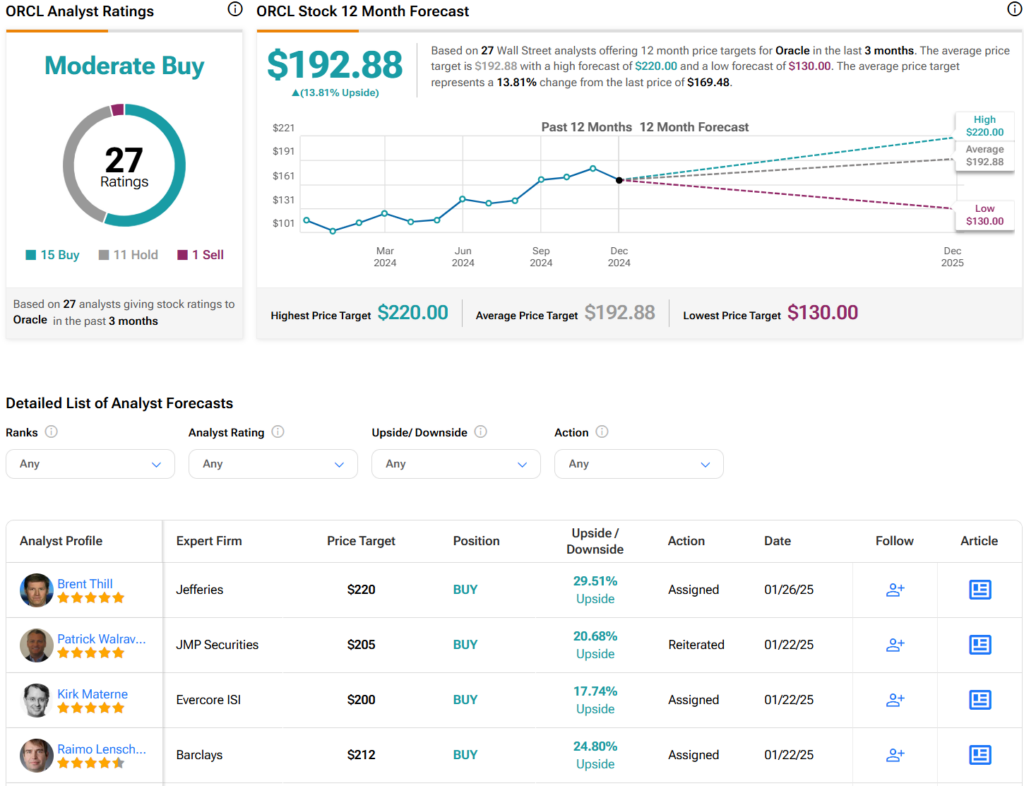

Turning to Wall Street, analysts have a Moderate Buy consensus rating on ORCL stock based on 15 Buys, 11 Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 53% rally in its share price over the past year, the average ORCL price target of $192.88 per share implies 13.8% upside potential.