Oklo (OKLO) stock fell on Monday even after the company announced progress on its first Aurora powerhouse. The company has broken ground on the first of these powerhouses, which is being built at Idaho National Laboratory (INL). The event is being attended by several major figures in the energy sector, including EPA Administrator Lee Zeldin, Oklo co-founder and CEO Jacob DeWitte, and INL Director John Wagner.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The new Aurora powerhouse is part of the Department of Energy’s Reactor Pilot Program that was created in response to President Donald Trump’s executive orders signed earlier this year to advance nuclear deployment and modernize nuclear licensing. Oklo has two other projects awarded to it under this program, including one directly for it and another for its Atomic Alchemy subsidiary.

U.S. Secretary of the Interior Doug Burgum said, “Oklo Inc.’s Aurora powerhouse will deliver clean, affordable, and reliable American energy to power a new generation of intelligence manufacturing across the country. As advancements in artificial intelligence drive up electricity demands, projects like this are critical to ensuring the United States can meet that need and remain at the forefront of the global AI arms race.”

Oklo Stock Movement Today

Oklo stock was down 2.85% on Monday but remained up 523.98% year-to-date. The stock has also increased 1,527.32% over the past 12 months. Shares have obviously benefited from President Trump’s focus on nuclear energy.

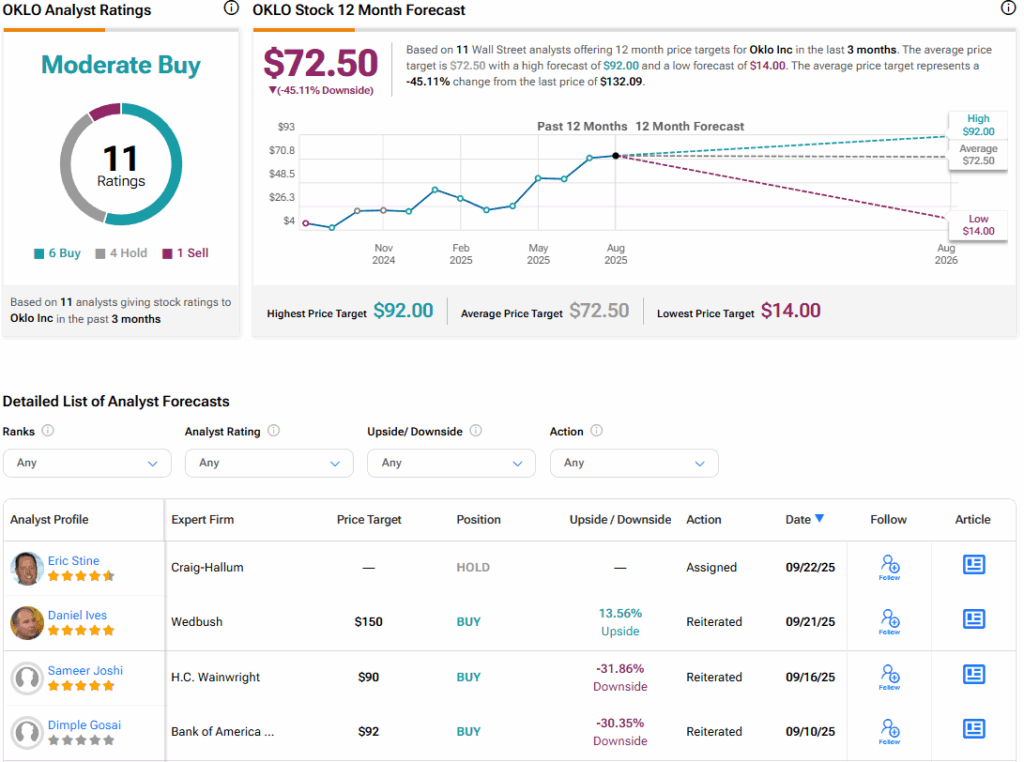

The dip in OKLO stock’s price today is likely tied to a new Hold rating from four-star Craig-Hallum analyst Eric Stine.

Is Oklo Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for Oklo is Moderate Buy, based on six Buy, four Hold, and a single Sell rating over the past three months. With that comes an average OKLO stock price target of $72.50, representing a potential 45.11% downside for the shares.