OpenAI (PC:OPAIQ) Chief Executive Sam Altman is traveling across Asia and the Middle East to secure new funding and suppliers for the company’s growing demand for computing power. Since late September, he has met with top executives from Taiwan Semiconductor Manufacturing (TSM), Foxconn (HNHPF), Samsung Electronics (SSNLF), and SK Hynix. According to a Wall Street Journal report, he’s asking these companies to expand chip output and give OpenAI priority on future orders. Altman has also visited Japan, where he held talks with Hitachi (HTHIY), and he plans to meet with investors in the United Arab Emirates.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Building the Next Phase of AI Infrastructure

OpenAI’s push reflects the rapid growth of the AI hardware market. The company expects to spend about $16 billion on computing servers this year, and it projects that number could rise to $400 billion by 2029. To manage that growth, OpenAI is seeking long-term supply deals and new partnerships. Samsung and SK Hynix have signed letters of intent to supply memory chips for OpenAI’s future data centers. Both companies also plan to co-develop new facilities in South Korea.

In Japan, OpenAI reached an agreement with Hitachi to help build power and data infrastructure, with OpenAI providing its AI technology to Hitachi in return. The company has also discussed with chip partners how to prepare for Nvidia’s (NVDA) next-generation Rubin systems, which are expected to be released in 2026. OpenAI will be among the first to use the new systems.

Global Expansion and Capital Support

Altman is also looking to raise funds from Abu Dhabi’s investment groups MGX, Mubadala, and G42. Some of that capital will likely go toward the Stargate data center in Abu Dhabi, one of the company’s key projects. OpenAI has said its goal is to build “a factory that can produce a gigawatt of new AI infrastructure every week.”

Investor confidence in OpenAI has improved since its major deal with Nvidia, which involves up to five million AI chips and could reach $100 billion in value. The deal boosted shares of Nvidia and its chip suppliers, while giving OpenAI a stronger position in its long-term hardware plans.

With its global expansion, OpenAI is positioning itself as one of the most valuable private tech companies in the world, now estimated at about $500 billion. Altman’s latest effort aims to make sure the company can secure enough chips, power, and capital to keep training larger and more advanced AI models in the years ahead.

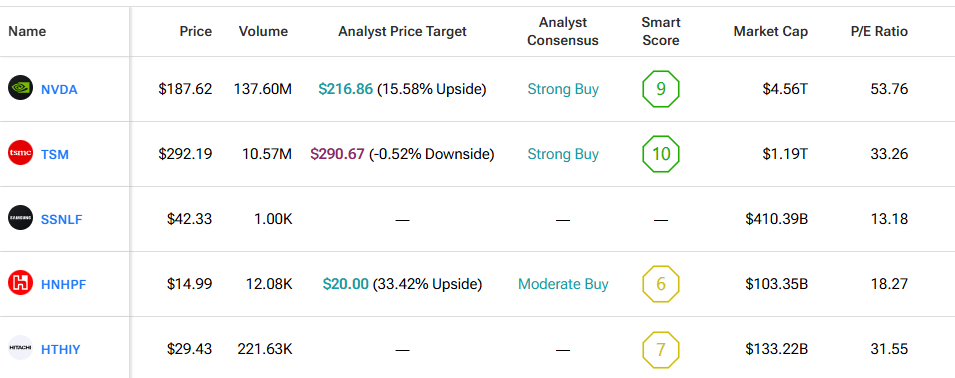

By using TipRanks’ Comparison Tool, we’ve compared all the tickers appearing in the piece. This is a great way for investors to gain a comprehensive look at each stock and the industry as a whole.