Rising prices for crude oil have pushed the Toronto Stock Exchange to a record high.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Canada’s main stock index, which is heavily weighted towards oil and natural gas, is beginning the trading week at a fresh all-time high having closed at 24,162.83 last Friday (Oct. 4). The Toronto Stock Exchange has now risen for four consecutive weeks, hitting multiple new highs along the way.

The index has gotten a big bump over the past week as crude oil prices rose 10% on growing concerns that the conflict in the Middle East is escalating and could impact oil production and supplies. West Texas Intermediate (WTI) crude oil, the U.S. standard, is trading at $75.73 per barrel, while Brent crude oil, the international benchmark, is trading at just under $80 a barrel.

Still Trailing U.S. Equities

Canada’s five big banks, combined with mining and energy stocks, comprise 63% of the Toronto Stock Exchange’s weighting. The index has very little exposure to technology stocks. As such, the index tends to boom and bust in tandem with the energy sector.

Energy stocks listed on the Toronto Stock Exchange rose 9% over the past week, their biggest weekly advance in two years. However, despite being at an all-time high, the Toronto Stock Exchange trails the performance of its U.S. counterpart. So far this year, the Toronto bourse has climbed 15% higher, trailing the 21% gain in the benchmark S&P 500 index in America.

Is the S&P/TSX 60 Index ETF a Buy?

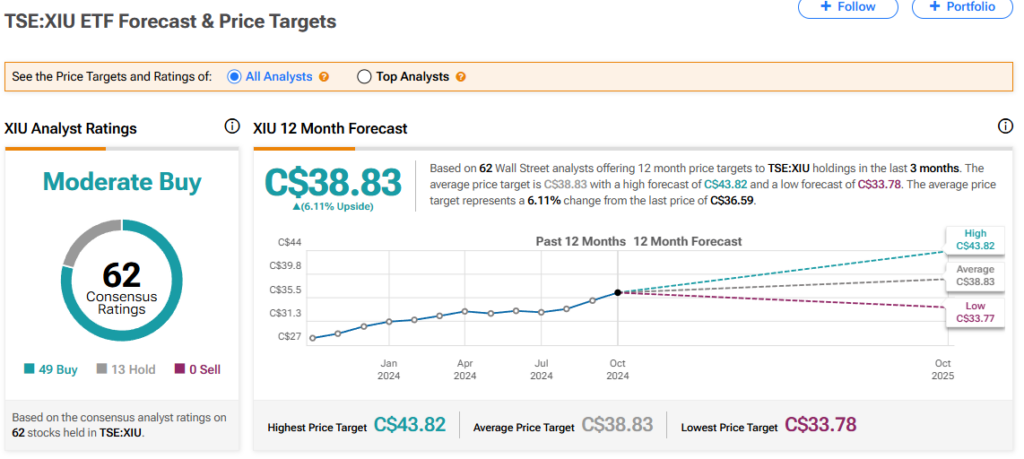

The iShares S&P/TSX 60 Index ETF (TSE:XIU), which tracks the 60 biggest stocks on the Toronto Stock Exchange, has a consensus Moderate Buy rating among 62 Wall Street analysts. That rating is based on 49 Buy and 13 Hold recommendations assigned in the last three months. There are no Sell ratings on the ETF. The average XIU price target of $38.83 implies 6.11% upside potential from current levels.