AI firm OpenAI (PC:OPAIQ) has warned the European Union’s antitrust regulator that big tech companies like Apple (AAPL), Google (GOOGL), and even Microsoft (MSFT), its biggest investor, might be engaging in behavior that makes it harder for others to compete. According to Bloomberg, OpenAI shared these concerns directly with EU antitrust chief Teresa Ribera. More specifically, the company said that it is running into “difficulties” competing fairly against these tech giants and urged the EU to step in to prevent them from locking in customers.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This is especially interesting because OpenAI has recently formed partnerships with Microsoft’s rivals, including Google and Oracle (ORCL), for cloud services. Meanwhile, Microsoft has called OpenAI a competitor in the fields of AI and search and has strengthened its relationship with OpenAI’s rival, Anthropic (PC:ANTPQ), by integrating Anthropic’s AI into its Copilot assistant, despite having invested $13.75 billion into OpenAI.

OpenAI has also been outspoken in the U.S. and publicly accused Google in August of holding an “illegal search monopoly.” Notably, the company referenced a 2024 U.S. federal court finding that claimed Google limits fair access to important tools like search visibility and mobile device space. In fact, OpenAI argues that as AI becomes more widely adopted, Google still controls the flow of data and user access, thereby giving it an unfair edge and creating major barriers for smaller competitors.

Is Google Stock a Good Buy?

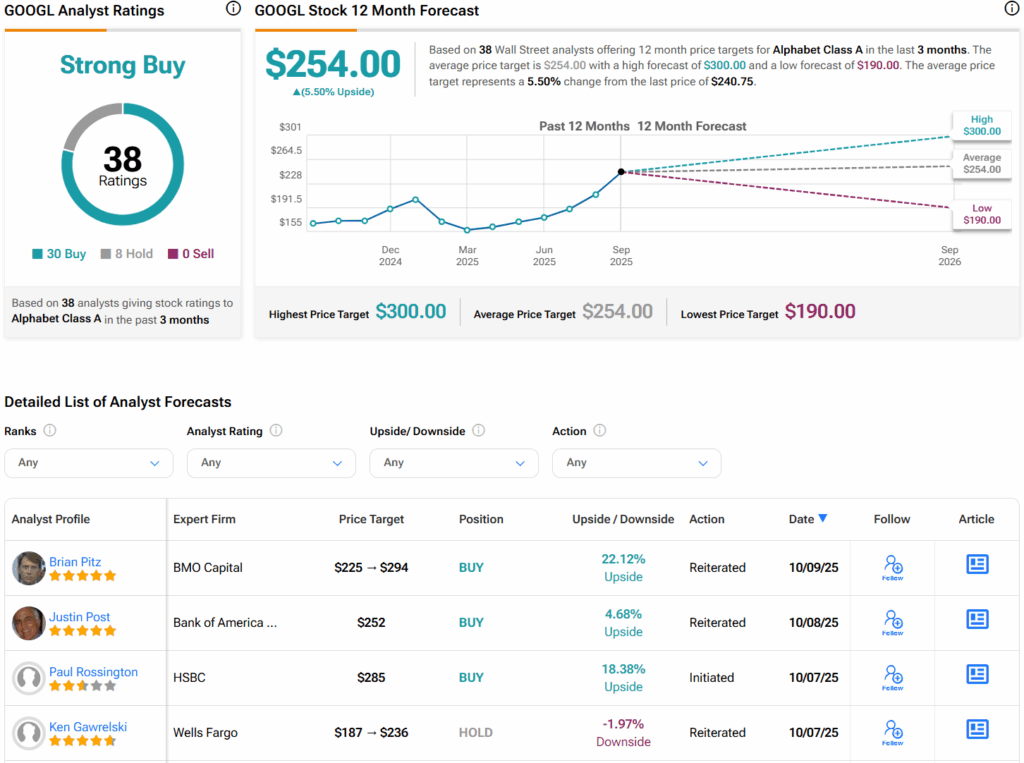

Turning to Wall Street, analysts have a Strong Buy consensus rating on GOOGL stock based on 30 Buys and eight Holds assigned in the past three months. Furthermore, the average GOOGL price target of $254 implies 5.5% upside potential.