Nuclear energy company Oklo saw its stock rocket higher on Wednesday following its latest earnings report. As a reminder, its adjusted earnings per share of -7 cents was better than Wall Street’s estimate of -11 cents. The company also didn’t report any revenue in its most recent earnings report.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

The potential of Oklo is huge as the need for data centers to house artificial intelligence servers continues to rise. Five-star Wedbush analyst Daniel Ives said this will require a “tremendous amount of energy.” That’s something Oklo can provide with its nuclear reactors, which Ives argues helps it stand out from it rivals in the AI energy space. Ives reiterated an Outperform rating and $45 price target for OKLO, representing a possible 20% upside.

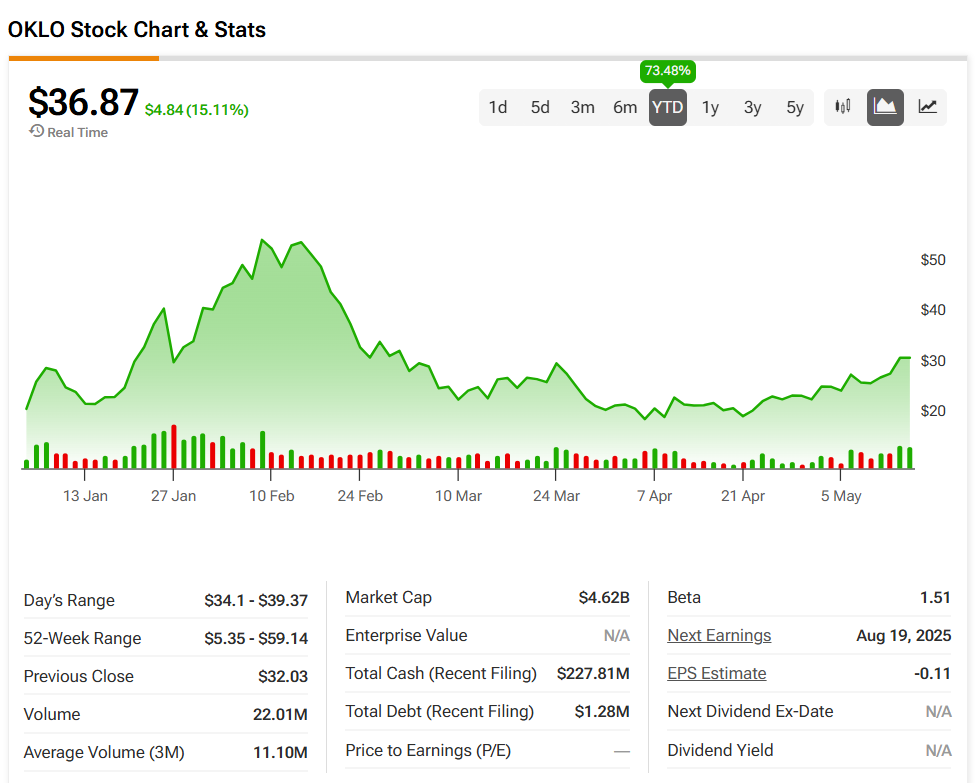

The strong earnings report and positive analyst comments have sparked interest in OKLO stock today. This has the energy company’s shares up 15.11% this morning, building on a 73.48% year-to-date rally. It also comes with heavy trading, as some 22 million units changed hands, roughly double its three-month daily average.

Not All Analysts Love OKLO Stock

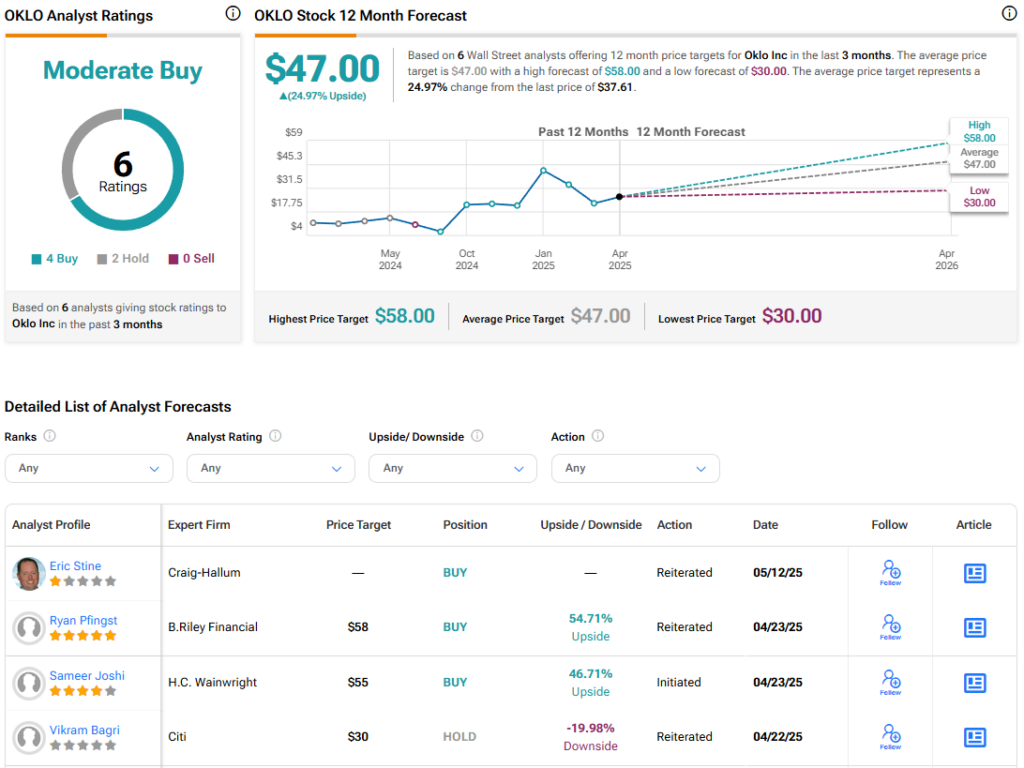

While Ives took a bullish stance on Oklo after the company’s latest earnings report, Citi analysts were less enthusiastic about the results. They cited a lack of major customer deals as reason for a Neutral rating and $30 price target, which is a potential 20% downside.

While Citi’s concerns are worth noting, there’s potential for Oklo to snag a power deal with AI powerhouse OpenAI. Sam Altman, the founder and CEO of OpenAI, stepped down as Chairman of Oklo’s Board of Directors last month. This opens the way for an energy agreement between the two companies without the risk of a conflict of interest. B. Riley noted such a deal would be a positive catalyst for OKLO stock.

Is OKLO Stock a Buy, Hold, or Sell?

Turning to Wall Street, the analysts’ consensus rating for Oklo is Moderate Buy, based on four Buy and two Hold ratings over the last three months. With that comes an average OKLO stock price target of $47, implying a possible 24.97% upside for the shares. These ratings and price targets will change as analysts update their coverage after earnings.