On Holding (NYSE:ONON) stock declined over 3% yesterday, despite the company reporting better-than-expected third-quarter results. The fall can be attributed to the company’s Q4 revenue growth guidance of 21%, which remained below the consensus estimate of 25%.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The company posted adjusted earnings of $0.22 per share, which came above the analysts’ estimates of $0.16 per share and increased 175% from the prior-year quarter. Meanwhile, On Holdings revenues of $532.4 million jumped 46.5% year-over-year and surpassed the Street’s estimates of $504.6 million. The performance was due to strong momentum in the footwear, apparel, and accessories categories.

Following the company’s earnings release yesterday, four analysts rated ONON stock a Buy, while one maintained a Hold rating. Analyst Anna Andreeva of Needham maintained a Buy rating on On Holding with a price target of $40.

Is On Holding a Good Buy?

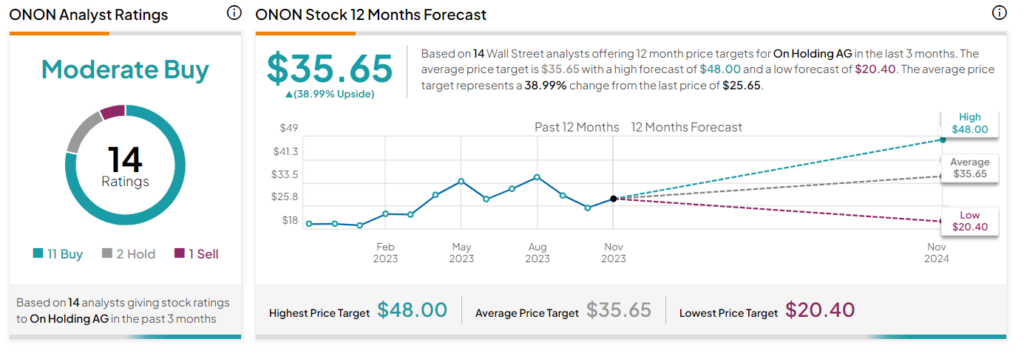

Wall Street analysts are cautiously optimistic about On Holding stock. It has a Moderate Buy consensus rating based on 11 Buys, two Holds, and one Sell. The average price target of $35.65 implies 39% upside potential. The stock has gained 50.3% year-to-date.