On Semiconductor (NASDAQ:ON), also known as Onsemi, is slated to release its results for the first quarter of Fiscal 2024 before the market opens on Monday, April 29. Analysts expect lower earnings due to weakness in key end markets, mainly electric vehicles (EV).

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Onsemi creates intelligent power and sensing technologies, with a focus on the automotive and industrial end markets. Its semiconductor technologies are used in EVs, industrial automation, energy grids, 5G, and cloud infrastructure.

Goldman Sachs Stays Bullish Ahead of ON’s Earnings

Goldman Sachs analyst Toshiya Hari believes that an overall global slowdown in EV demand and EV manufacturing is expected to hamper Onsemi’s revenue and growth profile in the near term. The analyst particularly thinks that Onsemi’s heavy reliance on EV maker Tesla (NASDAQ:TSLA) could hurt its performance in the short term. However, in the long run, ON is expected to outperform based on anticipated expansion and diversification in its customer base.

The five-star analyst reiterated a Buy rating on ON stock but slashed the price target to $81 (22% upside) from $91 on April 15. Hari also lowered the EPS (earnings per share) estimates for 2024-2026, on an average, by 3% and 5%, respectively.

Street’s Expectations from Onsemi’s Q1 Results

The Street expects Onsemi to post adjusted EPS of $1.04, down from the Q1 FY23 figure of $1.19. Furthermore, the revenue consensus is pegged at $1.85 billion, down 5.6% compared to the prior-year figure.

The consensus forecasts fall in line with the company’s Q1 guidance. The company guided for Q1 revenue in the range of $1.80 to $1.90 billion and adjusted EPS between $0.98 and $1.10. Importantly, Onsemi is transforming its business to make it more resilient. To achieve this, the company is driving innovation beyond its silicon and silicon carbide (SiC) solutions and diversifying into analog and mixed-signal platforms to drive further growth.

Is Onsemi a Good Stock to Buy?

Owing to the sluggish demand for EVs, ON stock has lost 7.7% in the past year. Analysts are cautiously optimistic about ON Semiconductor stock due to near-term headwinds.

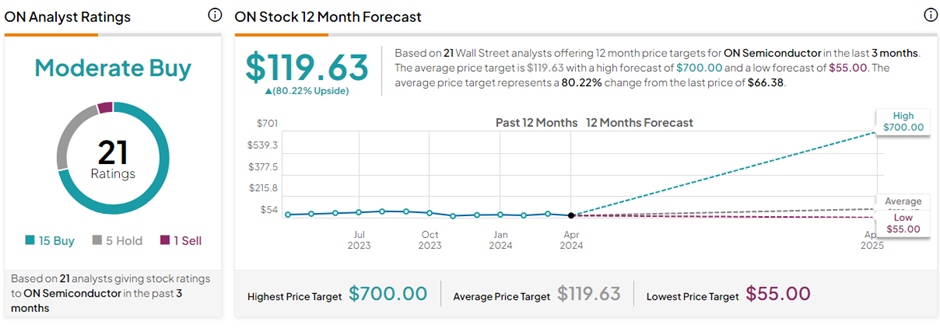

ON has a Moderate Buy consensus rating on TipRanks, based on 15 Buys, five Holds, and one Sell rating. The average On Semiconductor price target of $119.63 implies a massive 80.2% upside potential from current levels.

Insights from Options Trading Activity

It’s worth noting that options traders are pricing in a +/- 9.22% move on earnings, mostly in line with the previous quarter’s earnings-related move of +9.54%.

The expected move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Learn more about TipRanks’ Options tool here.

Ending Thoughts

Onsemi is expected to witness declining revenues and profits in the near term owing to a slowdown in the EV space, the company’s prime end market. Having said that, the company is poised for long-term growth driven by entry into new verticals and an expected pick-up in EV demand.