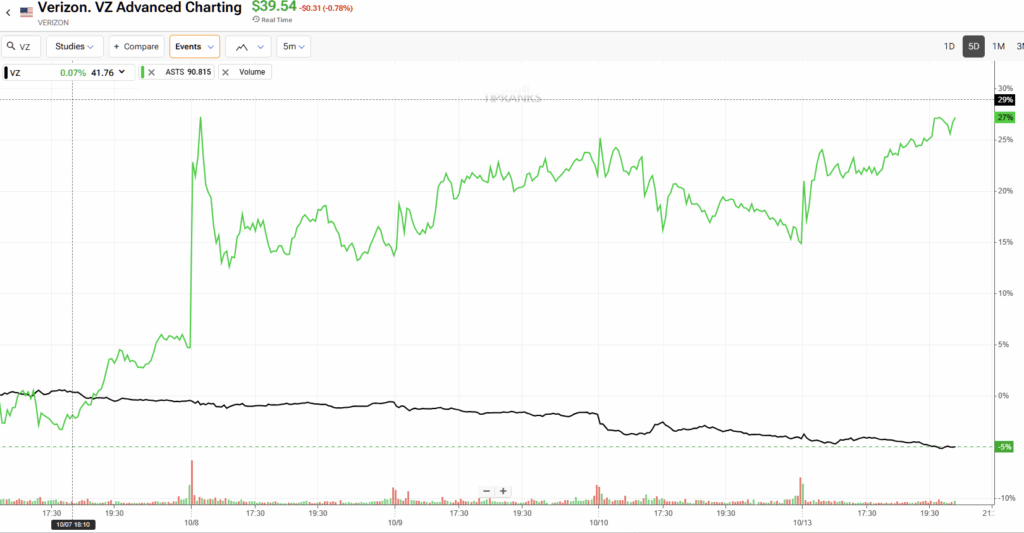

On a fundamental note, telecom giant Verizon Communications (VZ) would seem to be a winner. Just last week, the company inked a landmark commercial agreement with AST SpaceMobile (ASTS) to provide direct-to-device connectivity for cellphones across the U.S. in exchange for expanding its network coverage, particularly in remote areas.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

However, only one side has reaped the benefits so far, with ASTS gaining 27% since last week. On the flipside, VZ stock dropped 5% during the same timeframe. And with that ugly performance, the security ended up a tick below parity for the year.

It now has less than a quarter to deliver a respectable return for long-suffering shareholders. Those who follow the quantitative line of reasoning will want to pay close attention: VZ stock just flashed a rare signal that could imply upside over the next few weeks. As a result, there is a viable Bullish strategy available for risk-tolerant options traders.

A Quick Discussion on Probabilistic Distributions

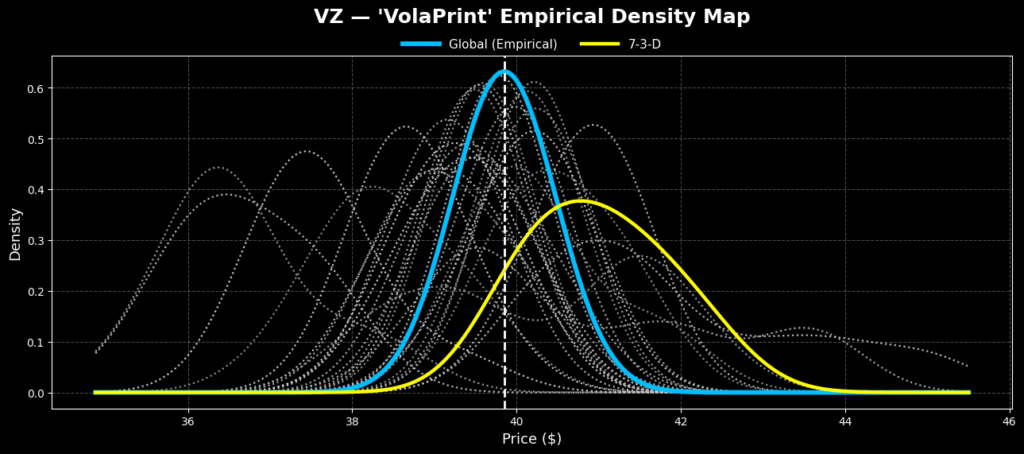

It goes without saying that because the market involves constant negotiations between bulls and bears, there will inevitably be winners and losers at the end of every trading session. Over a wide enough dataset, blue chips like VZ stock generally exhibit a normal distribution of market returns. Essentially, about half of the returns (with a slight positive drift) will fall into the profitable side relative to the starting point, and the other half will land on the losing side.

Relatively few returns will feature extreme gains, and relatively few downturns will feature extreme losses. This is the standard bell curve that pretty much describes most things in life. If you don’t understand this, trading options probably isn’t the right activity for you.

Now, the everyday reality is that while the clustering of aggregate returns resembling a normal distribution may make it appear as if the target security or asset is largely homeostatic, that’s rarely the case. Essentially, markets respond to the current catalyst, which can then influence the next move.

This is one of the core principles of what’s known as “GARCH (Generalized Auto-Regressive Conditional Heteroscedasticity)”, which states that volatility clusters rather than diffuses on a constant, independent basis. In other words, the chances of tomorrow being a volatile session depend heavily on today’s magnitude of volatility.

Now, to make a long story short, options are priced based on assumptions of the normal distribution of each stock. If we can find a favorable asymmetry between the commonly assumed distribution and the distribution that is likely to materialize, the underlying options strategy could be mispriced in our favor.

A Bimodal Pathway to Potential Profits for VZ Stock

Many years ago, a university professor uncovered a cheating scandal in his class. He noticed that there were two distinct population groups: one group of honest students, whose grades exhibited the classic bell curve of the normal distribution, and the other group of cheaters, which exhibited an unusual curve.

Taken together, these two subsets of the same parent dataset exhibited a bimodal distribution: a distributive curve with two (or more) distinct peaks.

Bimodal distributions effectively imply that something unnatural occurred. In the case of the college scandal, the unnatural event was a cheat sheet. When it comes to the equities market, a security’s price action could be structured or “coiled” in such a manner that indicates the likelihood of an unnatural distribution materializing.

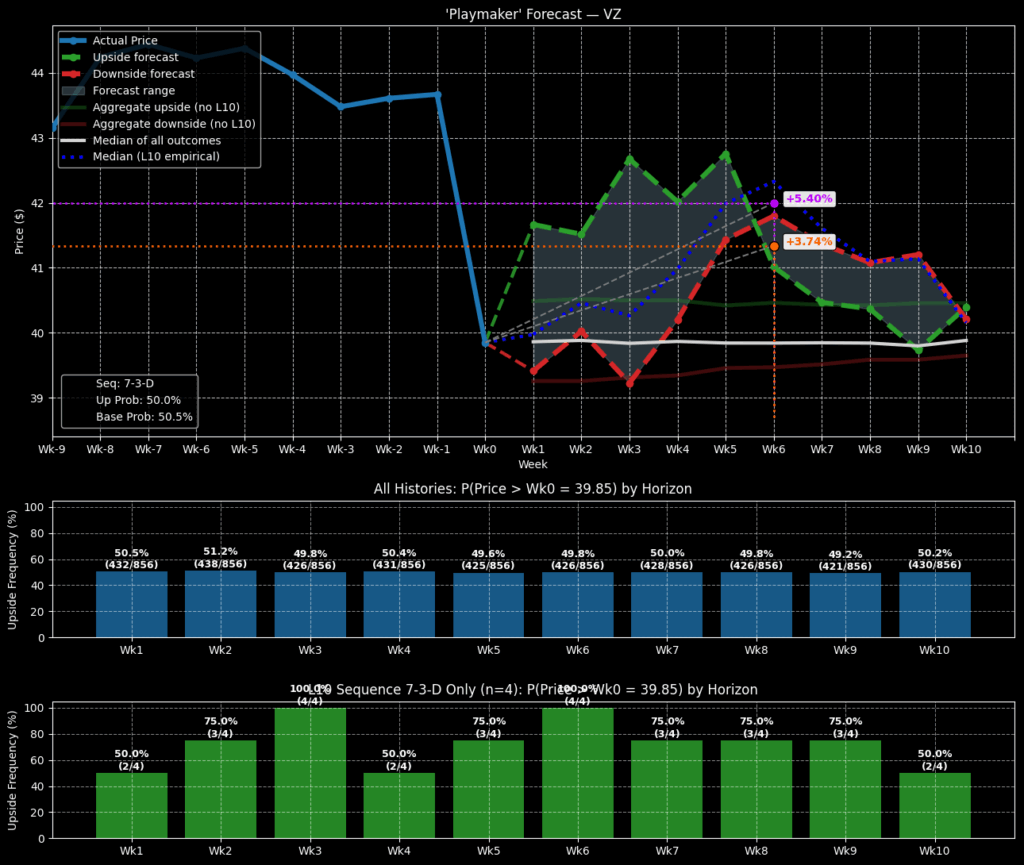

For VZ stock, the signal is quantitative in nature. In the past 10 weeks, it printed a rare 7-3-D sequence: seven up weeks, three down weeks, with an overall downward trajectory.

To be crystal clear, the above sequence is incredibly rare. Since January 2009, this pattern represents less than half a percent of all identifiable sequences that have flashed. With such a small sample, it’s impossible to make scientifically declarative statements.

Nevertheless, based on the distributive properties of the 7-3-D population curve relative to VZ’s normal distribution, the available data show that over the next 10 weeks, VZ exhibits an upward bias. From a contrarian perspective, then, last week’s volatility in Verizon stock could be a gift.

A Spread That’s Temptingly Bright

Based on the distributive properties of the 7-3-D sequence, the 41/42 bull call spread expiring November 21st could legitimately be in play. That’s because the median price of outcomes associated with this sequence should place VZ stock above $42 at expiration. If so, that’d be more than enough to trigger the maximum payout of over 194%.

Admittedly, the more conservative idea is to consider the 40/41 bull spread, also expiring on November 21st. This transaction would involve buying the $40 call and simultaneously selling the $41 call. If VZ stock rises through the second-leg strike price of $41 at expiration, the maximum payout would be 104%. That’s very respectable, but it’s a far cry from 194%.

At this moment, the net debit required for both spreads is relatively cheap; we’re talking $34 for the 41/42 spread and $49 for the 40/41 spread. Essentially, you’re paying more for the probabilistically higher chance of success of the lower spread, but at the potential opportunity cost of a reduced payout.

Given the low nominal cost, one might consider a staggered approach — buying more of the probabilistically superior spread while also having some exposure to the higher-paying spread.

Is Verizon a Buy, Sell, or Hold?

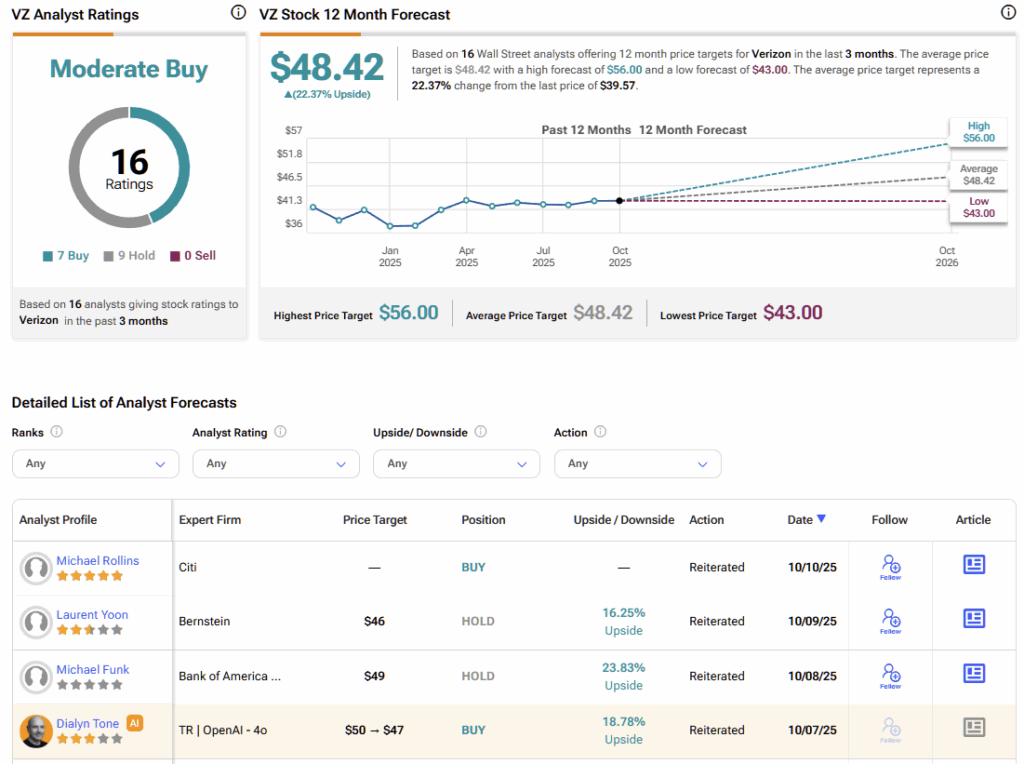

Turning to Wall Street, VZ stock carries a Moderate Buy consensus rating based on seven Buys, nine Holds, and zero Sell ratings. The average VZ stock price target is $48.42, implying 22% upside potential over the coming twelve months.

Using Overlooked Math to Trade VZ Stock Options

While the news cycle has focused on Verizon’s deal with AST SpaceMobile, the real spotlight should be on the quantitative signal that VZ stock just flashed. Based on the available empirical data, VZ has a higher-than-expected chance of rising, which implies that the underlying debit call spreads are favorably mispriced. Subsequently, intrepid contrarians can leverage this asymmetry to potentially extract huge profits.