TipRanks now presents options activity, to help investors plan their trades, ahead of earnings releases.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

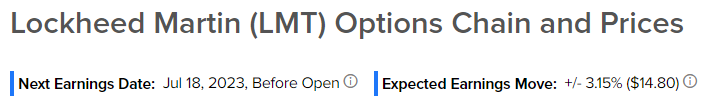

As of July 17, 2023 options traders are pricing in a 3.98% move on Bank of America (BAC) earnings, a 3.50% move on Morgan Stanley (MS) earnings, and a 3.15% move on Lockheed Martin (LMT) earnings.

Bank of America (BAC)

Bank of America (BAC) is scheduled to report earnings before the market opens, on Tuesday, July 18, 2023, at 6:45 AM ET.

The consensus estimate is for EPS of $0.84 on revenue of $25 billion.

The current analyst 1-year forecast is $34.39, while Susan Roth Katzke (Credit Suisse), the most accurate analyst on BAC, has a price target of $42.00.

Option traders are pricing in a 4.33% move on earnings, and the stock has averaged a 1.83% move in the last 8 quarters. On Monday, July 17, 2023, there was notable volume of 24,056 contracts of the $29.50 call expiring on Friday, July 21, 2023.

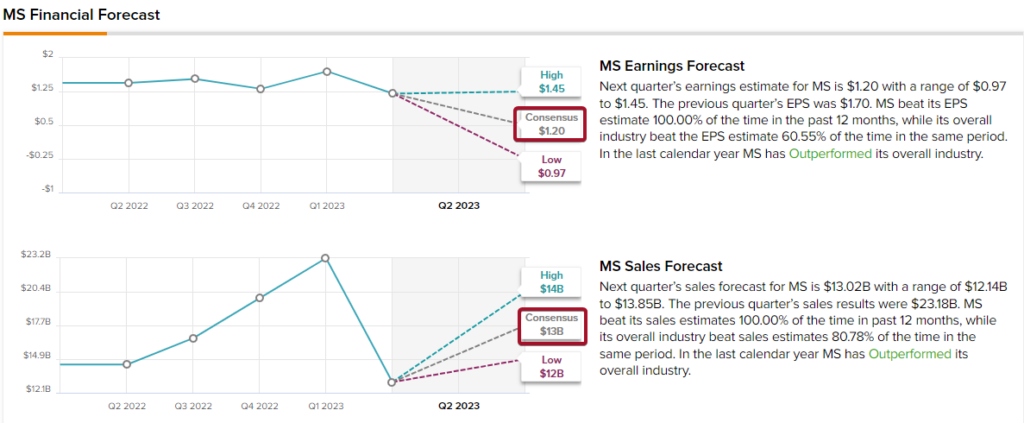

Morgan Stanley (MS)

Morgan Stanley (MS) is scheduled to report earnings before the market opens, on Tuesday, July 18, 2023, at 7:30 AM ET.

The consensus estimate is for EPS of $1.20 on revenue of $13 billion.

The current analyst 1-year forecast is $98.17, while Brennan Hawken (UBS), the most accurate analyst on MS, has a price target of $98.00.

Option traders are pricing in a 3.68% move on earnings, and the stock has averaged a 0.80% move in the last 8 quarters. On Monday, July 17, 2023, there was notable volume of 3,798 contracts of the $87.00 call expiring on Friday, July 21, 2023.

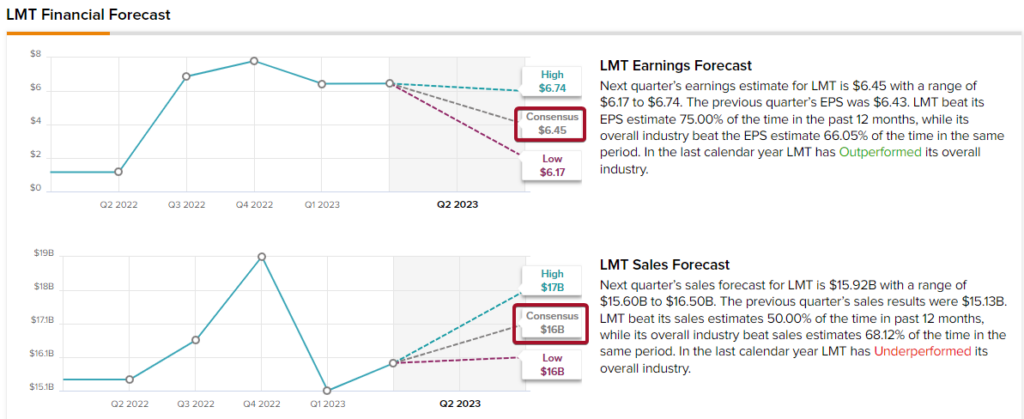

Lockheed Martin (LMT)

Lockheed Martin (LMT) is scheduled to report earnings before the market opens, on Tuesday, July 18, 2023.

The consensus estimate is for EPS of $6.45 on revenue of $16 billion.

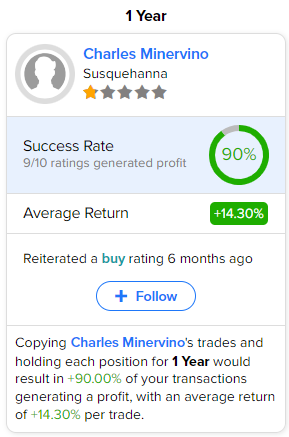

The current analyst 1-year forecast is $498.00, while Charles Minervino (Susquehanna), the most accurate analyst on LMT, has a price target of $512.00.

Option traders are pricing in a 2.90% move on earnings, and the stock has averaged a 0.08% move in the last 8 quarters. On Friday, July 14, 2023, there was notable volume of 811 contracts of the $480.00 call expiring on Friday, July 21, 2023.