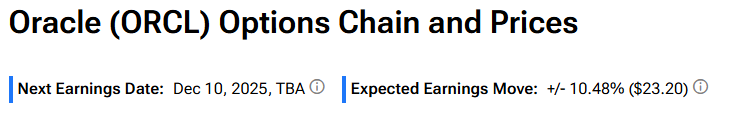

Oracle (ORCL) is set to report fiscal Q2 earnings after the market closes on Wednesday, December 13. Based on options pricing, Oracle shares could move 10.48% or by $23.20 in either direction following the results. This volatility expectation reflects high investor uncertainty about Oracle’s AI-driven growth story.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Also, the implied move is much larger than the software giant’s three-year average post-earnings move of 3.38%.

Currently, analysts expect ORCL to post revenue of $16.19 billion in Q2, up from $14.06 billion in the year-ago quarter. Further, the company is expected to report earnings of $1.64 per share, compared with $1.47 in the prior-year quarter.

Oracle’s cloud business, particularly AI-related workloads, is expected to drive results. Last quarter, cloud revenue grew nearly 28% year-over-year, now accounting for almost half of total sales. However, investors worry about Oracle’s limited customer diversification, leaving it vulnerable if AI growth slows.

What to Watch in Oracle’s Q2 Earnings

Here are the key points that investors will likely watch closely in Oracle’s upcoming results.

- AI‑Driven Cloud Demand: Oracle’s cloud infrastructure (OCI) has been the growth engine, with last quarter’s backlog surging to $455 billion in remaining performance obligations (RPO). Investors might look for clarity on whether this growth is sustainable.

- Debt and Financing: Oracle has taken on huge debt to fund AI infrastructure, with reports of $38 billion in new debt financing on top of $105 billion outstanding. The company’s recent borrowing has raised questions about balance sheet flexibility.

- Customer Concentration: Much of Oracle’s backlog is tied to a handful of large contracts, including its collaboration with OpenAI through the $500 billion Stargate Project. Analysts worry about counterparty risk if these customers cannot meet commitments.

- Guidance: Management’s Fiscal 2026 revenue outlook of at least $67 billion will be closely scrutinized.

Is Oracle a Buy, Sell, or Hold?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on ORCL stock based on 25 Buys, 11 Holds, and one Sell assigned in the past three months. Further, the average Oracle price target of $347.93 per share implies 56.91% upside potential.