Shares of U.S.-based Oklo Inc. (OKLO) kicked off the new year with a strong rally, gaining about 22% so far in 2026. The latest rally followed a surge in stocks tied to nuclear energy, fueled by geopolitical uncertainty after President Trump intervened in Venezuela. The sector gained further momentum after the U.S. Energy Department unveiled $2.7 billion in uranium-enrichment awards.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Oklo, which develops smaller, next-generation nuclear reactors (SMRs), saw double-digit gains as investor interest in the sector intensified. Similarly, Nuscale Power Corp. (SMR) jumped 15%, and Nano Nuclear (NNE) was up 12%.

What’s Behind the Recent Jump in OKLO Stock?

Overall, nuclear stocks surged on Monday, driven by a mix of geopolitical uncertainty following Trump’s intervention in Venezuela. For context, U.S. forces captured Venezuela’s president over the weekend, with the U.S. citing a safe transition and the country’s vast oil reserves as key factors. Overall, this intervention has sparked market attention, boosting energy and defense-related stocks while increasing geopolitical risk sentiment.

Momentum in Oklo stock was supported by the U.S. Energy Department’s expanded uranium-enrichment awards, including high-assay low-enriched uranium (HALEU), essential for next-generation reactors like SMRs. Fuel supply has been a key constraint for Oklo, which relies on HALEU for its ‘powerhouses.’ The stock’s recent surge reflects investor optimism that federal support could ease these bottlenecks and boost production potential.

What Lies Ahead for OKLO Stock?

Over the past year, Oklo’s stock has surged nearly 200% as investors bet on nuclear power for AI data centers. However, the company has yet to secure regulatory approval for its first 75-megawatt microreactor, Aurora Powerhouse, and commercial operations are not expected until late 2027 or early 2028.

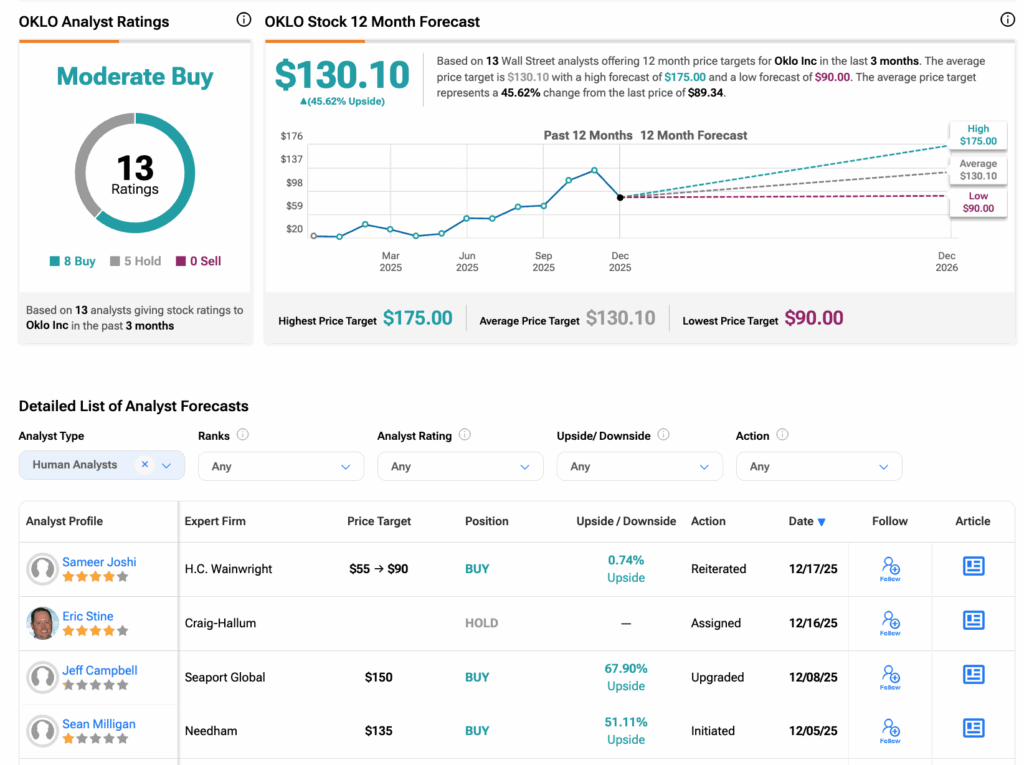

On Wall Street, analysts remain moderately bullish on OKLO. They see the company as well-positioned for a potential generational expansion of nuclear power if its SMR design commercializes early.

Notably, H.C. Wainwright four-star analyst Sameer Joshi reiterated his Buy rating on OKLO in December, highlighting the company’s ambitious long-term plan. This includes deploying Aurora Powerhouses to generate electricity, fabricating and selling HALEU fuel, and commercializing radioisotopes. Joshi also noted that revenue projections anticipate exponential growth, with expectations to surpass $21 billion by 2038, supported by strong gross margins once its facilities are fully operational.

However, analysts also caution that the stock’s valuation is high and the capital-intensive business model carries significant risks.

Is OKLO a Good Stock to Buy?

Overall, Wall Street has a Moderate Buy consensus rating on OKLO stock, based on eight Buys and five Holds assigned in the last three months. The average share price target for Oklo is $130.10, which implies an upside of 45.62% from current levels.