Opendoor Technologies (OPEN) shares plunged after the company’s first earnings report under new leadership failed to meet investor hopes. OPEN stock fell 23% to $5.02 in Friday’s premarket trading, erasing a chunk of this year’s rally, which had seen shares climb more than 300%.

TipRanks Cyber Monday Sale

- Claim 60% off TipRanks Premium for data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

OPEN’s Earnings Miss Sparks Sell-Off

The online homebuying platform reported an adjusted loss of $0.12 per share for the third quarter, worse than Wall Street’s forecast of a $0.08 loss. Revenue came in at $915 million, down 34% year over year but still ahead of expectations for $850 million.

Adjusted EBITDA showed a $33 million loss, wider than the projected $24.4 million shortfall. The results disappointed traders who had bid the stock up on hopes that a turnaround was taking shape under the company’s new CEO.

Nejatian’s Vision Is ‘Re-founding Opendoor’

Kaz Nejatian, who took over in September after stints at Spotify (SPOT) and Shopify (SHOP), has promised to rebuild Opendoor around artificial intelligence and software-driven efficiency.

“We are re-founding Opendoor as a software and AI company,” Nejatian said. “Our business will succeed by building technology that makes selling, buying, and owning a home easier and more joyful—not from charging high spreads and hoping the macro saves us.”

Nejatian’s plan centers on reaching positive adjusted income by late 2026 through higher transaction volumes, sharper pricing models, and “ruthless” cost control. It would mark the company’s first full-year profit since its 2020 public debut.

It’s a Classic ‘Short-Term Pain for Long-Term Gains’ Approach

The company warned that its next-quarter performance will reflect decisions made under its previous leadership. Opendoor expects an adjusted EBITDA loss between the high-$40-million and mid-$50-million range, roughly in line with last year.

Management said it is prioritizing long-term stability over quarterly targets, clearing older inventory and rebuilding its home supply.

“Our results in the upcoming quarter are largely the outcome of us managing decisions that were made several months ago,” the company said. “We’re focused on making the right long-term decisions for the business, not managing to short-term guidance.”

Opendoor Is a Meme Stock with a Mission

Despite the drop, Opendoor remains one of the year’s most volatile and carefully followed retail favorites. Its “Open Army” of traders has kept the stock in focus on social media, betting that Nejatian’s overhaul could mirror other AI-driven rebounds seen across tech.

Still, with losses deepening and competition intensifying, the new CEO faces a tall order: proving that data and algorithms can fix one of real estate’s most unpredictable business models.

Is Opendoor a Good Stock to Buy?

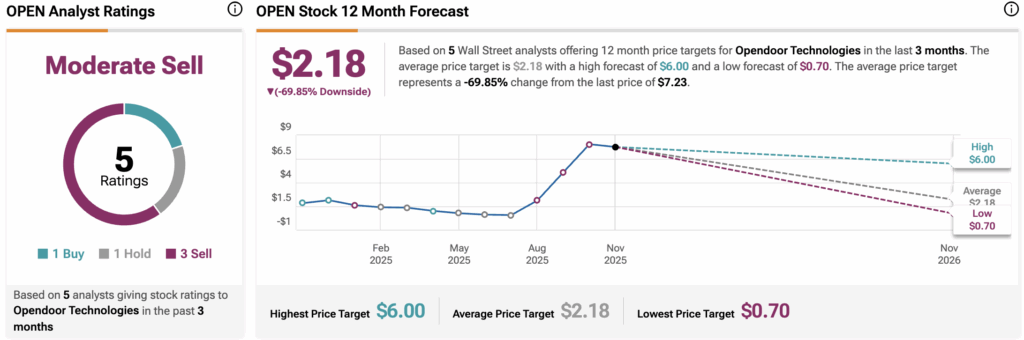

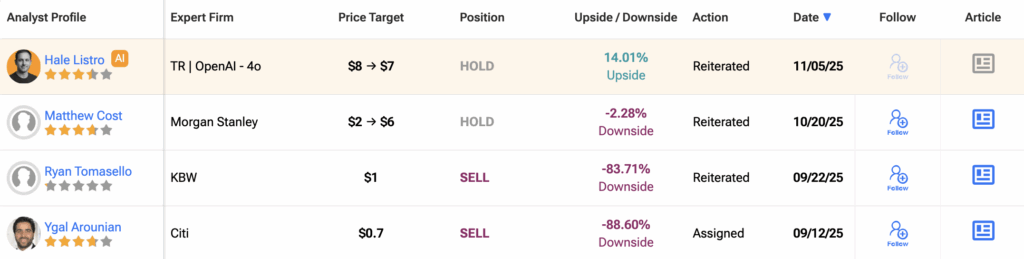

TipRanks data shows that Opendoor Technologies (OPEN) carries a “Moderate Sell” consensus rating based on five recent analyst reviews. The breakdown includes one Buy, one Hold, and three Sell recommendations.

The average 12-month OPEN price target stands at $2.18, implying a sharp 69.9% downside from current levels.