Shares of Opendoor Technologies (OPEN) are up in after-hours trading on news that quantitative trading firm Jane Street has taken a 5.9% stake in the online real estate company.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The stake in OPEN stock by Jane Street was disclosed on the social media platform X on Sept. 24. Jane Street is the latest high-profile investor to take a stake in Opendoor, sending the stock up 7% in after-hours trading and extending a big rally.

OPEN shares are now up 414% this year as investors treat the struggling company, which specializes in residential real estate, as a meme stock. Opendoor’s stock has skyrocketed ever since hedge fund manager Eric Jackson disclosed a stake in the company and began promoting it on social media.

Jane Street

Jane Street is a privately held trading firm based in New York City. It employs more than 2,600 people in Manhattan, London, Hong Kong, Chicago, and Singapore who trade a broad range of assets around the world and around the clock.

Jane Street is viewed as a leading market maker. The firm typically trades more than $10 trillion worth of securities a year. The investment in OPEN stock is seen as a vote of confidence in the real estate firm. Other recent stocks that were purchased by Jane Street and saw their share prices vault higher include CoreWeave (CRWV) and Tesla (TSLA).

Is OPEN Stock a Buy?

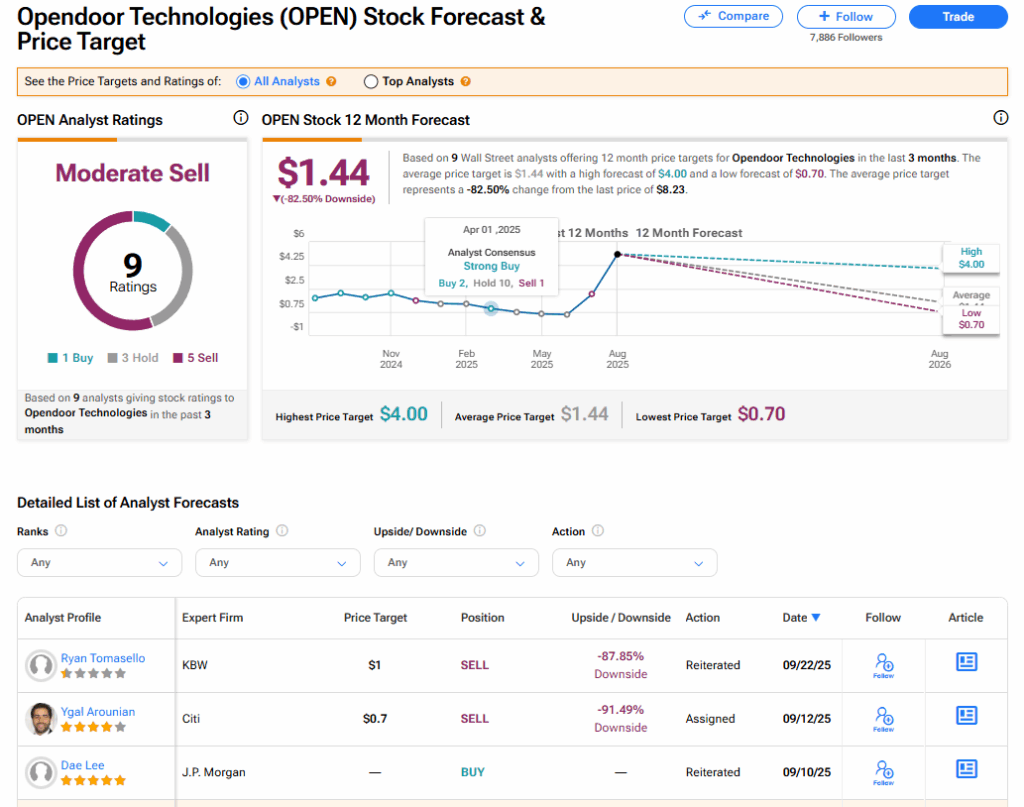

The stock of Opendoor has a consensus Moderate Sell rating among nine Wall Street analysts. That rating is based on one Buy, three Hold, and five Sell recommendations issued in the last three months. The average OPEN price target of $1.44 implies 82.50% downside from current levels.