Opendoor Technologies (OPEN) stock and shares of several home-buying platforms and housing stocks rallied in Thursday’s extended trading session after U.S. President Donald Trump said that he is ordering his representatives to buy $200 billion in mortgage bonds. Trump expects this move to bring down mortgage rates and make U.S. homes affordable. OPEN stock jumped 12.1%, while shares of Offerpad Solutions (OPAD), Rocket Companies (RKT), and UWM Holdings (UWMC) rose 58%, 7.1%, and 7.2%, respectively.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Meanwhile, Opendoor responded to the impact of Trump’s statement about proposing a ban on institutional investors from buying single-family homes. In a post on X, CEO Kaz Nejatian supported Trump’s proposal and said, “We’re not institutional investors, our job is to help people buy homes. We don’t hold the homes!”

Nejatian’s clarification came after OPEN stock plunged on Wednesday following news of the proposed ban.

Trump Aims to Make Homes Affordable

In a Truth Social post, Trump said his directive to purchase $200 billion in mortgage bonds comes as the two government-sponsored mortgage entities, Fannie Mae (FNMA) and Freddie Mac (FMCC), have abundant cash.

Trump criticized former President Joe Biden for ignoring the housing market and other policy failures. He added that he is now paying “special attention” to the housing market. The president also said that he made the right decision by not selling Fannie Mae and Freddie Mac in his first term.

“Because I chose not to sell Fannie Mae and Freddie Mac in my First Term, a truly great decision, and against the advice of the ‘experts,’ it is now worth many times that amount — AN ABSOLUTE FORTUNE — and has $200 BILLION DOLLARS IN CASH,” said Trump.

Meanwhile, it is not clear whether the purchase of mortgage bonds will affect mortgage rates, as mortgage rates generally follow long-term Treasury rates rather than mortgage bond yields.

Is Opendoor Stock a Buy, Sell, or Hold?

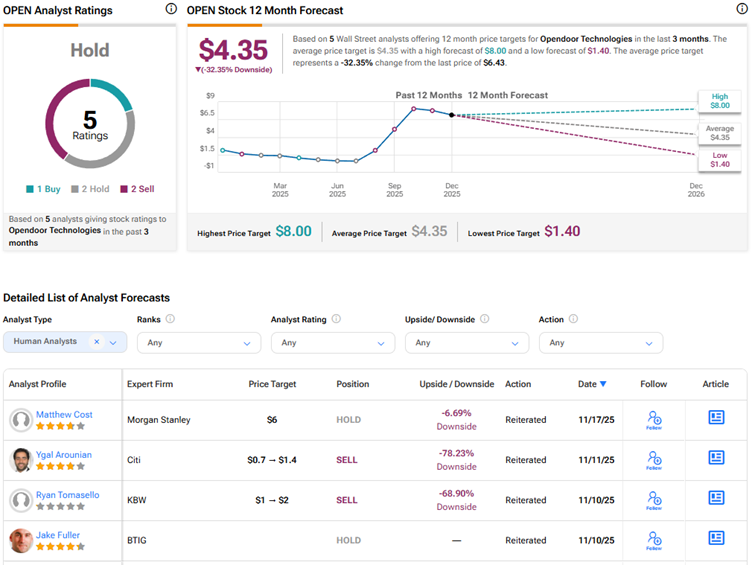

Currently, Wall Street has a Hold consensus rating on Opendoor Technologies stock based on two Holds, two Sells, and one Buy recommendation. The average OPEN stock price target of $4.35 indicates a downside risk of 32.4% from current levels.