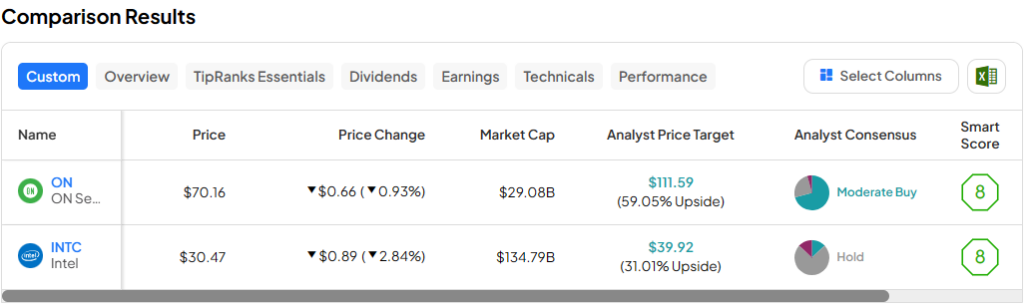

In this piece, I evaluated two chipmaker stocks, ON Semiconductor (NASDAQ:ON) and Intel (NASDAQ:INTC), using TipRanks’ Comparison Tool to see which is better. A closer look suggests a long-term bullish view for ON Semiconductor and a neutral view for Intel.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

While both companies make semiconductors, ON Semiconductor, often referred to as onsemi, specializes in system-on-chip (SoC), application-specific integrated circuits (ASICs), and other custom solutions for the automotive, industrial, medical, and aerospace & defense markets. Meanwhile, Intel focuses on chips for data centers and servers, workstations, the Internet of Things, laptops, and desktops.

Shares of ON Semiconductor have tumbled 16% year-to-date and are off 10% over the last year, while Intel stock has plummeted 39% year-to-date, although it’s still in the green for the last 12 months — up 2%.

With both onsemi and Intel down dramatically year-to-date, their performances stand in stark contrast to Wall Street darlings Nvidia (NASDAQ:NVDA) and Advanced Micro Devices (NASDAQ:AMD), which have gained 75% and 7.5%, respectively, year-to-date.

Below, we’ll compare onsemi’s and Intel’s price-to-earnings (P/E) ratios to gauge their valuations against each other and against that of their industry. For comparison, the semiconductor industry is currently trading at a P/E of 57.3x versus its three-year average of 33.3x.

ON Semiconductor (NASDAQ:ON)

At a P/E of 14.7x, ON Semiconductor is trading at a deep discount to its industry and to Intel, despite the latter’s steep year-to-date sell-off. The chipmaker’s significant exposure to the EV market is a concern currently, but EV adoption should recover over the long term, suggesting that a long-term bullish view might be appropriate.

Onsemi shares rose 4% on Monday after the company beat earnings and sales estimates for the first quarter, although its guidance came up short. The chipmaker posted adjusted earnings of $1.08 per share on $1.86 billion in revenue versus expectations of $1.04 per share on $1.85 billion in sales. GAAP (generally accepted accounting principles) net income came in at $1.04 per share or $453 million. However, onsemi’s sales fell 5% year-over-year while earnings declined 9%.

For the second quarter, onsemi guided for sales between $1.68 billion and $1.78 billion, adjusted earnings of 86 cents to 98 cents per share, and GAAP earnings of 82 cents to 94 cents per share. Nevertheless, the consensus was looking for adjusted earnings of $1.10 per share on $1.92 billion in revenue for the second quarter.

Unfortunately, more than half of onsemi’s sales come from its Automotive division, which has significant exposure to Tesla (NASDAQ:TSLA) and its declining vehicle deliveries. Given the problems in the broader automotive and EV industry, onsemi’s issues may not go away anytime soon.

In fact, the first-quarter report is onsemi’s fifth straight quarter of falling earnings and third straight quarter of declining sales, both on a year-over-year basis. However, Cox Automotive expects EV sales in the U.S. to rise on a year-over-year basis in 2024, reaching a roughly 10% share of the auto market by the end of the year.

Additionally, onsemi has been striking deals with multiple automakers for its silicon-carbide technology, including BMW (OTCMKTS:BMWYY) and Volkswagen (OTCMKTS:VWAGY), so as demand for SiC technologies increases, it is well-positioned to benefit.

Finally, ON Semiconductor’s long-term stock gains of 89% over the last three years, 213% over the last five, and 687% over the last 10 suggest this could be an excellent buy-and-hold position for the long term, especially at its currently discounted valuation.

What Is the Price Target for ON Stock?

ON Semiconductor has a Moderate Buy consensus rating based on 15 Buys, five Holds, and one Sell rating assigned over the last three months. At $119.63, the average ON Semiconductor stock price target implies upside potential of 70.5%.

Intel (NASDAQ:INTC)

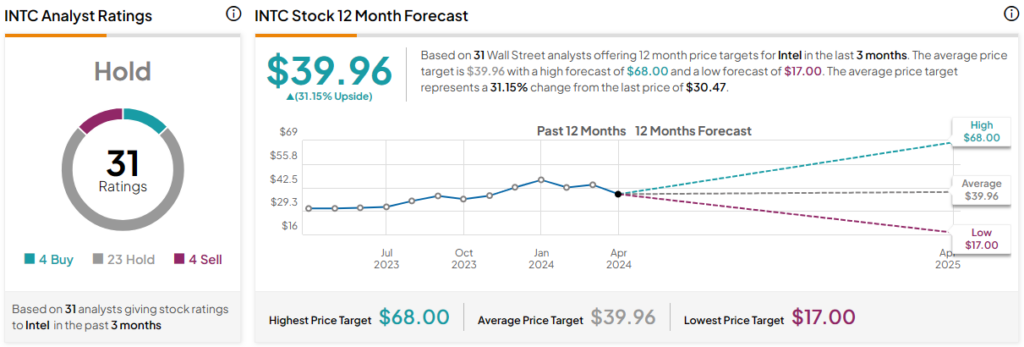

At a P/E of 32.5x, Intel is trading in line with the semiconductor industry’s three-year average P/E. With its Relative Strength Index (RSI) reading of 21.4, the chipmaker is significantly oversold, suggesting a rally might be around the corner. However, investors are advised to proceed with caution with Intel stock, as a neutral view seems appropriate due to the impossibility of predicting what will happen with the shares.

For the first quarter, Intel posted adjusted earnings of 18 cents per share on $12.7 billion in revenue versus the consensus numbers of 14 cents per share on $12.8 billion in sales. Unfortunately, the chipmaker posted a net loss of nine cents per share or $400 million. While that certainly isn’t a good sign for a company that was once a key bellwether for the technology industry, it is a marked improvement from the year-ago loss of $2.8 billion or 66 cents per share.

Intel also came up short with its outlook, guiding for second-quarter revenue of between $12.5 billion and $13.5 billion, adjusted earnings of 10 cents per share, and a net loss of five cents per share. Analysts had initially predicted earnings of 25 cents per share on $13.6 billion in sales for the quarter, although estimates appear to have declined to 13 cents since the report.

While Intel’s net loss is a key concern, its oversold status does suggest we could see a return to the mean before too long. There are also some other reasons to consider Intel stock — albeit with warnings about the extreme risks inherent in the shares.

The chipmaker recently launched the world’s first systems foundry for artificial intelligence (AI) and is investing over $100 billion to boost domestic chip manufacturing in the U.S. While all this would put Intel in an outstanding position if it pans out, the chipmaker’s foundry business lost $7 billion in 2023, calling into question whether it can actually pull any of this off.

In fact, Intel doesn’t even expect its foundry business to break even until 2027 — an eternity in the world of semiconductors. By then, the chipmaker could have missed out on several more rounds of new technologies, just as it failed to take share in smartphones, AI (at least so far), and other areas.

Thus, while Intel could bounce back eventually, there is absolutely no guarantee that will happen.

What Is the Price Target for INTC Stock?

Intel has a Hold consensus rating based on four Buys, 23 Holds, and four Sell ratings assigned over the last three months. At $39.96, the average Intel stock price target implies upside potential of 31.15%.

Conclusion: Long-Term Bullish on ON, Neutral on INTC

As things stand now, both ON Semiconductor and Intel are highly risky investments. ON stock remains a speculative play on silicon-carbide technology, but its long-term track record suggests better-than-even chances of success, especially given the size of its current discount.

On the other hand, a wait-and-see approach may be best for Intel as it remains essentially a show-me story with a history of coming up short of expectations and missing out on multiple waves of new technology.

Thus, onsemi remains the clear winner of this pairing, although it could take a while for the bull thesis to play out.