Shares of Oklo (OKLO), the nuclear startup that has yet to turn a profit, pumped up nearly 8% on Wednesday afternoon despite reporting a wider loss per share than Wall Street anticipated for its third quarter. The results have attracted a combination of Buy and Hold ratings from Wall Street analysts.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Oklo’s Q3 Losses Deepen as Expenses Rise

During Q3 2025, Oklo lost 20 cents per share, which widened from a loss per share of eight cents in the same period last year. The figure came in worse than the expected net loss of 14 cents per share projected by analysts who are tracking the company’s progress.

Oklo’s operating loss for the recent three-month period came in at $36.3 million, which includes $9.1 million in expenses for non-cash stock-based compensation. The figure rose nearly threefold from $12.3 million recorded a year ago.

However, for a company that has yet to launch its first nuclear power plant — a target the startup is looking to achieve by 2028 — Oklo’s result was generally greeted with a positive sentiment, according to TipRanks.

This is even as the startup wrapped up the recent quarter with about $1.2 billion in cash and marketable securities. Oklo also achieved several other milestones during the quarter, including being selected for three projects under the U.S. Department of Energy’s (DOE) Reactor Pilot Program.

Why Is Wall Street Divided on Oklo?

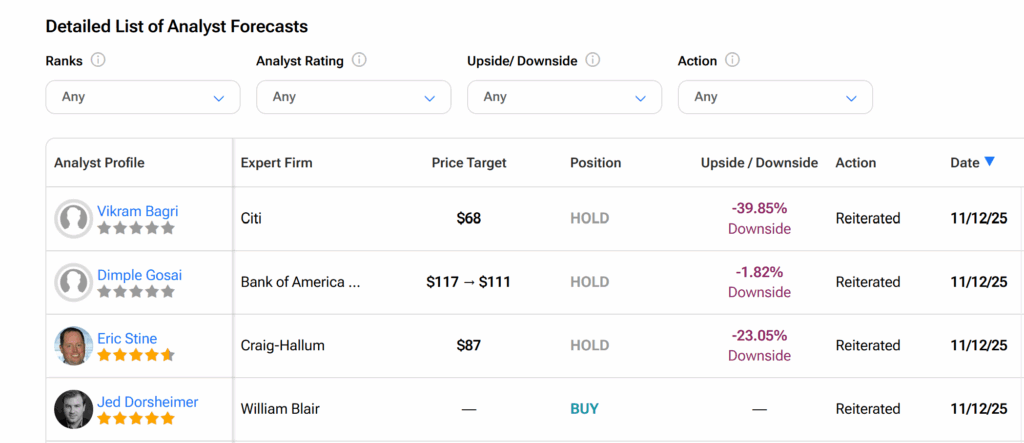

However, since Tuesday — when Oklo released the results — OKLO stock has received four Hold and three Buy ratings from analysts, TipRanks’ analyst forecast data shows.

B. Riley Securities analyst Ryan Pfingst, who elevated his price target by more than 122% to $129 at about 14% upside, pointed to Oklo’s progress in securing new authorizations from the DOE, including obtaining quick safety design approval for its Aurora Fuel Fabrication Facility. Oklo broke ground on its first Aurora nuclear reactor plant in late September.

The five-star analyst noted that the approval is expected to help Oklo accelerate the deployment of its nuclear reactors as well as make it easier to secure other licenses from the U.S. Nuclear Regulatory Commission in the future.

However, BofA analyst Dimple Gosai trimmed her price target on Oklo to $111, down from $117, and refused to move her Neutral rating on OKLO stock. Gosai noted that while Oklo made “constructive” progress in obtaining regulatory approvals and reducing the risks associated with its fuel source, investors remained concerned about its capital expenditure and the timing of its power purchase agreements.

Is Oklo a Good Stock to Buy?

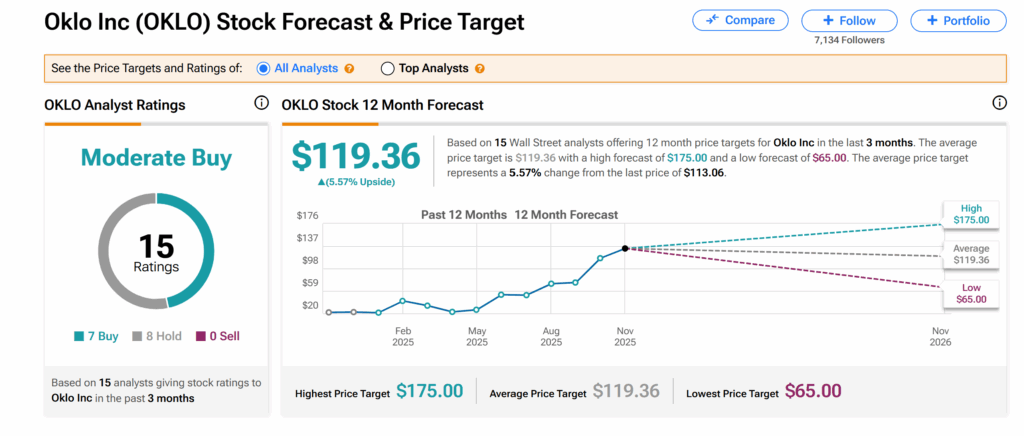

Across the broader Wall Street, analysts’ consensus rating for Oklo is Moderate Buy. This is based on seven Buys and eight Holds issued by 15 analysts over the past three months.

At $119.36, the average OKLO price target implies about 6% upside for the stock.