The benchmark crude WTI (CM:CL) rallied by over 4% this week as rising global uncertainties took center stage. Aiding this rise was a bullish U.S. inventory report from the EIA (Energy Information Administration).

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Global Uncertainties

Global geopolitical uncertainties are on the rise after Yemen’s Houthi rebels sunk a second ship in the Red Sea. The specter of escalating tensions between Israel and Hezbollah adds more geopolitical risk premium to oil prices. Additionally, a drone strike from Ukraine impacted an oil terminal in Russia’s port of Azov. These developments have helped oil prices steadily climb this month.

Numbers from the EIA

Aiding this rise was the latest inventory report from the EIA for the week ended June 14. During this period, crude inventories in the U.S. declined by 2.55 million barrels and gasoline inventories decreased by 2.3 million barrels. The decline comes after consecutive weekly gains in U.S. stockpiles. Additionally, the numbers point to an impact from summer driving demand.

OPEC’s Demand Expectations

Another factor driving the oil rally is a robust demand outlook for the remainder of 2024. OPEC estimates global oil demand to rise by 2.25 million barrels a day this year and by 1.85 million barrels a day next year. This implies healthy demand in H2 2024 on the back of strong economic growth globally.

What Is the Outlook for Oil

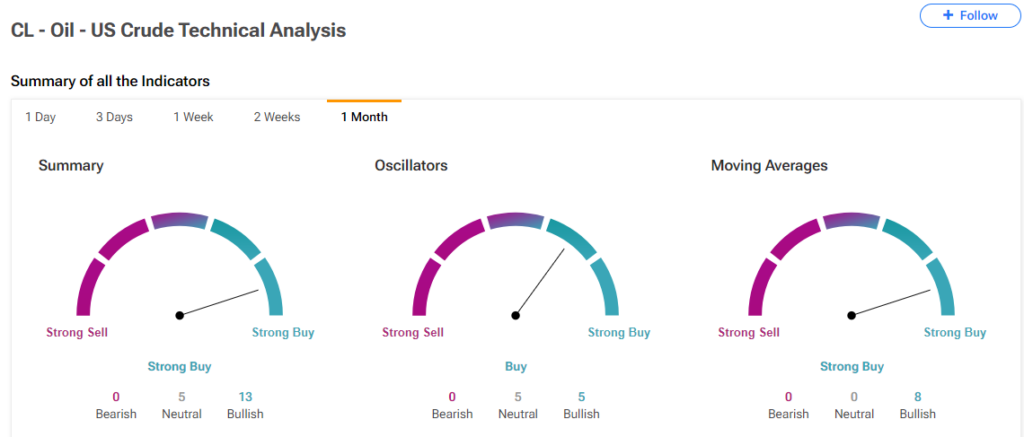

Together, these factors have driven crude oil prices from around $72 at the beginning of June to the current $81 level, and it looks like this price strength could continue. The TipRanks Technical Analysis tool is flashing a Strong Buy signal for oil on a monthly time frame.

Ready to “commodi-tize” your knowledge? Click here to dive into the world of commodities on TipRanks

Read full Disclosure